To say that Ethereum is weakening against the king of cryptocurrencies would be a huge understatement. The ETH/BTC pair is down by nearly 50% year-to-date as it languishes in bear territory for 17 months and counting. The sentiment is so overwhelmingly bearish that some traders are happy to short the crypto pair.

$ETH / $BTC 4H

ethbtc short setup pic.twitter.com/2vH5M25M3W— Suprematic Wassie (ex_hermit) (@GothBtcSinner) September 10, 2019

Nevertheless, big accounts in the Crypto Twitter community are starting to feel that the worst is over for the pair. If you’ve been HODLing, you may want to listen to what the widely-followed DonAlt has to say.

Analyst: Ethereum/Bitcoin Fractal ‘Playing Out Magically So Far’

On July 10th, DonAlt shared on Twitter a chart of the ETH/BTC pair illustrating a fractal that involves one dump to support at 1,500,000 satoshis before a “mega moon” to 20,000,000 satoshis.

$ETH hopium

I posted this a few months ago but can’t find the post anymore.

Playing out magically so far.

The ETH fractal – dump it into mega moon. pic.twitter.com/UZHZ5Xa8zY— DonAlt (@CryptoDonAlt) July 10, 2019

The trader then provided an update on August 15th. At the time, the cryptocurrency was hurling towards support of 1,500,000 satoshis. In the tweet, the analyst wrote,

This is starting to get spooky now. 0.015 (1,500,000 satoshis) is really good support for ETH.

$ETH hopium update:

This is starting to get really spooky now.

0.015 is really good support for ETH either way, the fractal is just there for additional confluence.There is a decent chance we set at least a short/midterm bottom there in my opinion. pic.twitter.com/COsQwarUSr

— DonAlt (@CryptoDonAlt) August 8, 2019

Recently, the trader provided another update. It appears that the pair is respecting support of 1,500,000 satoshis. However, the analyst noted that even though the patterns look similar, a shakeout would be ideal. In the tweet, the trader noted,

How funny would it be if the meme fractal actually played out?

$ETH hopium update:

How funny would it be if the meme fractal actually played out?

Slim chance for that, I’d personally like to see a shakeout to call a bottom.

That said it still looks very similar. pic.twitter.com/8e0RNR9zAO— DonAlt (@CryptoDonAlt) September 7, 2019

DonAlt is not alone to have a bullish stance on the cryptocurrency. “Trader Max” (also known as Bitcoin Jack), the lead analyst at Bravado Trading, supports DonAlt’s sentiments. The trader spoke to CCN. He said:

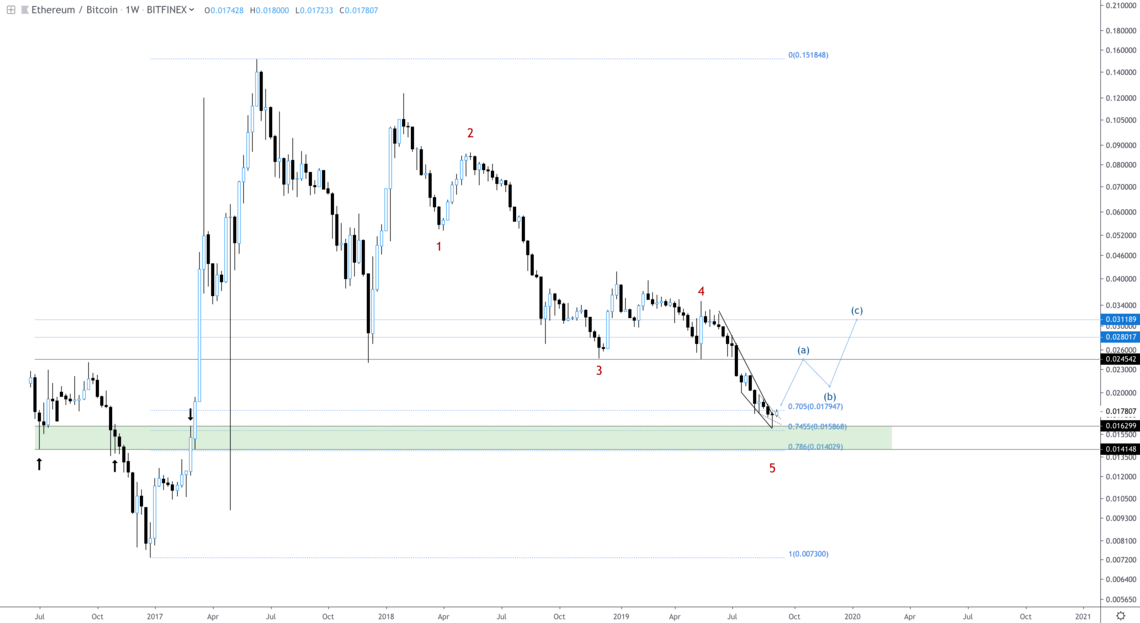

Ethereum has found a bear market bottom with an ending fifth wave diagonal. Demand sits in the 0.0141-0.0163 range and near term targets are 0.0240 and if broken 0.028, 0.0312 and 0.035.

Fundamental Developments Could Catalyze the Mega Moon

The mega pump to 20,000,000 satoshis predicted by DonAlt will likely not happen unless there’s a strong fundamental driver. Big price movements should be propelled by big fundamental changes. This is where Ethereum 2.0 might come in.

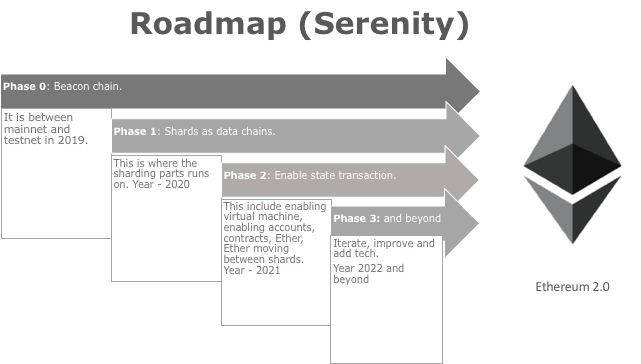

According to the June 13th Ethereum Implementers call, the first stage of transition to version 2.0 should take place on January 3, 2020. Phase zero is the name of this stage.

According to a Consensys article, Phase zero would be the foundation of Ethereum 2.0. It will be the most complex part of the transition as it accounts for the management of the proof-of-stake (POS) protocol as well as the coordination of independent parallel shards.

The transition to the POS model will likely ignite an Ethereum arms race as validators will receive rewards in proportion to the coins they stake. More importantly, those who would like to become validators will have to deposit a minimum of 1,500 ETH. This figure is a strong catalyst for DonAlt’s mega moon scenario.

In addition, The Crypto Oracle spoke with CCN. The researcher thinks that Ethereum 2.0 can act as a driver of growth.

Ethereum 2.0 is set to release early next year. I’m sure that it will give Ethereum some momentum.

With just a few months before the release of Ethereum 2.0 and Bitcoin Jack calling for a bear market bottom, DonAlt’s mega moon fractal doesn’t sound so far-fetched.

Last modified (UTC): September 11, 2019 9:21 PM