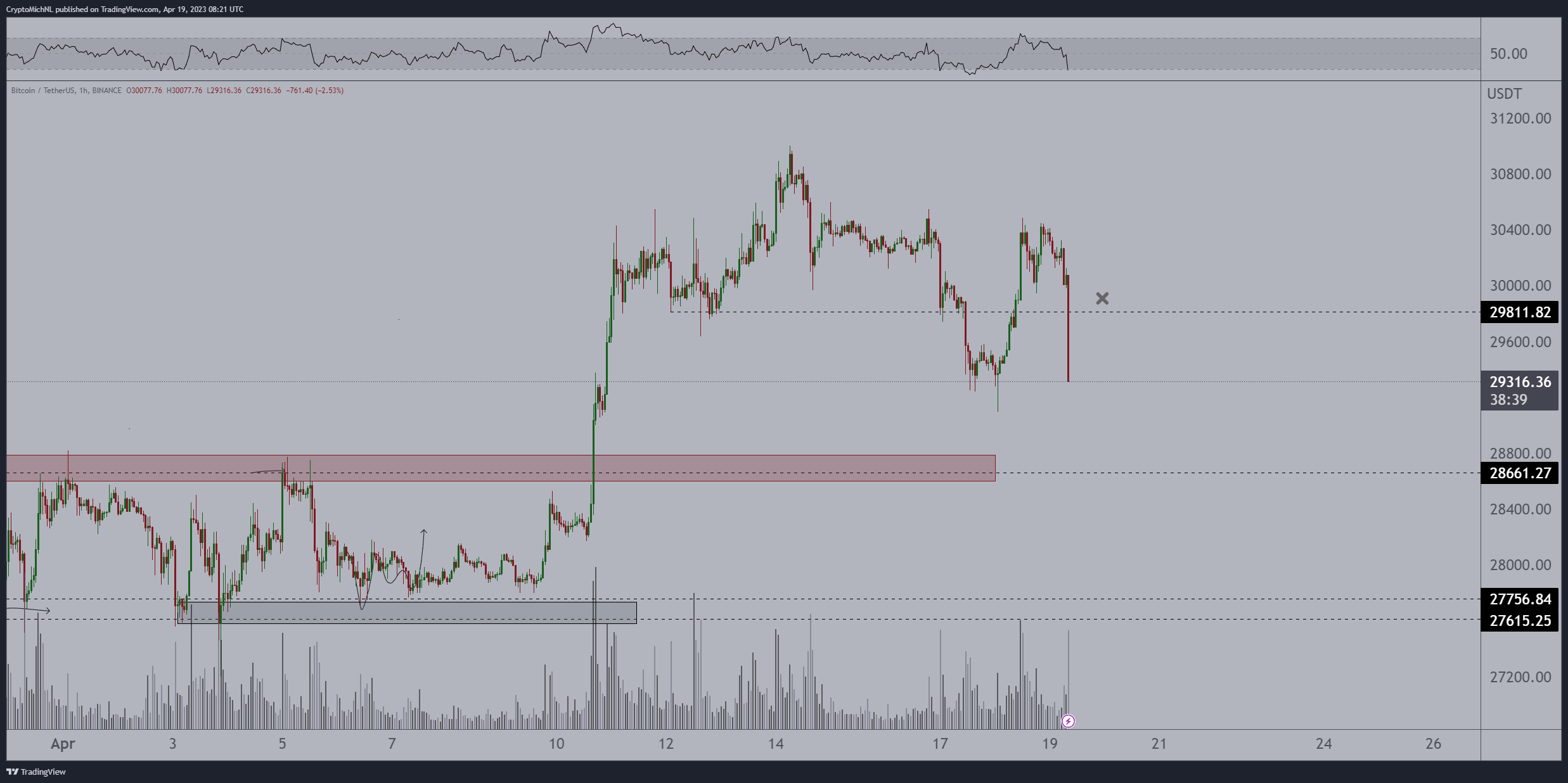

Bitcoin (BTC) abruptly reversed gains on April 19 as a cascade of long liquidations sent BTC/USD plummeting lower.

Bitcoin sees “beautiful” retracement

Data from Cointelegraph Markets Pro and TradingView followed the pair as it made lows of $29,015 on Bitstamp.

The sudden move followed an equally strong rebound above the $30,000 mark the day prior, with bulls ultimately unable to preserve higher levels.

As volatility returned, Bitcoin thus fell to its lowest since April 10 as the upside saw its latest challenge.

“Deep correction on the markets, as Bitcoin can’t hold at $29,700-29,800 and shoots downwards through a cascade of liquidations,“ Michaël van de Poppe, founder and CEO of trading firm Eight, reacted.

Hours prior, monitoring resource Material Indicators had flagged changing conditions on the Binance order book, arguing that the result could still swing both ways, with either bulls or bears profiting.

Long day. Time to get some sleep and recharge for tomorrow. Going to leave you with one more #FireChart which shows bids in the $28k – $29k range continuing to move up toward the active trading range. Watching to see if bids replenish enough to take another shot at $31k or become… pic.twitter.com/ixwP1Affx9

— Material Indicators (@MI_Algos) April 19, 2023

Among traders, some participants, such as bullish trader Crypto Kaleo, remained optimistic.

“Remember dips are gifts,” he told Twitter followers, calling the retracement “beautiful” for tagging the range lows.

Longs “squeezed” as liquidations mount

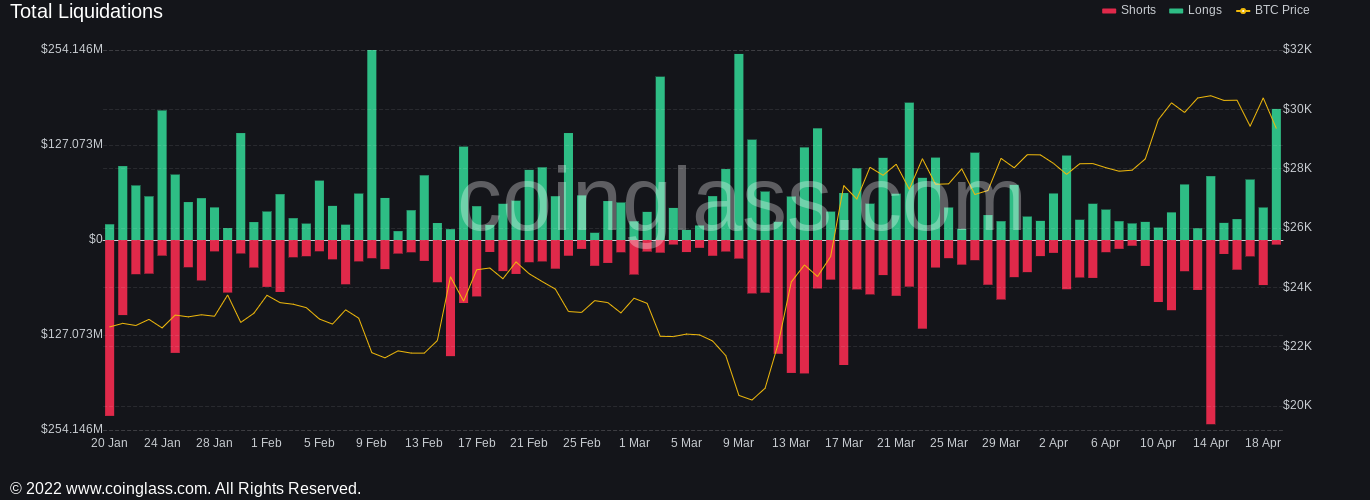

Conditions were ugly for those long BTC, with liquidations stacking up rapidly.

Related: BTC price heading under $30K? 5 things to know in Bitcoin this week

At the time of writing, total crypto long liquidations for April 19 stood at around $175 million on platforms monitored by data resource Coinglass.

These followed a painful day for shorts as BTC/USD returned above $30,000.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.