For the second time in two weeks, Ether price (ETH) has notched a new 2020 high. This time the surge from $217.83 to $253.79 occurred as Bitcoin’s (BTC) price reversed course from $9,700s and rallied to a new high at $10,346.83.

As Bitcoin rallied on Feb. 12, many altcoins pulled back in their BTC pairs but Ether succeeded in holding on to its gains and currently registers a 14.3% gain.

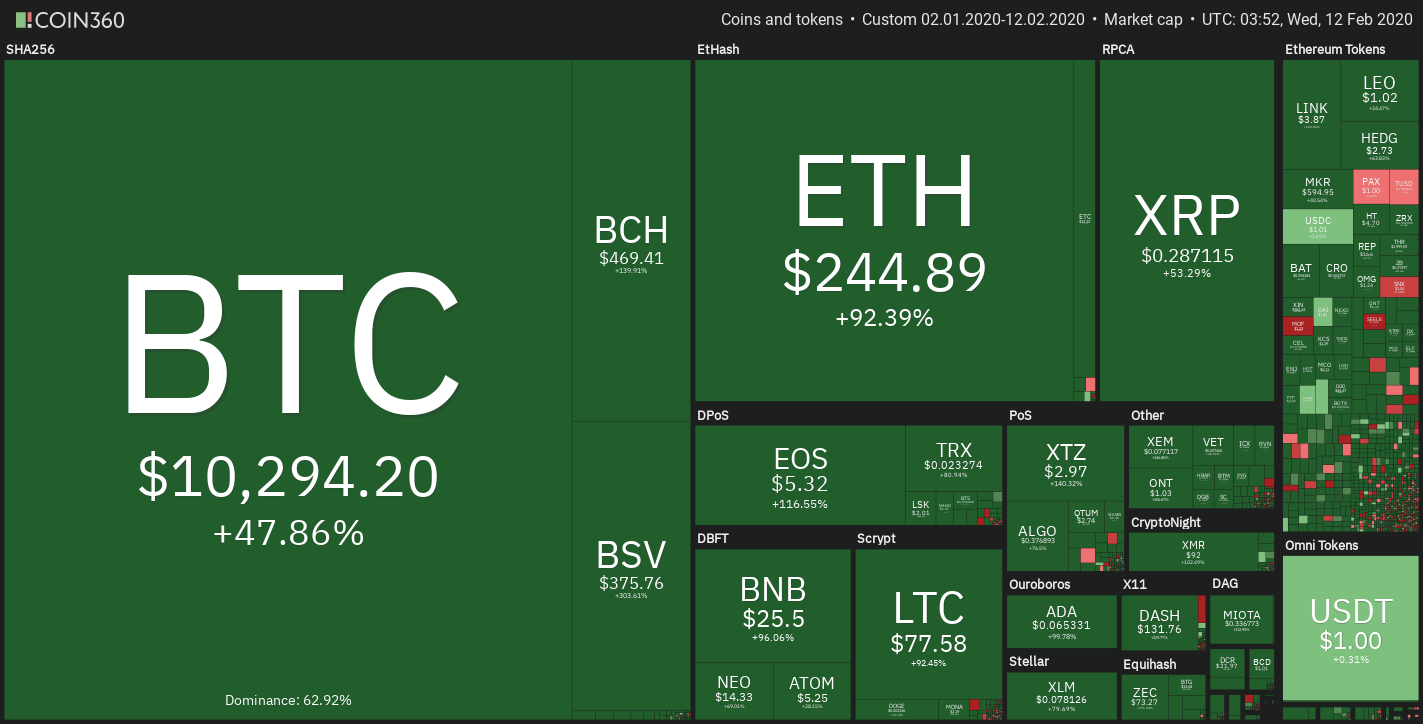

Crypto market daily price chart. Source: Coin360

Generally, investors are feeling bullish about the crypto market’s future prospects. But while Bitcoin appears set for continuation higher, news that the scammers behind the PlusToken crypto Ponzi scheme transferred 12,423 BTC to new wallet address is sure to raise an eyebrow with some investors.

PeckShield Inc. co-founder and VP of research, Chiachih Wu said that the coins were likely deposited to a series of cold wallet addresses and Twitter user Sue Zhu explained that:

“Plus Token coins are on the move again, but more importantly, are now being split into smaller amounts vs the single output transfers from a few hours ago.”

While investors should try and not be too heavily impacted by random news from Twitter, in 2019 the PlusToken scammers regularly liquidated massive amounts of Bitcoin and Ether on spot exchanges, causing the price to drop significantly.

2020 crypto market price chart. Source: Coin360

All FUD aside, the market is in a strong bullish trend with large and small-cap cryptocurrencies producing impressive gains. Since the start of 2020, Bitcoin’s value has risen by 47.86%, Ether gained 92.39% and XRP has rebounded with a 53.29% gain.

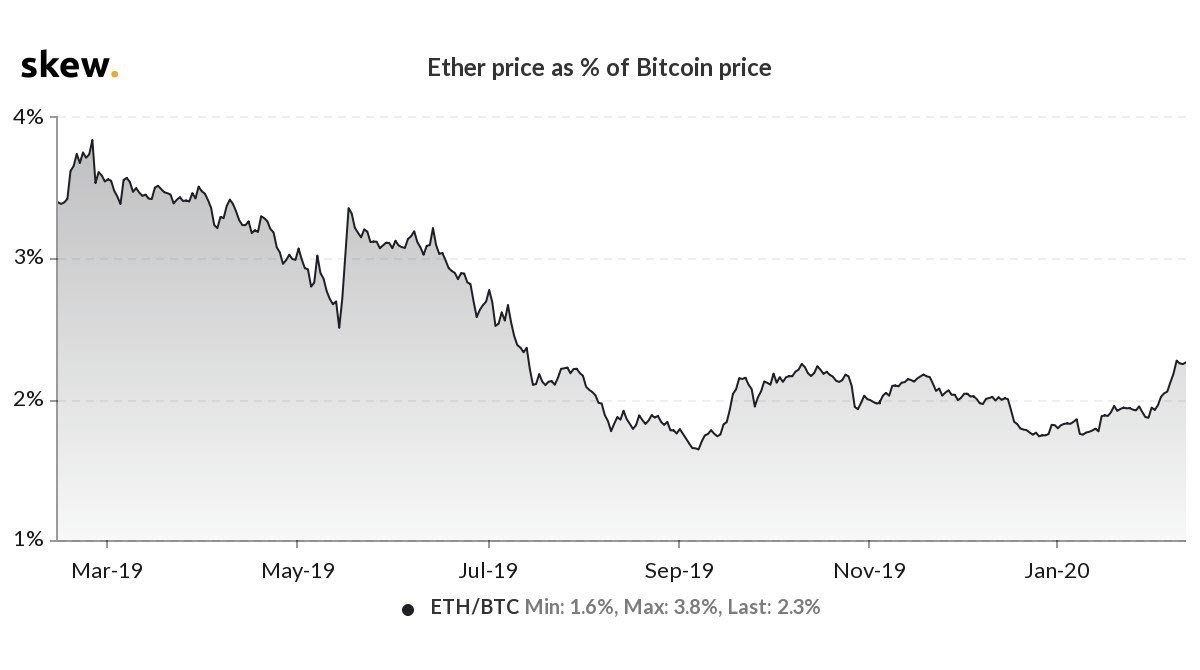

Ether price as % of Bitcoin price chart. Source: Skew Analytics

Data from Skew Markets also shows that Ether’s price as a percentage of Bitcoin price recently rising to 2.3%, a high not seen since July 2019 when the percentage was around 2.5% and ETH traded for $364.

Let’s take a look at the charts to see what might be next for Ether.

Bulls are in the driver’s seat

The bulls continue to press Ether price higher allow the altcoin to reach the first take profit (TP) level at $240, which was the target focused on in the previous analysis.

Traders are now focused on setting a higher high above $270 but the volume gap on the volume profile visible range (VPVR) shows that it’s entirely possible for Ether to rally to $280 on a high volume spike. Despite this possibility, a TP target has been set at $270.

ETH USD daily chart. Source: TradingView

Traders will notice an impending golden cross between the 200-day and 50-day moving average on the daily time frame. Typically the 50-MA converging with the 200-MA is interpreted as a strong buy signal by investors.

In the event that Ether is able to continue to $270, TP is at $300 which is right below a high volume node on the VPVR.

Currently, the relative strength index (RSI) is rising to 84 which is in the overbought zone and the moving average convergence divergence, or MACD, continues to rise higher as the histogram shows an increase in momentum.

On the shorter timeframe, we can see that purchasing volume continues to increase and the set up for Ether remains bullish.

ETH USD 6-hour chart. Source: TradingView

At some point traders will take profit, leading larger-cap cryptos like Bitcoin and Ether to lose some momentum over the short-term. Such a pause would likely lead Ether price to revisit the 23.6% Fibonacci retracement at $227. This point aligns with the support at $230, the Bollinger Band indicator’s moving average and a high volume node on the VPVR.

Below this level, there appears to be strong support at $226 and $222. If the price drops below the lower Bollinger Band arm ($210.66) then a drop to the 61.8% Fibonacci retracement at $191.77 could occur but given the technical strength of Bitcoin and Ether’s recent moves, this seems an unlikely scenario.

ETH/BTC mirrors the ETH/USD pair

ETHBTC daily chart. Source: TradingView

The ETH/BTC pair has also been on a tear lately, with the 50 and 200-MA on the verge of a golden cross and the price looks ready to extend to 0.02530 satoshis.

Similar to the ETH/USD pair, a pullback in Ether price would prompt traders to anticipate a bounce at the 23.6% Fibonacci retracement 0.02241 satoshis and below this the VPVR show strong interest and support at 0.02162 satoshis.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of CryptoX. Every investment and trading move involves risk. You should conduct your own research when making a decision.