In mid-September, the foreign exchange company CME Group announced the launch of options on its bitcoin futures contracts in Q1 2020, pending regulatory review. CME Group executive Tim McCourt said there was “increasing client demand” for the firm’s bitcoin derivatives and now the company has published specifications for the options products.

Also Read: French Ministry of Education Publishes Bitcoin Resource Guide for Educators

CME Group’s Bitcoin Options

The global markets company CME Group has provided clients with the ability to hedge or trade benchmark options on futures across nearly every asset class. The firm has an average daily volume of $4.3 million this year and aims to offer options on bitcoin futures so investors can have a variety of different methods to trade the asset. When CME announced the launch of bitcoin options, McCourt detailed that the new product will provide “clients with additional flexibility to trade and hedge their bitcoin price risk.” This week, following Bakkt’s recent volume surges, CME published the preliminary contract specifications for the options. Price values will be based on the CME CF Bitcoin Reference Rate (BRR) which is determined by a variety of major crypto exchanges.

The contract unit will consist of one bitcoin futures contract, which is approximately five BTC quoted in USD. There’s a minimum price fluctuation and the listing cycle will mirror the firm’s bitcoin futures exposure. CME’s bitcoin options on futures will be traded between Sunday through Friday on Globex and Clearport. The company notes that the BTC options product is subject to revision and review by financial regulators. “We’re working to launch options on those futures,” McCourt said to crypto analyst Benjamin Pirus in a recent interview. “The option on the bitcoin future will give the holder of that option, either a put or a call, the right — but not necessarily the obligation, to either purchase or sell the underlying futures contracts at maturity.” McCourt further stressed:

It’s very similar to the way other options in the marketplace work. The difference here is the underlying, or the deliverable, of the options contract, is a CME Group bitcoin future.

Is Bitcoin Being ‘Tamed’ Like a Traditional Investment?

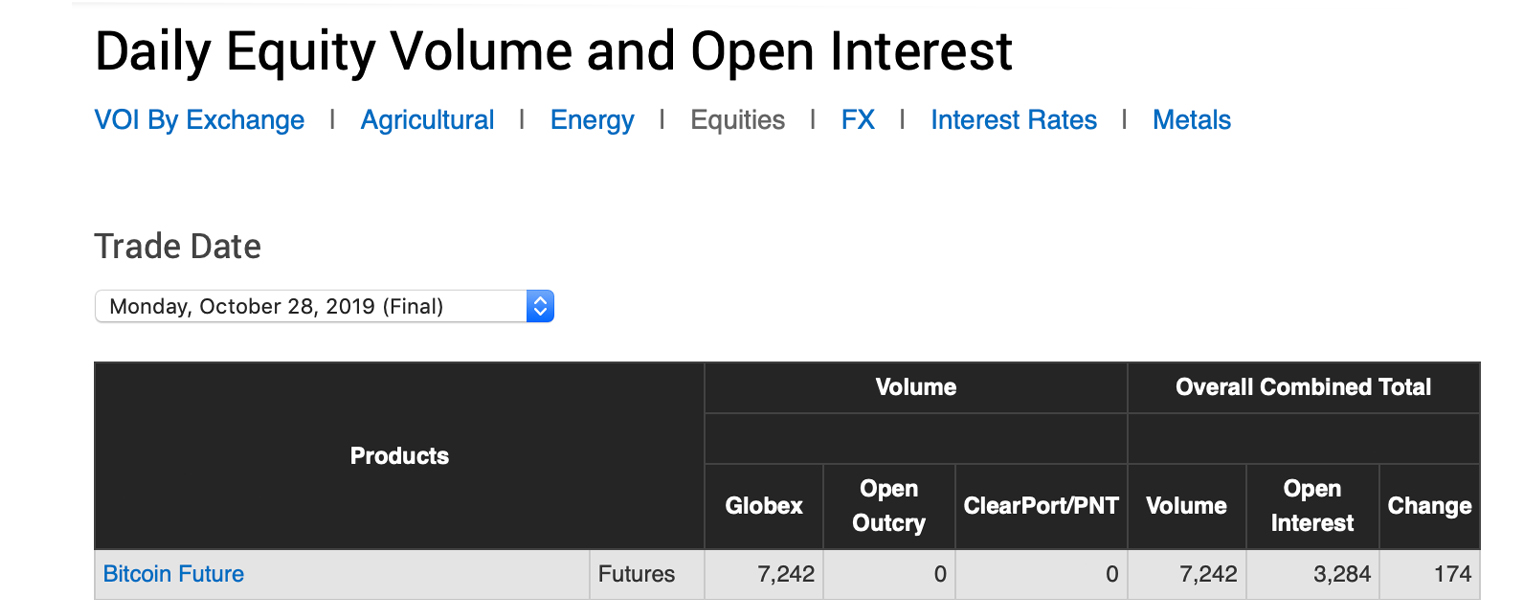

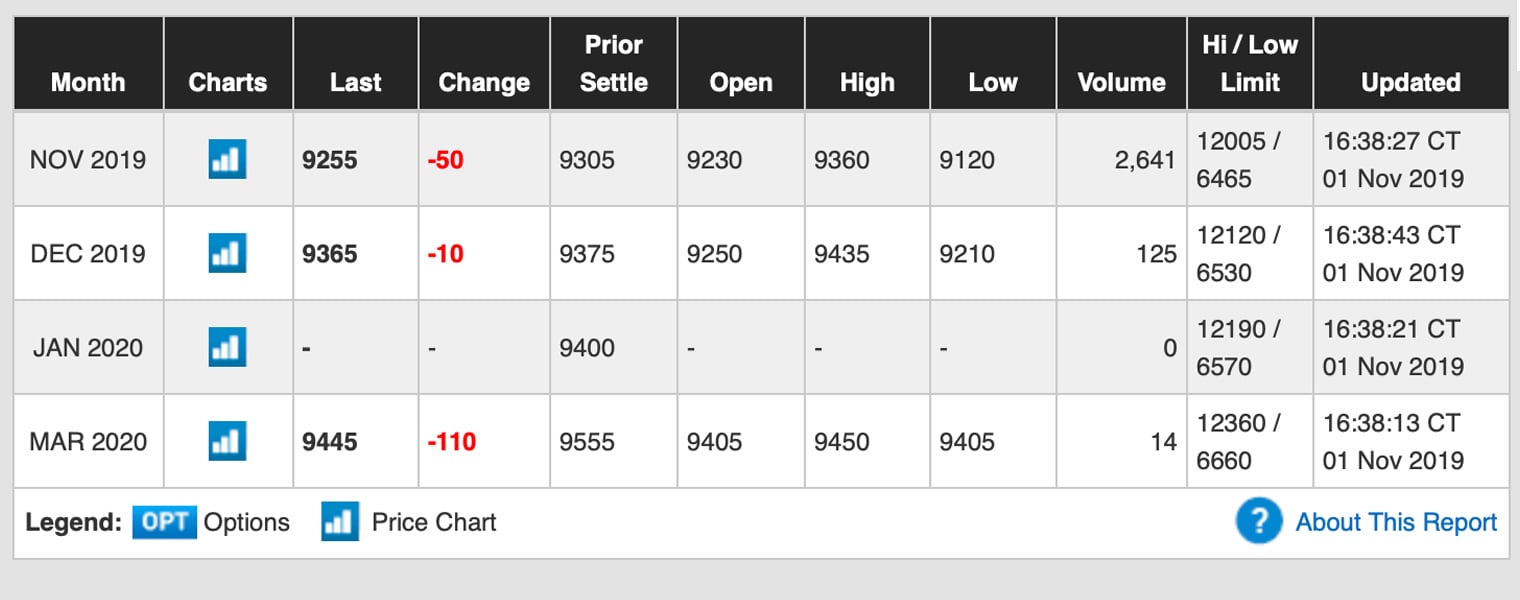

Bakkt’s physically-delivered bitcoin futures product has been getting a lot of fanfare lately after the exchange topped a few new records and CEO Kelly Loeffler announced Bakkt will be offering options on bitcoin futures as well. Despite the all-time highs at the Bakkt warehouse, CME Group’s BTC derivatives have seen much more volume. CME’s Globex saw 7,242 bitcoin futures contracts on October 28 and 3,284 in open interest. The following days on Globex through November 1, contracts were between 2,200 and 3,687. November’s CME bitcoin futures contracts today stand at 2,641 contracts and December positions are starting to pile up as well.

The crypto derivatives markets and products have matured a great deal since they launched and it’s been a touch less than two years since CME launched its BTC-based futures. At the time, the company’s chairman emeritus Leo Melamed told Reuters in an interview that adding BTC futures was a “very important step for bitcoin’s history.” Melamed added that he believed institutional investors would be very interested in the new asset class. “We will regulate, make bitcoin not wild, nor wilder. We’ll tame it into a regular type instrument of trade with rules.” Since then a slew of different companies have offered bitcoin-based derivatives products and futures are coming to other cryptocurrencies like ETH and BCH as well. Reports detail that BCH futures are expected to debut on a CFTC-regulated exchange in Q1 2020.

What do you think about CME’s bitcoin options specifications? How do you feel about the overall growth of crypto-based derivatives? Let us know what you think about this subject in the comments section below.

Image credits: Shutterstock, CME Group, Bitcoin Futures Volume Globex, and Pixabay.

Did you know you can buy and sell BCH privately using our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The local.Bitcoin.com marketplace has thousands of participants from all around the world trading BCH right now. And if you need a bitcoin wallet to securely store your coins, you can download one from us here.