Bitcoin starts 2024 by surpassing the $45,000 mark, setting a new 20-month high. What’s next?

At the onset of 2024, Bitcoin (BTC) has made a leap, surpassing the $45,000 mark and setting a new 20-month high. As of this writing, BTC is trading at $45,465.

In 2023, Bitcoin experienced an increase of 156%, indicating its strongest yearly performance since 2021. This surge was primarily driven by the anticipation of the approval of spot Bitcoin exchange-traded funds (ETFs) in the U.S.

Secondly, the expectation of major central banks cutting interest rates this year has bolstered risk appetite, proving beneficial for cryptocurrencies like Bitcoin.

As Bitcoin continues to garner attention and debate, let’s find out what’s happening with BTC and its market trajectory amid current developments.

Factors triggering BTC price action

The crypto market is currently buzzing with anticipation over the possible early approval of a spot Bitcoin ETF.

Matrixport suggests that the approval could occur much sooner than anticipated, potentially within the next few days and well before the expected dates of January 8-10.

However, Fox Business reporter Eleanor Terrett suggested in a recent post that early January approval for a spot Bitcoin ETF is improbable. She highlighted that the SEC is still examining changes to the S-1 filings for these ETFs.

Adding to this scenario is a notable shift in Bitcoin storage trends. In the past year, approximately 70% of all Bitcoins have been moved off exchanges and into more secure cold storage solutions.

This behavior indicates a growing preference for long-term holding and security among Bitcoin investors. However, it also leads to a potential scarcity of Bitcoin available on exchanges.

Matrixport also suggested that scarcity becomes particularly crucial when considering the influx of $5-10 billion in fiat money potentially entering the market, aiming to gain Bitcoin exposure through ETFs.

Moreover, BTC’s historical performance during halving cycles — periods when the reward for mining new blocks is halved, thereby reducing the rate at which new Bitcoins are generated — suggests a bullish trend. In past halving years (2012, 2016, and 2020), Bitcoin has demonstrated significant rallies, with an average return of 192%.

The market’s bullish sentiment is further underscored by the sustained high Bitcoin funding rate during the holiday period.

This high funding rate, peaking at an annualized +66%, indicates that traders are maintaining their long positions despite the cost, suggesting a strong belief in the potential for further price increases.

This confidence among traders, coupled with the anticipation of the ETF approval, paints a strong picture for Bitcoin’s performance in the near term.

What’s happening with altcoins?

As Bitcoin kicks off 2024 with a bullish momentum, the altcoin market is not far behind, showing positive market activity and notable price increases.

Solana (SOL), for instance, has been on a strong upward trajectory, breaking past the $100 mark and becoming the 4th largest coin by market cap. This is a remarkable recovery from the bear market of 2022, where its price crashed below $10.

Key factors contributing to SOL’s surge include the rise in the number of active addresses on the Solana network and an increase in the total value locked (TVL), which has surpassed $1.4 billion as of Jan. 3.

Ethereum (ETH) has also been experiencing a bullish trend. It reached its highest price since May 2022, with a notable peak of $2,445 on Jan. 2. As of this writing, Ethereum’s price hovers around $2,300.

In addition to Solana and Ethereum, other significant altcoins like Polygon (MATIC), Ordinals (ORDI), Binance Coin (BNB), and others have also shown impressive gains. Over the last seven days, these cryptocurrencies have increased by more than 10%, maintaining a bullish trend.

What to expect in the coming days?

According to Bitcoin Magazine, Fidelity’s spot Bitcoin ETF could have a 0.39% fee, while Invesco and Galaxy could waive their fee for the first six months.

This could spark a fee war among the world’s largest asset managers, potentially impacting the market dynamics for Bitcoin.

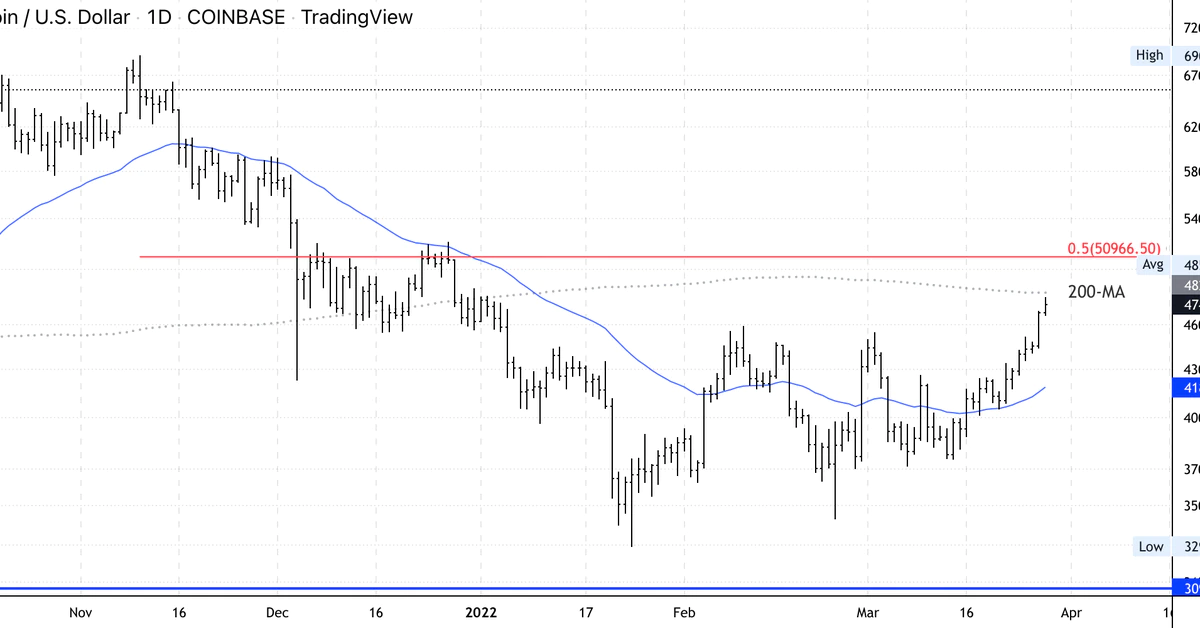

In terms of Bitcoin price predictions, Michaël van de Poppe, a recognized figure in the crypto community, anticipates a new rally for Bitcoin.

He expects BTC to reach $48,000 to $51,000 in the short-term, and possibly encounter resistance at these levels. He also hints at the possibility of the ETF being approved within this week.

On the other hand, more bullish predictions exist as well. The price of Bitcoin could trade as high as $250,000 by April 2024 if some of the most bullish predictions for BTC come true.

Additionally, machine learning algorithms from CoinCodex have set a BTC price prediction of $43,716 by Jan. 31, suggesting a more moderate view of the market.

It’s crucial to understand that these predictions are speculative and subject to market dynamics. It’s always recommended to approach Bitcoin price predictions with caution and consider various viewpoints before making investment decisions.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.