This week Chainlink (LINK) is on an absolute tear, gaining 47% over the past four days on strong purchasing volume. The price had dropped by a massive 63.50% from March 11 to March 12 and bottomed at $1.35 on March 13. Since March 13 LINK has rallied 149% and at the time of writing the digital asset was up 6.65% for the day.

Other than the entire crypto market recovering from deeply oversold conditions, the recent announcement of new partnerships with decentralized finance giant Celsius, and Fantom could possibly be adding to the current excitement as previous partnership announcements have been known to drive LINK price higher.

Regardless of the reason, the recent gains are quite impressive and the current state of the daily chart suggests that there could be more to come. After LINK broke from the $1.99 – $2.30 range the price took off, clearing the volume profile visible range high volume node and rapidly reclaiming lost ground from the March 11-12 drop from $4.10 to $1.33.

LINK USDT daily chart. Source: TradingView

The swift drop on March 12 basically led to the price slicing through all key supports in one candle so traders will note that the consolidation that occurred on March 19 through April 5 matches the same price action from December 18 – January 13 when LINK traded in the same price range.

Today the price stopped right at $3.47, a point which previously served as support on Feb. 27 andFeb 25. If LINK is able to reclaim $3.47 as support, further gains to the 23.6% Fibonacci retracement at $4.13 will be the next step traders anticipate.

Above $4.13, the next target is $4.57, a bit closer to the all-time high and although the current move is looking over-extended, it’s foolish to doubt the wiles of the LINK marines.

In the event of a brief pullback, the price could drop to $2.89, which is right above the 61.8% Fibonacci retracement and a high volume node on the VPVR. If the $2.89 – $2.58 range fails to provide support then a full retrace of the most recent 47% gain could occur as the price drops back to $2.26.

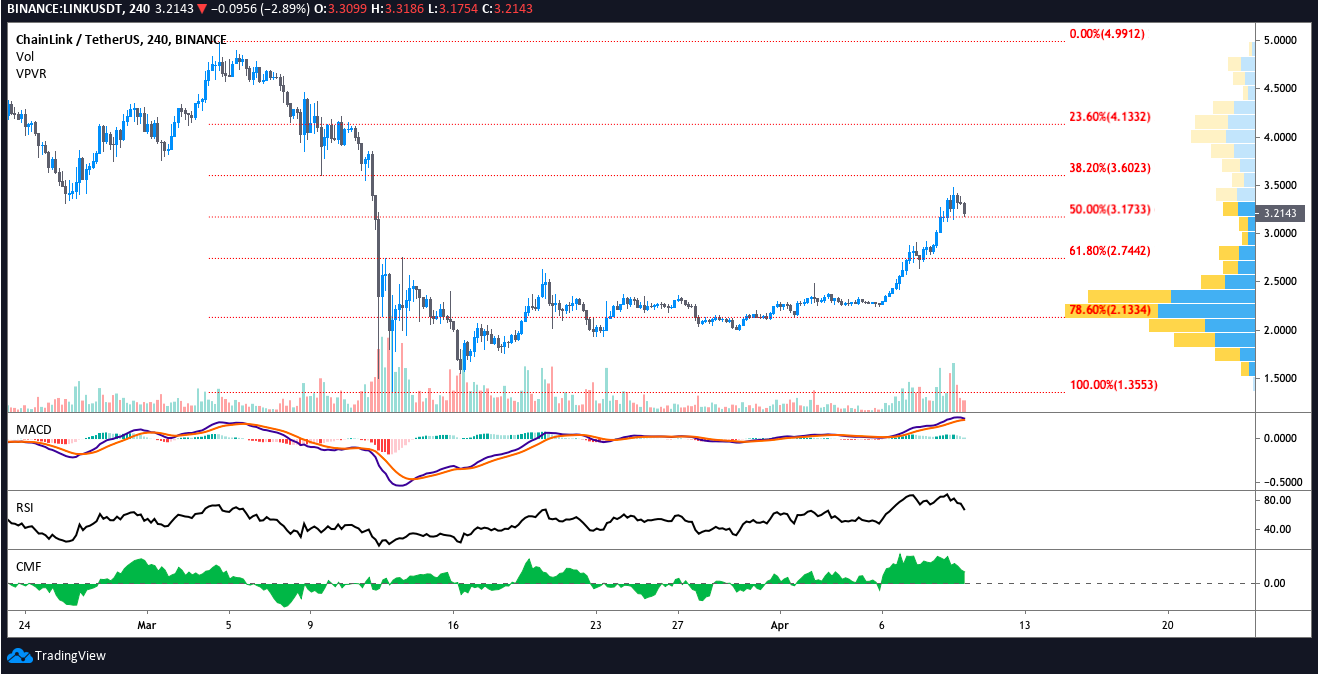

LINK USDT 4-hour chart. Source: TradingView

While all looks good on the daily time frame, the 4-hour chart suggests the altcoin is losing a bit of momentum as the moving average convergence divergence begins to roll over toward the signal line. The relative strength index has also dropped from bullish territory to 66.

For the time being, traders of the LINK/USDT pair should keep an eye on purchasing volume and whether or not the price bounces on the 50% Fibonacci retracement at $3.17.

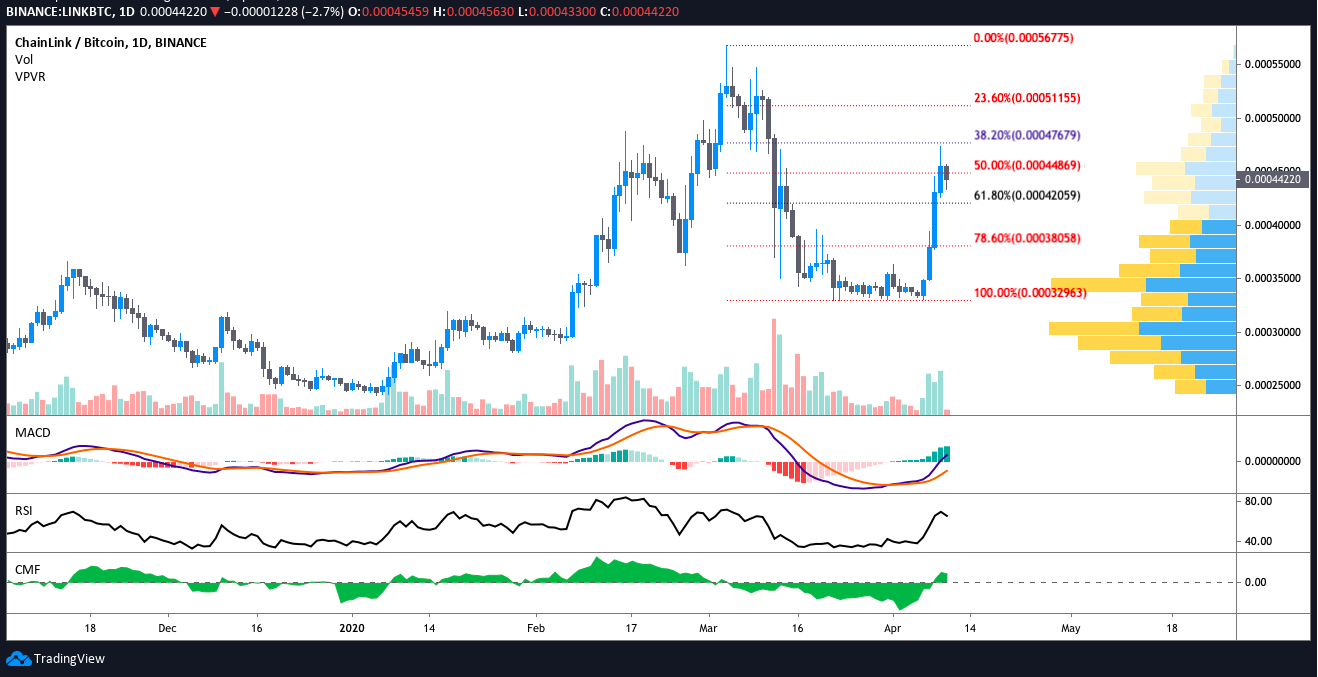

LINK/BTC

The LINK/BTC pair has also rallied fairly well since the March 13 crash. Currently the pair is up 38% off its bottom at 0.00032963 satoshis. Similar to the USDT pair, LINK/BTC price surged higher after breaking above the high volume node at 0.00035111 sats.

LINK BTC daily chart. Source: TradingView

LINK has already pulled back to the support at 0.00043891 sats after topping out at 0.00047347 sats and if the 61.8% Fibonacci retracement (0.00042061 sats) level fails to hold as support then the price could drop to 0.00038941 sats.

LINK BTC 4-hour chart. Source: TradingView

Like the LINK/USDT pair, the MACD is rolling over but sell volume has also decreased, suggesting that some traders took profits. The RSI has also dropped from overbought conditions and currently in a sharp descent at 72.

As suggested for the LINK/USDT pair, traders of the LINK/BTC pair should also keep an eye on volume and whether or not the price bounces off the 61.8% Fibonacci retracement at 0.00042061 sats.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.