As Chinese authorities make it harder than ever to exchange cryptocurrency into fiat, miners may be forced to move to other jurisdictions, local sources say.

On Monday, crypto industry blogger Colin Wu tweeted that miners in China have been struggling to pay for electricity after the authorities started cracking down on OTC brokers in the country.

“74% of the miners surveyed told Wu that the payment of electricity bills has been greatly affected,” the tweet reads. China recently started blocking bank accounts and cards involved in purchases of cryptocurrency, and has investigated the two largest brokers, Zhao Dong and Xu Mingxing, Wu wrote in a blog post.

It’s currently a “challenge” for Chinese miners to convert bitcoin or tether into yuan, as “many people have had their bank accounts frozen when exchanging crypto for RMB on OTC platforms,” said Thomas Heller, formerly global business director at the mining pool F2Pool and now chief operation officer of mining and media firm HASHR8.

As CryptoX reported, in June, Chinese authorities ramped up efforts to block bank accounts that could be connected to illicit activities such as money laundering via cryptocurrency deals.

“It has always happened, but this year more than others,” Heller told CryptoX. “I would say it has become more common in the last couple months.”

However, he played down the scale of any exodus of miners from China, even though HASHR8 is currently helping some operators to move their operations – most to Russia but some to Kazakhstan.

“Most Chinese miners are mostly only familiar with the Chinese market, so it’s hard for them to move abroad and start mining,” Heller explained. “It’s [the China OTC clampdown] another factor that may make overseas mining more attractive, however this alone is not enough to push them overseas. Rather, they would try to find some workarounds.”

In the meantime, some operators are unplugging their miners, Wu wrote in a blog post. “There are also miners who said that their mining machines have been shut down for a month because they cannot sell the cryptocurrency to pay the electricity bill.”

Some OTC companies that specialize on serving mining firms “have also terminated their business,” Wu wrote.

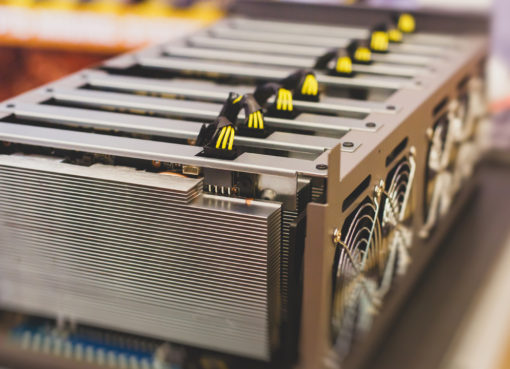

Most of the largest mining pools are based in China. An interactive map from Cambridge University’s Centre for Alternative Finance shows that the nation’s miners currently account for almost 72% of the average monthly bitcoin hash rate, that is the computing power dedicated to supporting the network.