By CCN Markets: Crypto exchange OKEx isn’t concerned that the bitcoin price appears to have hit a wall just above the $10,000 mark.

In fact, the industry giant believes BTC will surge another 34% to $14,000 before the end of the year, thanks to a helping hand from the US Federal Reserve.

#Fed is expected to signal a further rate cut at today’s Jackson Hole Symposium. An OKEx #analyst gives a $BTC target by this year’s end. 📰 More insights: https://t.co/Krun0cIal7

— OKEx (@OKEx) August 23, 2019

OKEx Explains $14,000 Bitcoin Price Target

OKEx predicts that the price of bitcoin is on track to move higher in response to global monetary policy, which seems biased toward easing in light of fragile economic growth.

The cryptocurrency exchange said:

“With additional rate cuts on the horizon and global central banks are jumping on the easing bandwagon, the demand for hard assets like gold is expected to surge, and that inflation-hedging drive could push the prices of bitcoin to $14,000 levels by the end of the year.”

OKEx observed that three central banks have slashed interest rates just this month.

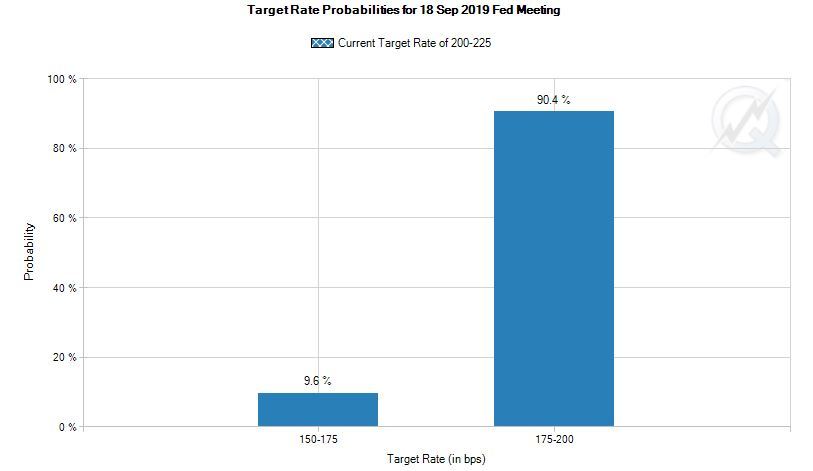

The exchange also points out that there’s a virtually-100% chance of the Federal Reserve reducing its benchmark target again in September at the next FOMC policy meeting.

Bitcoin shot up 12% between the June and July FOMC meetings, as anticipation of a rate cut increased.

The Fed then slashed rates by 25 basis points toward the end of July, and OKEx has based its estimate on this relationship – even though the bitcoin price barely budged when the rate cut was formally announced.

The cryptocurrency exchange is assuming that a 25 basis rate point cut could boost the bitcoin price by 12%. That’s great for crypto bulls since traders currently expect as many as three more rate reductions in 2019.

“Assume that a 25 bps cut could give about 12% gain to BTCUSD, three more 25bps cuts could send BTCUSD to $14,000 levels by the year-end, breaking the previous high near $13,800.”

Why Should Interest Rate Cuts Bolster Crypto?

Bitcoin bulls believe that monetary easing by central governments could be a tailwind for the cryptocurrency.

That’s because low interest rates disincentivize cash hoarding and could also trigger inflation.

If this thesis holds true, then OKEx’s prediction of the year-end bitcoin price of $14,000 shouldn’t be ruled out as a fantasy.

Click here for a real-time bitcoin price chart.

This article is protected by copyright laws and is owned by CCN Markets.