The long awaited Ethereum 2.0 network upgrade has taken one step closer to launch with a preliminary date announced for the final planned public testnet.

The platform’s launch coordinator, Danny Ryan (@djrtwo) shared the news on the testnet’s discussion board on Discord.

“After discussions with client teams, the next multi-client testnet (mainnet config including min validator numbers) will have a min genesis time of August 4th,”

Further details would be made public in a couple of days, the Ethereum developer added.

Phase 0 of ETH 2.0 has been running on various testnets since the genesis block was created for Beacon Chain in April. Phase 0 is the first stage in the long awaited upgrade to Proof-of-Stake and will dramatically increase transaction speeds.

Instead of the current Proof-of-Work system which involves miners, ETH 2.0 will be secured by users putting up a minimum of 32 ETH stake to run a validating node.

Three months of successful testing

Beacon Chain went live on the initial testnet, called Sapphire, in April using smaller 3.2 ETH deposits. Following its success, full 32 ETH nodes went live in May on the Topaz testnet and staking rewards were issued.

The Onyx testnet commenced in June and was running steadily with around 20,000 validators by the end of the month. Finally, the Altona coordinated multi-client testnet for Phase 0 went live in early July to ensure stability before a public testnet could be rolled out.

Prysmatic Labs have conducted most of the previous testing. The Prysm ETH 2.0 client was successfully audited last week by blockchain security and auditing firm Quantstamp. A weekend blog post by Prysmatic confirmed that its developers are “so close” to launching a final multi-client public testnet.

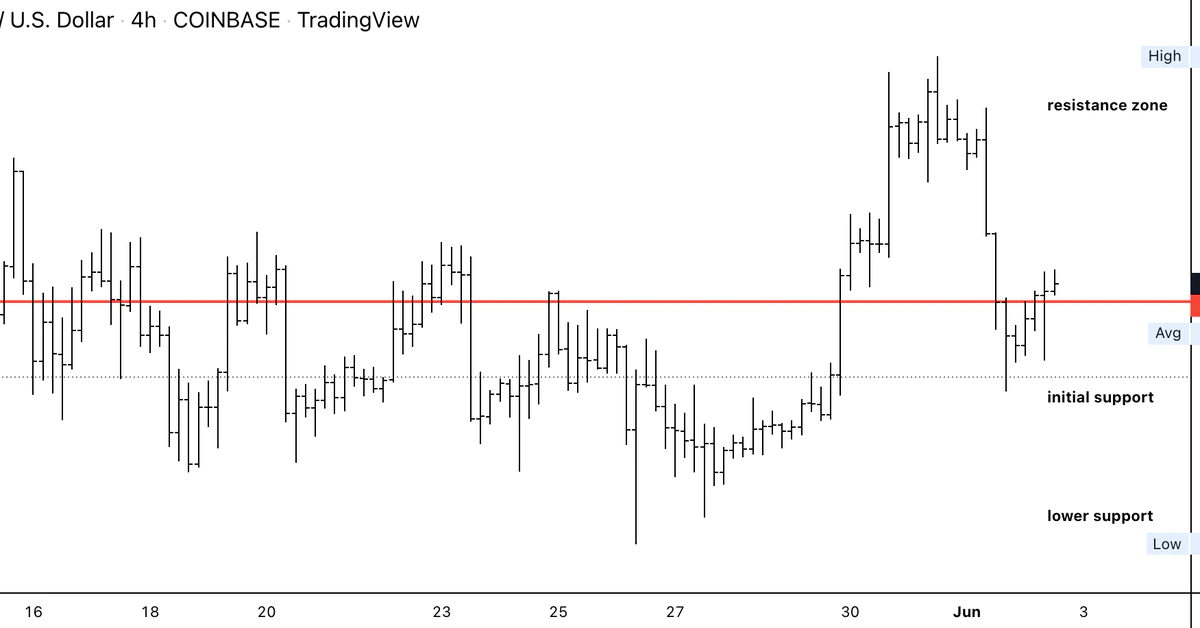

Network under pressure

Ethereum has faced increased pressure recently from a surge in stablecoin issuance and the DeFi boom. Gas usage and network fees have skyrocketed to record levels leaving the platform open to criticism from its detractors.

In the interim, Layer 2 scaling solutions could alleviate these bottlenecks and bring gas fees back down to sustainable levels. But in the long run there is a lot riding on Ethereum 2.0.