Over the past few weeks, Ether (ETH) has tracked Bitcoin’s (BTC) price action and observant traders have deftly played reversals off double bottoms and back to back bounces at the $162 and $153 support. A comparison of the daily and weekly charts of Ether and Bitcoin highlights a number of similarities, chiefly, the Doji candle set right outside the upper arm of a wedge pattern. Ether, like Bitcoin, is consolidating into a tightening range as Bitcoin cools off and searches for direction after the meteoric 42% rally on Oct. 25.

Crypto market data weekly view. Source: Coin360

With the weekly close approaching, traders are probably enjoying the weekend and waiting for the candle close to provide some insight into what direction the market might take going forward. Let’s take a look at the charts to see where Ether price might go.

ETH USD daily chart. Source: TradingView

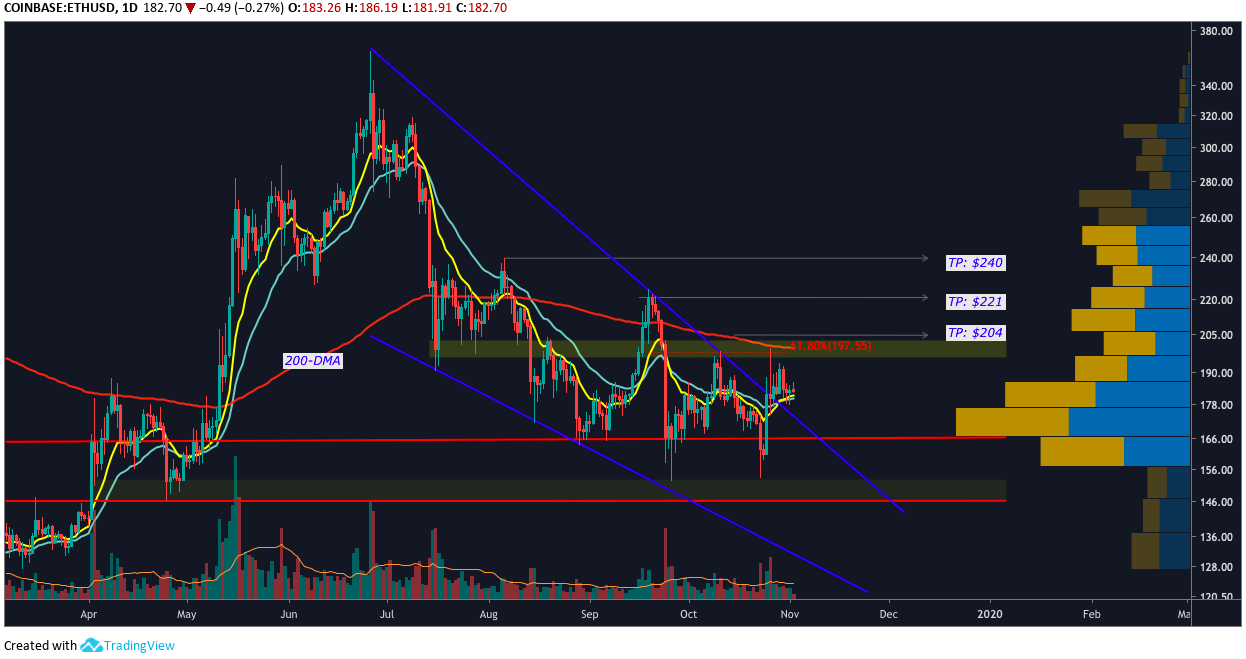

Similar to Bitcoin, Ether trades outside of a descending channel (wedge for Ether) in a tightening range. On the daily timeframe, the 12 exponential moving average (EMA) has pulled slightly above the 26-EMA and the volume profile visible range (VPVR) shows that

Ether needs to clear $184.27 and $185.12 to gain above the high volume node of the range. As has been custom over the past weeks, double bottoms patterns have provided pleasant results and the recent double bottom at $177.60 was followed by successive 4.30% gains

ETH USD daily chart. Source: TradingView

Like Bitcoin, the Bollinger Bands are drawing closer together and Ether rides atop the middle moving average of the indicator. As is customary of crypto assets before they make an up or downside move, trading volume has steadily decreased and the trading range has tightened.

A move to $187 would clear the high volume nodes of the VPVR at $180 to $184 and also move price to the upper arm of the Bollinger Band indicator. This could lead to a move to $191, a 5% gain, and also give Ether the opportunity to set a lower high at $193.

Ultimately, traders would like to see Ether set a higher high above $194, a point which also aligns with the 200-day moving average and the 61.8% Fibonacci retracement level. This would bring the price closer to $204 which has been the first sell target since the double bottom at $153 on Oct. 23.

The ETH/BTC pair looks relatively unchanged since the last analysis and the altcoin sill needs to rise above 0.021100 satoshis (sats) and 0.021961 (sats) to spark traders’ interest.

ETH BTC weekly chart. Source: TradingView

Currently, Ether price action can be described as neutral, hence the neutral Doji candlestick directly outside of the descending wedge on the weekly timeframe. On the weekly timeframe, Bitcoin is also in a similar position but is attempting to overcome the $9,400 resistance.

Investors are well aware of the fact that Ether tends to follow Bitcoin’s price action so its likely Ether could mirror whatever path Bitcoin takes as the weekly close approaches.

ETH BTC weekly MACD. Source: TradingView

On the weekly timeframe, the moving average convergence divergence (MACD) is pulling toward the signal line which is descending. The weekly Stochastic RSI (Stoch) is also steadily ascending towards bullish territory.

While this is encouraging, for the past 4-weeks Ether price has been capped by the 20-week moving average (WMA) and it’s clear that this moving average needs to be taken out before Ether can continue towards the 61.8 Fibonacci retracement level at $197.55.

Ultimately, either an increase in trading volume or a bullish breakout from Bitcoin is needed to push Ether’s price higher. With the weekly close fast approaching, we will all just have to wait and see. Buying on the dips to $153, $160, and $166 has proven to be a successful strategy since Aug. 29 so in the event that Ether turns bearish into the weekly close there might be some lucrative trading opportunities.

The views and opinions expressed here are solely those of the author (@HorusHughes) and do not necessarily reflect the views of CryptoX. Every investment and trading move involves risk. You should conduct your own research when making a decision.