- Dow Jones Industrial Average (DJIA) futures plough higher again on Monday morning.

- The Federal Reserve reported a huge drop in demand for its emergency liquidity services – a sign that financial markets are now stable.

- New York moves to phase two of re-opening, brining 300,000 back to work.

Stocks are flying yet again in the Monday premarket session. Dow Jones Industrial Average (DJIA) futures popped almost 1% higher, erasing earlier losses.

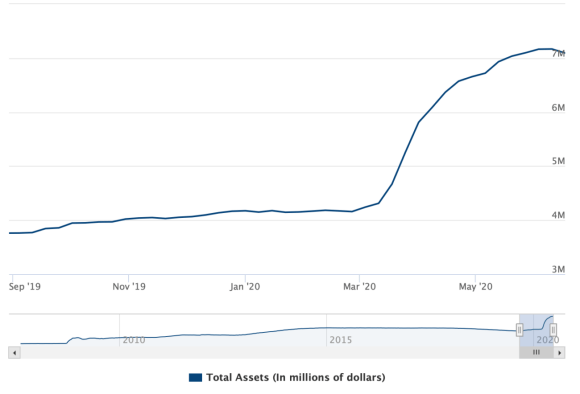

Traders are feeling bullish as the Federal Reserve hinted that the liquidity crisis that trigged the March selloff is now over. Chairman Powell rolled back the bank’s balance sheet by $74 billion – the most since 2009. And demand for dollar liquidity is at the lowest in months.

Simply put: the markets are ready to stand on their own feet again. Analysts at Clifton Capital were cautiously optimistic about the move:

A drop in repos and central bank liquidity swaps has actually led to the first report of a decline in the Fed’s balance sheet in the latest report – this is a good thing, assuredly, but there’s a long way to go.

Dow futures turn positive in strong overnight session

Despite opening negative on Sunday evening, Dow futures climbed more than 400 points from the low overnight. The index is set to open almost 1% higher at the bell. Despite the rise, JP Morgan warns that the broad rally won’t continue into the second half of the year, and investors will have to get more selective in picking stocks.

S&P 500 futures and Nasdaq Composite futures were up 1% each.

The dollar crunch is over

By rolling back its balance sheet by the most since 2009, the Fed is sending a clear message: the worst of the liquidity crisis is over.

It was a dollar crunch that sent stocks into the fastest and sharpest bear market in history this March. Now the crisis has stabilized, it’s one less fear for investors.

And it’s not just the balance sheet. All the Fed’s emergency operations are tapering off. Swap lines (which eases dollar demand) are at the lowest since early April. Loans, commercial paper facilities, money market mutual funds, and overnight repo operations are all at the lowest rate in months.

It’s a sign of strength that stocks are holding strong as Fed stimulus tapers off. It suggests there is underlying demand beyond what the Fed is doing. John Roberts at NatWest Markets said the markets are ready to stand on their own and take charge seamlessly.

We expect this handoff from central bank liquidity to the market to be relatively uneventful.

The Federal Reserve bear case

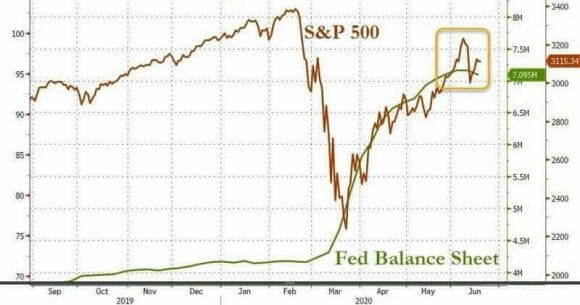

Not everyone is convinced the Fed’s actions are bullish. Many have pointed out the eerie correlation between stocks and the Fed’s balance sheet. As the Federal Reserve starts tapering off, there’s a real risk the S&P 500 and Dow Jones pull back with it.

However, any correction is likely to be short-lived, as Powell has reiterated his support for the market if required. Barry James at James Investment Research is one of many warning investors not to stand in the way of the market.

The market wants to go higher because of an old saying: ‘Don’t fight the Fed’ … They are throwing everything they can at this and that is the huge prop.

Dow Jones buoyed by New York re-opening

Another strong catalyst for traders this morning is the phase two re-opening of New York. The financial capital of the world will see up to 300,000 people return to work today. Restaurants will re-open with outdoor dining and shops will cautiously reopen their doors.

While the countrywide trend remains worrisome, New York numbers have consistently driven trader sentiment so it’s little surprise to see an uptick.

Big tech continues to lead the advance with Apple (NASDAQ: APPL) and Microsoft (NASDAQ: MSFT) up almost 1% each in the early session. As Kirk Hammett at Wells Fargo explained, big tech has now become the ‘defensive’ trade.

I think you have to look for the mega-technology stocks which are now viewed as defensive plays… It’s interesting a lot of the more traditionally defensive value stocks are viewed as more speculative.

Airlines, hotels, and financials lead the declines going into Monday’s open.