Are cryptocurrencies past their prime, or is their still a lot of room for growth? As someone who was a bit late to the party of adopting crytpos, this is a question that I frequently ask myself. I am sure that each of us has an intuitive hunch that cryptos have a bright future ahead of them, but today I want to use Industry Lifecycle Theory to justify why I am optimistic about cryptocurrency.

Industry Lifecycle is the term that business analysts use to describe the introduction, adoption, and eventual decline of an industry. Although cryptocurrencies are not an “industry” in the traditional sense, lifecycle theory can give us some hints as to how crypto acceptance and usage could change and develop over the coming years.

Basics of Industry Lifestyle

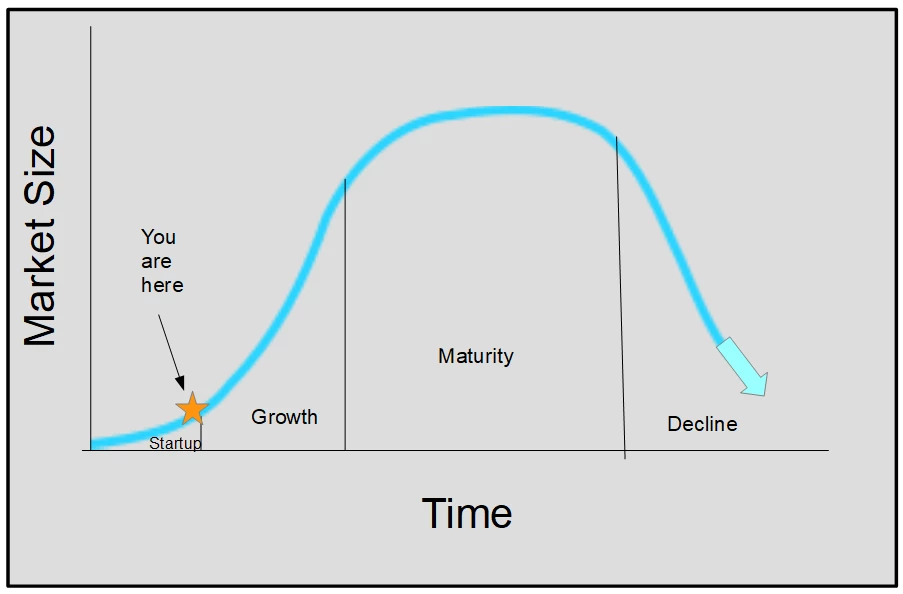

According to the theory, each industry goes through the same basic stages. The key to understanding whether cryptos have a bright future is determining what stage of the industry lifecycle they are currently in. If they are in the startup phase, then the future is bright; if they are in the maturity phase, then the future is mostly downhill. This article will look at the characteristics of each stage of the industry lifecycle to estimate what stage crypto is currently in.

The first stage for any industry (cryptocurrencies) is the startup phase. In this phase, demand tends to be unclear, information on the products is limited, and the industry is highly fragmented (Kenton, 2019). Let’s look at these lifecycle qualifications in terms of crypto. Demand is unclear; the volatile price swings of crypto indicate that the market is still attempting to find a proper valuation. Information is certainly limited; most people have heard of Bitcoin, but how many of your neighbors could describe blockchain or the advantages of Proof of Work vs. Proof of Stake?

The industry is highly fragmented. Bitcoin is the dominant crypto, but sorting coins by volume on CoinMarketCap reveals that there are 51 different crytpos that have traded over $10 million in volume over the past 24 hours.

Following the startup phase, an industry enters the growth phase in which “a handful of important players usually become apparent”, companies increase spending on marketing, consumers begin to understand the product’s value, and large companies in adjacent industries enter the market through acquisitions (Kenton, 2019). In my opinion, we are just at the cusp of entering the growth phase for cryptocurrencies. Large companies in adjacent industries are expressing an interest in developing their own crypto projects. Facebook’s Libra is the most glaring example, but even retailers such as Walmart have expressed interest in getting on board with cryptos. As a whole, the market still doesn’t know the exact value that cryptos hold, but more and more businesses are at least starting to recognize the value of cryptos by accepting them as a payment for services.

What Stage are Cryptos In?

I think we are still in the startup phase of the crypto industry, but several trends suggest that we are getting ready to enter the growth phase for the crypto industry. According to lifecycle theory, demand for and acceptance of cryptos will increase rapidly during this phase. Just as importantly, we should expect to see a “shake out” in which many crypto projects fall out of favor, but the remaining projects become much more widely accepted. In other words, the number of cryptos used will fall, but the acceptance level of the remaining cryptos will increase.

If cryptos were past their prime, what would we expect to see? The maturity stage comes right before the decline of an industry. During this phase, it becomes harder to launch new products, each business (coin) begins to have a specific niche, and growth becoming less important (Kenton, 2019).

Clearly, none of these applies to the current state of cryptos. It seems like a new project is launching almost every day. Airdrops, giveaways, and promotions demonstrate that growth and driving adoption are still important for cryptocurrency projects. Outside of a few coins that are designed for a specific purpose, most coins are not confined to a specific niche. If anything, the opposite is true, and coins that originally served a single purpose are now branching out to fulfill other roles as well.

How many cryptos will become mainstream, and which ones will they be? The simple answer is that we don’t know for sure. Industry lifecycle theory does not help us predict what specific business (or coin/token) will become the industry leader; it gives broad predictions about the industry as a whole. If I had to take my best guess, I would estimate that we are at the end of the startup phase and slowly moving into the growth phase. If my estimate is right, this means that there is a lot of potential growth and a bright future ahead for crytpos.

References

Kenton, W. (2019, March 12). Industry lifecycle. Retrieved 29 August, 2019 from: https://www.investopedia.com/terms/i/industrylifecycle.asp