In brief:

- $250 is a major resistance zone for Ethereum.

- ETH had managed to break this price level and briefly traded at $253.

- The push was short-lived as Bitcoin dumped hard taking down the entire crypto market with it.

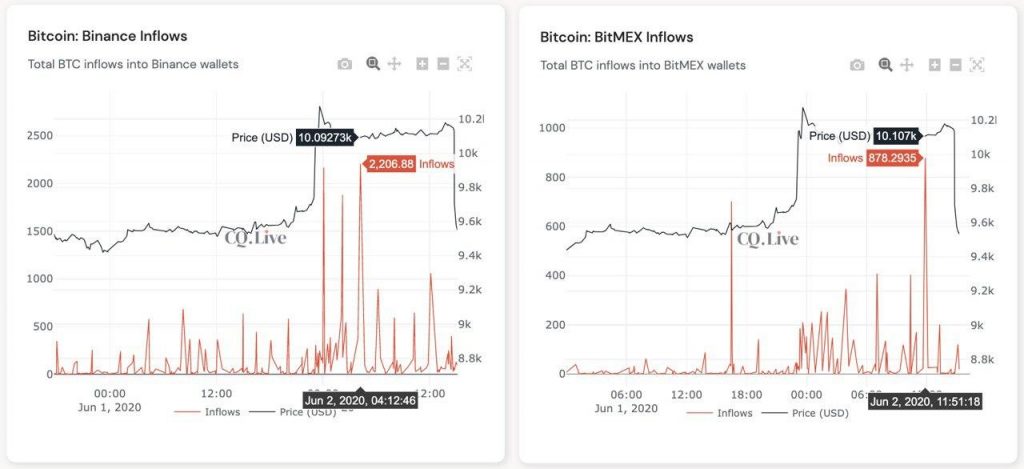

- Stats show that whales moved a lot of Bitcoin to Binance and Bitmex before the dump.

- ETH2.0 is still on track for launch.

Earlier today, crypto investors and traders experienced a roller coaster of price movement from the entire spectrum of digital assets led by Bitcoin. Earlier on in the day, BTC had managed to pump hard from around $9,700 to a few dollars shy of $10,400. The bullishness was not limited to Bitcoin as Ethereum also pushed above the earlier identified resistance zone of $250. In this regard, ETH traded briefly at $253 before the tides changed for the worse when Bitcoin dipped to $9,300 on Binance and as low as $8,600 on Bitmex.

Due to the Bitcoin crash, ETH went as low as the support zone of $225 that was formerly a resistance level.

Whales Moved a Lot of Bitcoin to Binance and Bitmex

Before the Bitcoin dump happened, the amount of Bitcoin sent to the two crypto exchanges of Binance and Bitmex experienced a drastic increment. According to the team at CryptoQuant, 2,206 BTC and 878 BTC were sent to Binance and Bitmex respectively. The subsequent selling and/or shorting resulted in the domino effect that brought down Ethereum to $225. A graphical representation of the Bitcoin movement into the two exchanges can be found below.

Progress with Ethereum 2.0

Earlier today, the development team at the Ethereum project released an update on the progress of ETH2.0. In the elaborate blog post, they explained that Ethereum 2.0 was inching closer and closer to launching. However, at the time of writing this, they did not give a definite time frame of the launch. Many investors, developers and traders are still for the idea that it will be launched before the end of July. A brief excerpt from the update on the Ethereum blog can be found below.

Eth2 is a huge undertaking to provide an upgraded, next-generation, highly-scalable and secure, decentralized consensus to Ethereum. There are dozens of teams and hundreds of individuals working each day to make this a reality. The path we’ve chosen is difficult, but immense progress has and continues to be made.

The core of this new mechanism is just around the corner.

(Feature image courtesy of Unsplash.)

Disclaimer: This article is not meant to give financial advice. Any additional opinion herein is purely the author’s and does not represent the opinion of EWN or any of its other writers. Please carry out your own research before investing in any of the numerous cryptocurrencies available. Thank you.