- The U.S. stock market has been rallying over the past week in anticipation of Fed chair Jerome Powell’s speech.

- Despite fundamental bearishness in the markets, investors are not betting against the Fed, rising liquidity, and low-interest rates.

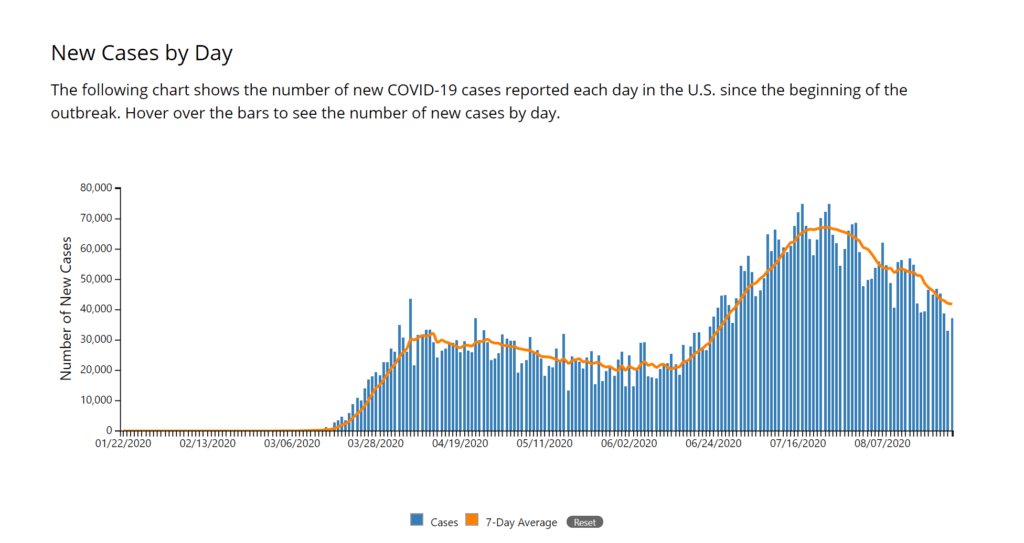

- The positive stance from the Fed coincides with declining daily virus cases in the U.S.

The Federal Reserve is rethinking its monetary policy. The new “market-friendly” Fed raises the likelihood of a prolonged stock market bull run in the near term.

Investors turned bullish ahead of Fed Chair Jerome Powell’s speech at Jackson Hole, with the S&P 500 and Nasdaq returning to record highs.

Expectations of sustained low-interest rates, rebounding industrial profits, and higher inflation could strengthen the ongoing U.S. stock market rally.

Reason #1: Powell’s Surprising Stance

The Fed has become noticeably more market-friendly, especially when compared with its response to White House pressure in 2018.

The U.S. stock market is already hovering at all-time highs, as Big Tech continues to thrive with large earnings.

Yet, AxiCorp’s chief global markets strategist Stephen Innes says no-one is willing to bet against the Fed:

Markets are now turning bullishly focused on U.S. Fed Chair Powell’s speech at Jackson Hole, which is expected to be a very market-friendly delivery. After all, I do not think anyone is willing to bet against the Fed finding a way to sound overtly dovish, especially during this pandemic-induced easing cycle.

There are technical indicators that suggest the stock market has become overheated. For instance, the Buffett Indicator shows U.S. stocks are as overvalued as the dot-com era.

But the Fed is providing a strong backdrop for the stock market in the short term, which could sustain investor confidence.

Investors expect the Fed to maintain a low-interest rate for the years to come. Watch the video below.

Those expectations were vindicated on Thursday as Powell once again reiterated that the Fed is in no rush to raise interest rates.

Reason #2: Industrial Profits in Asia Rebound

From March to June, factories and manufacturing firms have struggled due to the pandemic. Virus outbreaks disrupted supply chains and halted deliveries, which prevented factories from running at full capacity.

Since July, industrial profits in China have recovered at a pace unseen since 2018. Economists say the rebound still faces obstacles as a result of declining low household demand and geopolitical risks.

China’s increase overall business productivity suggests that Asia and the U.S. might see similar growth with eased restrictions. Bloomberg Economics’ David Qu wrote:

The increase is due to strong exports and moderating producer price deflation, and these should continue to support profits in coming months.

Since mid-July, daily COVID-19 cases in the U.S. have declined from around 75,000 to 42,000.

Reason #3: Global Liquidity Remains a Strong Fundamental Catalyst

In August, Bank of America strategist Michael Hartnett says he sees many bearish factors in the U.S. stock market.

Hartnett emphasized that growing liquidity has masked any bearishness in the markets. Despite the fundamental warning signs, he said maximum liquidity and low-interest rates lead to “maximum” bullishness.

The strategist said that “nothing matters but liquidity,” and global liquidity has continued to increase in recent weeks. On August 18, Welt market strategist Holger Zschaepitz said:

S&P 500 rises to new ATH, surpassing high reached before coronavirus hit, mainly driven by a fresh record in global liquidity.

The markets might be experiencing peak “euphoria,” as CCN.com previously reported, but investors betting against the Fed remains unlikely.