Bitcoin’s lackluster price action reached a pivotal point throughout July. As the range where it was trading was narrowing over time, BTC’s price reached the lowest levels of volatility ever recorded in its 11-year history, according to Arcane Research.

“With only 11 days left of July, we’re currently seeing the tightest monthly price range in Bitcoin’s history! We have never seen a price range this low (currently 6%), with the all-time low being 9% from May 2015,” said data-driven analytics firm.

Bitcoin's Monthly Price Range Hits New All-Time Low. (Source: Arcane Research)

Nevertheless, the flagship cryptocurrency kicked off Tuesday with a bang. Its price appreciated by 2.90% to hit an intraday high of $9,440. The bullish price action got many market participants excited about what the future holds for Bitcoin, but a particular technical index suggests that the upswing could be part of a fakeout.

The TD Sequential Turns Bearish On Low Time Frames

The Tom Demark (TD) Sequential indicator has been crucial in identifying Bitcoin’s price action. Not only was this gauge able to anticipate in mid-February that BTC was poised for a steep decline, but in mid-March, it presented a buy signal that led to its run-up to $10,000 before the halving.

Now that the pioneer cryptocurrency has posted significant gains over the past few hours, the TD setup estimates that a pullback is underway.

Based on BTC’s 45-min, 30-min, and 15-min charts, the renowned index presented sell signals in the form of green nine candlesticks. These bearish formations forecast a one to four candlesticks correction or the beginning of a new downward countdown.

TD Setup Presents Sell Signal For Bitcoin Across Multiple Time Frames. (Source: TradingView)

A red two candlestick trading below a preceding red one candle, within any of the time frames previously mentioned, can serve as confirmation of the pessimistic outlook.

Massive Support Wall Ahead

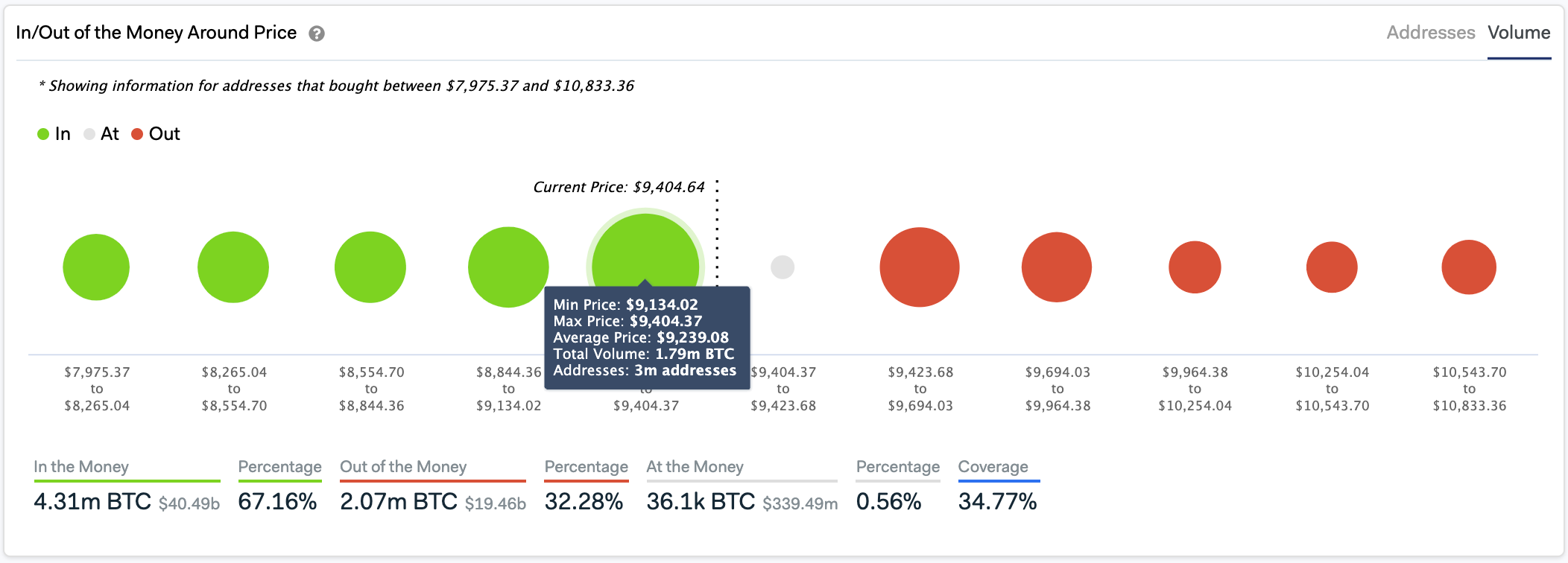

If sell orders begin to pile up, IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) model suggests there is a considerable supply barrier that may prevent Bitcoin from a steep decline. Based on this on-chain metric, the area between $9,130 and $9,400 is on the most significant support walls ahead of the bellwether cryptocurrency.

Around these price levels, roughly 3 million addresses had previously purchased nearly 1.80 million BTC.

Holders within this price range may try to remain profitable in the event of a downswing. They may even buy more Bitcoin to allow its price to bounce back up.

Massive Support Barrier Ahead of Bitcoin. (Source: IntoTheBlock)

On the flip side, the IOMAP cohorts show that approximately 1.20 million addresses bought over 800,000 BTC between $9,420 and $9,700. If Bitcoin is able to move past this hurdle, it would likely be able to resume the uptrend seen in the past few hours.

Featured Image by Depositphotos Price tags: btcusd Chart from TradingView.com