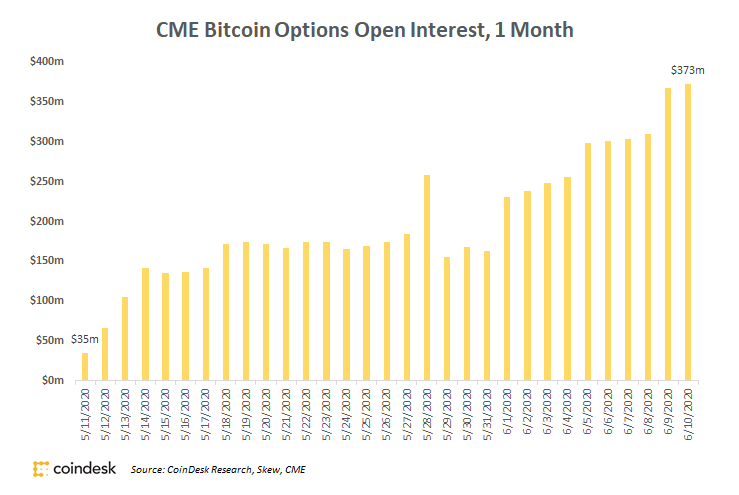

Over a recent 30-day period, the total open interest for CME bitcoin options increased more than tenfold, from $35 million on May 11 to $373 million on June 10. Moreover, open interest made a new all-time high on six consecutive days from June 5-10.

Significant growth in CME futures points to rapidly growing interest by institutional investors in trading regulated bitcoin derivatives products. Despite this growth, however, CME Group “has no plans to introduce additional cryptocurrency products,” a spokesperson told CryptoX. Thus for now, CME Group’s cryptocurrency products will only involve bitcoin.

CME, which launched its bitcoin options product only at the beginning of 2020, now represents over 20% of the global bitcoin options market measured by open interest, or the total number of outstanding derivative contracts. It’s now the second-largest bitcoin options market in the world behind Panama-based Deribit, according to Skew.

Growth in CME’s bitcoin options market is “a strong signal that regulated institutions are exposing their books to bitcoin,” said Matt Kaye, managing partner at Los Angeles-based Blockhead Capital. “CME has a higher cost of capital and is closed on weekends, so anyone trading there is likely making those sacrifices because they have to.”

Much of CME’s growth appears to have come at the expense of Deribit. Market shares claimed by competing bitcoin derivatives markets LedgerX, Bakkt and OKEx have remained largely unchanged since January.

Options aren’t the only bitcoin derivatives market where CME is seeing gains. In May, CME’s bitcoin futures demonstrated similarly remarkable growth, outpacing nearly every other bitcoin derivatives platform on a real and percentage growth basis. CME bitcoin futures open interest grew 29% over the last 30 days as institutional investors continue to enter the bitcoin derivatives market.

The leader in blockchain news, CryptoX is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CryptoX is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.