The world is slowly descending into the age of deflation. Under this condition, central banks adopt a negative interest rate policy (NIRP).

In other words, those who park their cash in banks must pay interest. This forces many citizens to invest their excess cash in assets such as stocks, commodities, or even cryptocurrencies.

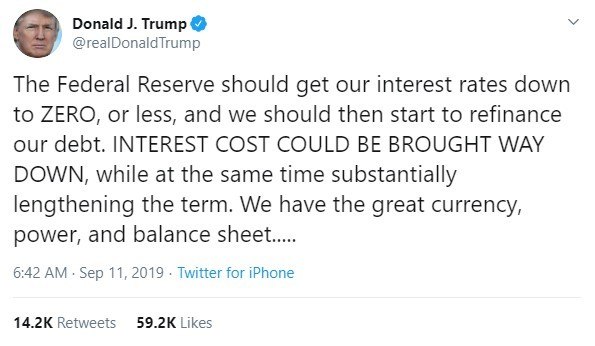

In 2014, the European Central Bank (ECB) embraced NIRP. The Bank of Japan followed suit in 2016. Recently, the President of the United States tweeted that the Federal Reserve should reduce interest rates to zero or below.

In addition, the Reserve Bank of Australia is starting to flirt with the idea of cutting interest rates to zero or even less.

It appears that we’re seeing a trend where central banks are considering introducing NIRP. Read below to find out why this is good for bitcoin.

It’s Possible That the U.S. Introduces Negative Interest Rates

In a CNBC interview, former Texas congressman Ron Paul said that the Fed will eventually adopt negative interest rates just like other countries. The former presidential candidate said,

We will join the rest of them and go to total negative interest rates in hopes that that will be the solution.

Alex Kruger spoke to CCN and said that while it may be unlikely for negative interest rates to hit the U.S. in the short-term, it can be a possibility in the long-term. The economist said,

[It is] extremely unlikely in the short-term. The Fed would rather likely restart QE before going negative. In the long-term, everything is possible.

In addition, David McAlvany, CEO of Vaulted and The McAlvany Financial Group, also sees a trend emerging. He said,

The average citizen may think negative interest rates are impossible, but they are a very real weapon in the arsenal of central banks. And while it may be a rarely-used tactic, it is one that is relatively on the rise.

As a depositor, paying banks to hold your cash sounds absurd. However, this is the reality of the world that we live in. For cryptocurrency enthusiasts, NIRP should be music to your ears as it is bullish for bitcoin and other cryptocurrencies.

Gold Investment Executive: ‘Bitcoin Could See Long-Term Growth in Value as a Shelter in a Negative Interest Rate Environment’

We are not alone in our view that a deflationary environment with negative interest rates is bullish for bitcoin. The co-founder of MarketOrders, Sukhi Jutla, spoke to CCN and shared her view as to how a deflationary climate could impact the price of bitcoin. She said:

With negative interest rates, there is less of an incentive to save and an incentive to spend. Bitcoin, like the asset gold, stores value and are equal to current spending power. Therefore it makes sense to invest more into bitcoin when interest rates are low.

She added:

Negative interest rates raise the attractiveness of age-old stores of value like gold and Bitcoin, [which] also behaves in similar ways to gold in that there is a finite and limited supply and has real exchangeable value.

In addition, Nic Carter, a partner in Castle Island Ventures and a former cryptoasset analyst at Fidelity, supports the stance of Sukhi Jutla. The venture capitalist said,

I think persistent, deep negative rates are a redpill that awaken people to the confiscatory nature of fiat currency, and will make crypto look like a very attractive alternative.

Nic Carter also mentioned that we have yet to reach that point. However, we might soon as the amount of negative-yielding debt skyrockets. According to ZeroHedge, it could act as a catalyst for a longer bitcoin rally.

Central bank executives may call bitcoin as an ‘evil spawn’ but it appears that their policies may be the ones that will drive mass adoption.

Last modified (UTC): September 17, 2019 1:00 PM