Data published today from Cryptox Markets and Arcane Research found that despite investor concerns over the block reward halving disincentivizing miners and possibly compromising the security of the network, demand for Bitcoin continues to rise globally.

Proof of increasing adoption is supported by the total number of functioning Bitcoin ATMs rising to 8,000, a more than 90% increase since 2019. Bitcoin ATM operator, Coinstar, also reported a 40% increase in Bitcoin ATM use since February of this year.

Real BTC daily volume vs. BTC Price. Source: Messari

Bitcoin gains and daily transaction volume eclipses altcoins

When compared against altcoins, Bitcoin also continues to lead in market capitalization and USD transaction volume with more than $10 billion in daily transaction volume. This figure eclipses Ether (ETH) and Litecoin (LTC) which are both seeing daily transaction volumes below $500 million.

Currently, for the month of May, Bitcoin price is up nearly 10%, whereas altcoins like Ether, XRP, and Monero (XMR) are hardly breaking even.

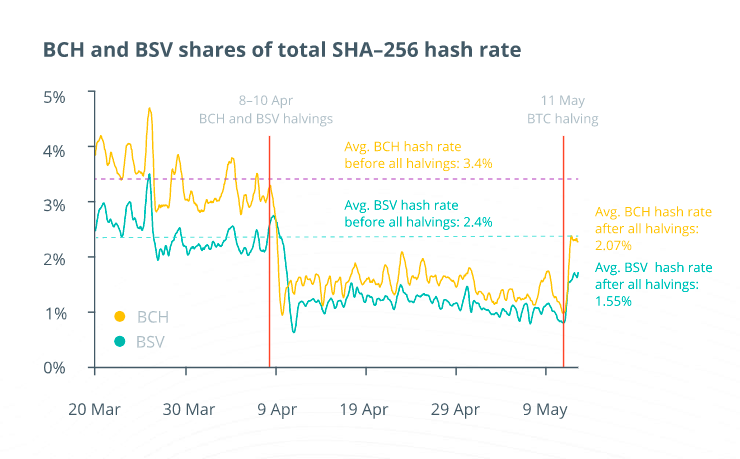

Arcane Research also found that after the halving on May 11, miners are gradually shifting back to the Bitcoin Cash (BCH) and Bitcoin SV (BSV) network but both networks have seen drastic drops in their share of total SHA-256 hash rate.

BCH and BSV hash rate shares. Source: Cryptox Markets / Arcane Research

Bitcoin Cash dropped from 3.4% to 2.07%, a startling 40% reduction. Meanwhile, Bitcoin SV fell from 2.39% to 1.55%, a sharp 35% decline.

Retail and institutional investors remain bullish on Bitcoin’s future value

Bitcoin’s most recent price has occurred on strong volume, a bullish sign as signals investors sentiment is high amongst retail and institutional investors.

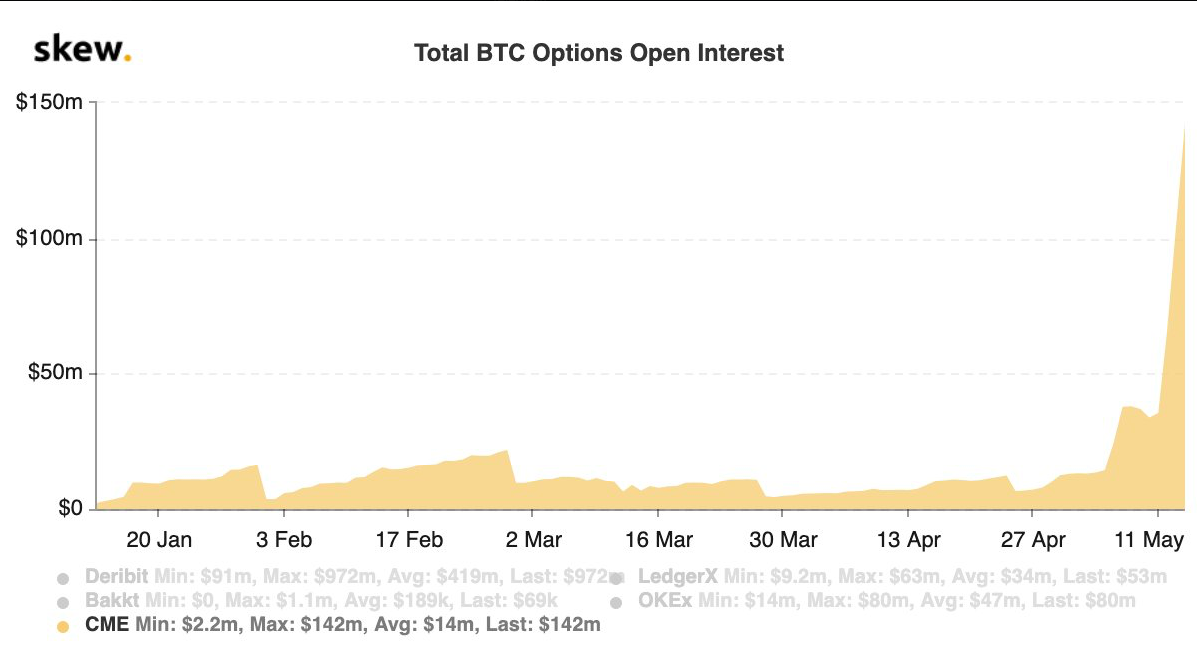

Total BTC Options Open Interest. Source: Skew

In addition to breaking above $10,000 on (date), this week Cryptox reported the total open interest on CME Bitcoin futures rose by 1,000% since the start of the month. This is a healthy sign and noticeably different than the low volume recovery from the March 13 crash to $3,750.

Arcane Research also found that significant growth in the peer-to-peer lending markets and an increasing percentage of women represented in crypto sector jobs further indicates that the Bitcoin network and ecosystem continue to make positive strides forward.