Ethereum entered a consolidation period over the past week that has led to the formation of a descending triangle on its 4-hour chart. A horizontal trendline developed along with the swing lows while a descending trendline formed along with the swing highs.

The continuation pattern estimates that a spike in demand for Ether that allows it to break above the hypothenuse could propel its price to $251. This target is determined by measuring the distance between the two highest points of a triangle and adding it to the breakout point.

Ethereum Forms a Descending Triangle. (Source: TradingView)

Even though a sudden increase in sell orders may have the strength to invalidate the bullish outlook, multiple on-chain support the idea that Ethereum is poised to breakout.

Ethereum’s On-Chain Metrics Turn Bullish

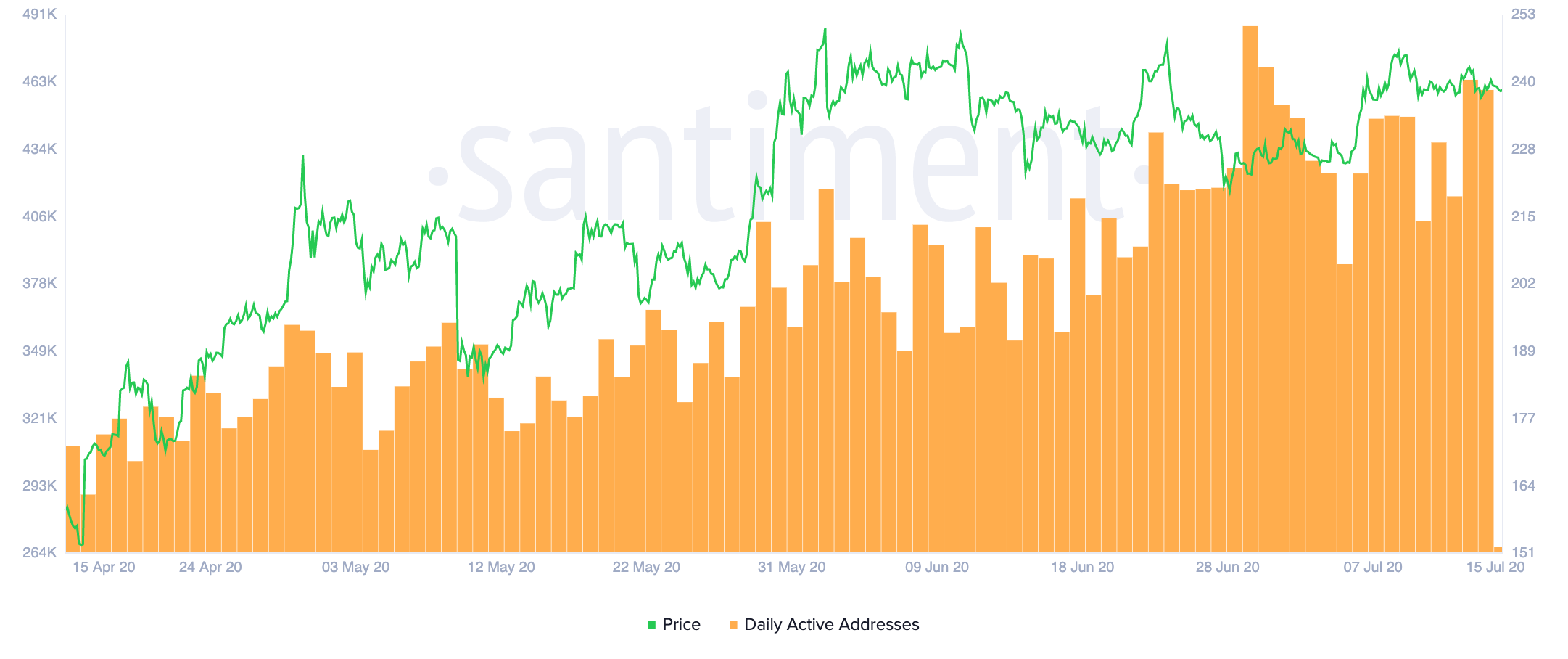

The number of daily active addresses on the Ethereum network continues rising at an exponential rate despite the lackluster price action. On July 14 and 15, ETH saw the third and fourth highest number of daily active addresses in the past year, according to Brian Quinlivan, marketing and social media director at Santiment.

Based on historical data, such a massive bullish divergence between prices and daily active addresses has been followed by a price increase in the past. Now, a similar phenomenon could be about to take place.

Bullish Divergence Between Daily Active Addresses and ETH's Price. (Source: Santiment)

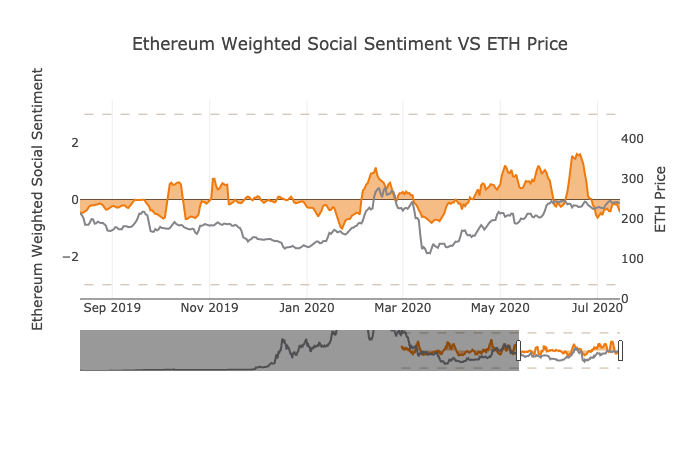

The number of ETH-related mentions across different social media networks adds credence to the optimistic scenario. Ethereum’s weighted social sentiment is currently trending down as investors seem to have shifted their focus towards lower-cap altcoins. This negative social sentiment is likely due to the low levels of volatility, but the outcome could benefit the bulls.

“With enough people ignoring ETH while keeping their eyes on smaller caps, there will be an opportunity to catch the crowd off guard to make whale investors maximize their gains when they finally make their moves,” said Quinlivan.

Ethereum's Social Sentiment Turns Negative. (Source: Santiment)

Massive Support and Resistance Ahead

Regardless of the positive outcome forecasted by the on-chain metrics previously mentioned, Ethereum sits between two critical supply barriers.

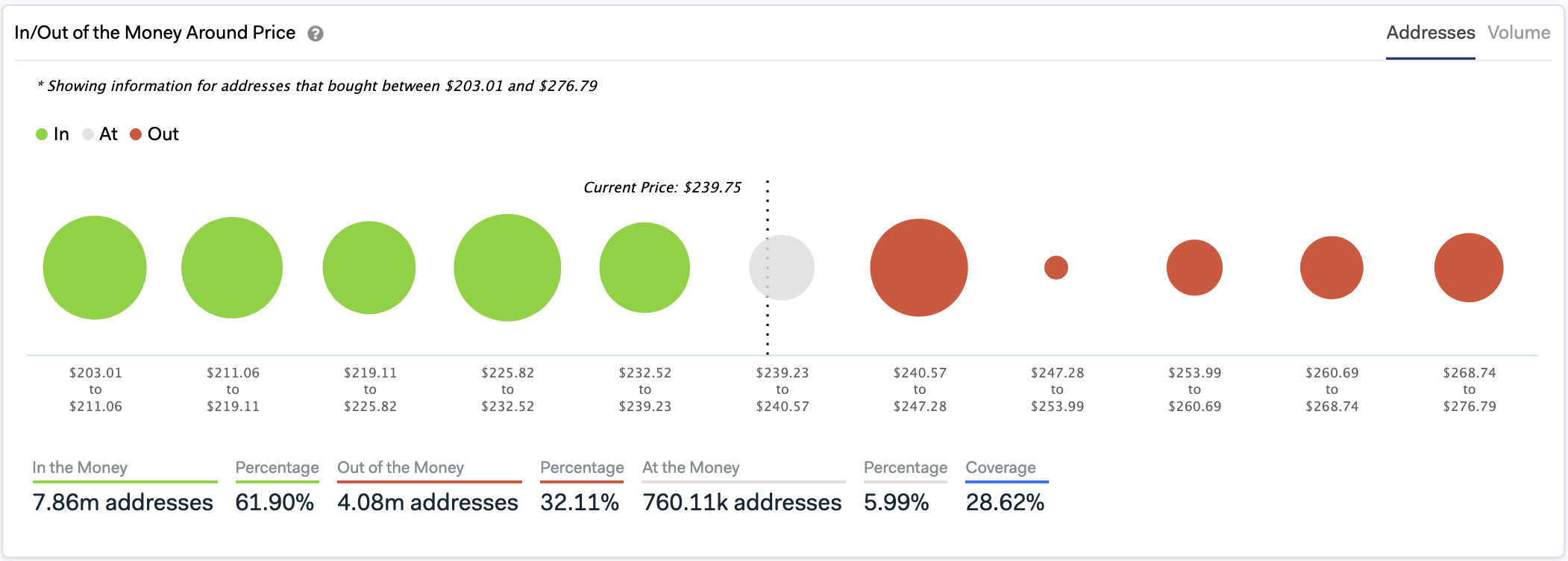

IntoTheBlock’s “In/Out of the Money Around Price” model estimates that over 1.5 million addresses had previously purchased more than 4 million ETH between $240 and $247. On the flip side, roughly 1.3 million addresses bought nearly 10.4 million ETH between $232 and $239.

Holders within the higher range may try to break even when Ether rises, while those in the lower range would likely try to remain profitable in the event of a correction. Therefore, a breakout will only occur once one of these two trading groups cannot hold any longer.

Ethereum Contained Within Strong Support and Resistance. (Source: IntoTheBlock)

Now that Ethereum seems to be on the cusp of resuming its historic bull trend, investors must wait patiently on the sidelines to avoid getting caught on the wrong side of the trend.

Featured Image by Depositphotos Price tags: ethusd, ethbtc Chart from TradingView.com