- Dow Jones Industrial Average (DJIA) futures fell as much as 178 points on Tuesday.

- Apple warned investors that coronavirus shutdown in China would hit revenue.

- One Morgan Stanley analyst said we are entering a ‘downturn’ phase for the U.S. markets.

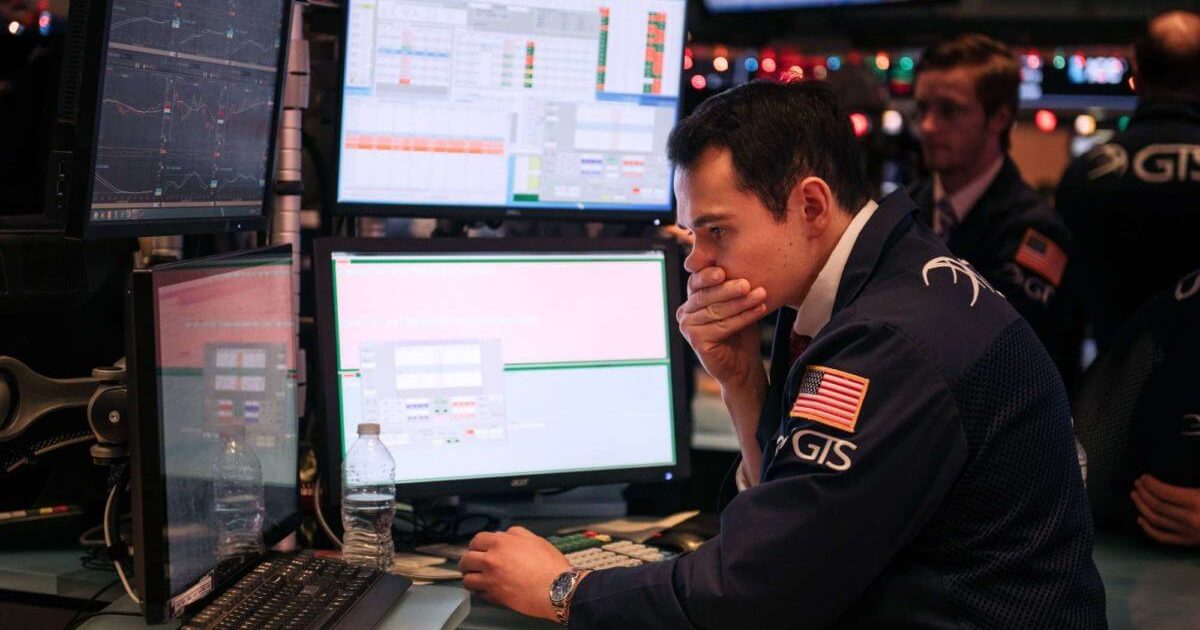

U.S. stock markets were knocked off their record highs during after hours trading after Apple issued a revenue warning. Dow Jones Industrial Average (DJIA) futures slipped 178 points pointing to a weak opening on Tuesday.

At the same time, Morgan Stanley issued a warning of its own. In a note to clients, chief cross-asset strategist Andrew Sheets said we’re approaching the end of this current market cycle, citing a long list of warning signs:

Historically, in the ‘downturn’ phase of our indicator, long-dated bonds outperform stocks. Defensive and large-cap equities (modestly) outperform cyclicals and small caps. U.S. stocks (modestly) outperform those in the rest of the world. Investment grade credit returns more than high yield. Precious metals outperform other commodities.

These alarm bells have been ringing for a while, argues Sheets.

All have been happening, not just year-to-date, but for the better part of a year.

Dow futures in triple-digit slide

Dow futures contracts slipped as much as 178 points on Tuesday as traders return to their desks after Presidents’ Day.

S&P 500 futures and Nasdaq Composite futures were down 0.49% and 0.88% respectively.

Morgan Stanley: ‘We don’t really like anything’

Sheets re-iterated the bank’s ‘neutral’ stance to equities and advised clients to maintain a balanced portfolio until things become clearer.

In an interview with Bloomberg last year, Sheets confirmed that he doesn’t see much value anywhere right now.

We really don’t like anything … It looks like a cycle that’s turning, not continuing to expand.

It should be noted that the Dow Jones is up 15% since that interview. The analyst also revealed that the second half of 2020 will be weaker than the first. In Morgan Stanley’s own podcast, Sheets said any stock market gains this year will be ‘front-loaded.’

From growth to central bank policy to trade to politics, we think favorable forces are concentrated in the first half of 2020 with more challenges in the second half of the year. Enjoy the rally but be prepared to sell.

Dow Jones knocked by Apple revenue warning

Those front-loaded gains may already be over as the true economic impact of China’s coronavirus slowly unfolds. Apple popped investor complacency last night, saying the coronavirus will directly impact its revenue targets.

We are experiencing a slower return to normal conditions than we had anticipated. As a result, we do not expect to meet the revenue guidance we provided for the March quarter.

Apple cited store closures and factory shutdowns in China for the revision. It’s expected that other companies will follow Apple in lowering guidance in 2020.

The Dow Jones bull case

Not everyone agrees with the stock market’s bleak outlook today. In a lengthy rebuke to Morgan Stanley’s note, Market Review’s Eric Baker insisted we are nowhere near the ‘late-stage’ of this cycle. Quite the opposite, he says.

There is so much wrong with [Morgan Stanley’s] reasoning that it’s even hard to know where to start… We’re both in a low-rate environment and in the stable phase of the business cycle.

After a long weekend closure for Presidents’ Day, we’ll get a sense of trader sentiment as Wall Street opens up again.

This article was edited by Samburaj Das.