Bitcoin’s (BTC) consistent failure to break the $9,400 level over the past three weeks has led to some analysts becoming skeptical about the chance of a positive breakout.

Although the $9,000 support has been holding strong for the past 50 days, any slightly negative indicator tends to get more attention from media and pundits.

Recently, crypto media has focused on Bitcoin’s 25 % skew as proof that options traders are turning bearish in the short-term, but in reality there’s more to it than just interpreting signals from one data point.

Skew is an options-trading concept that compares the volatility rates between put and call options within the same expiration date. A positive skew means implied volatility for puts is larger than calls, indicating a higher insurance cost for a downside price move.

One can usually assume that investors are more bearish, since the protection for downside is more costly than the upside protection but deeper analysis shows this is not the case at this moment.

First, the current level is not something unseen in history, in fact, it’s quite the opposite.

The most common measure uses 25% delta, which translate to options being priced with 25% probability of happening.

Bitcoin options 25% delta skew. Source: Skew

As the chart shows above, the 1-month 25% delta skew peaked at 23% on May 21, compared to the current 12%.

Meanwhile, the 3-month options displayed similar movement with previous peaks at 6% compared to the actual 4%. By no means is skew indicating anything unusual or extremely bearish.

Regardless of the protection for the downside being more expensive than the upside, one should determine if investors are effectively buying such options.

This is done by measuring call options open interest up to 20% from the current $9,150 price and comparing it to the put options down to 20%.

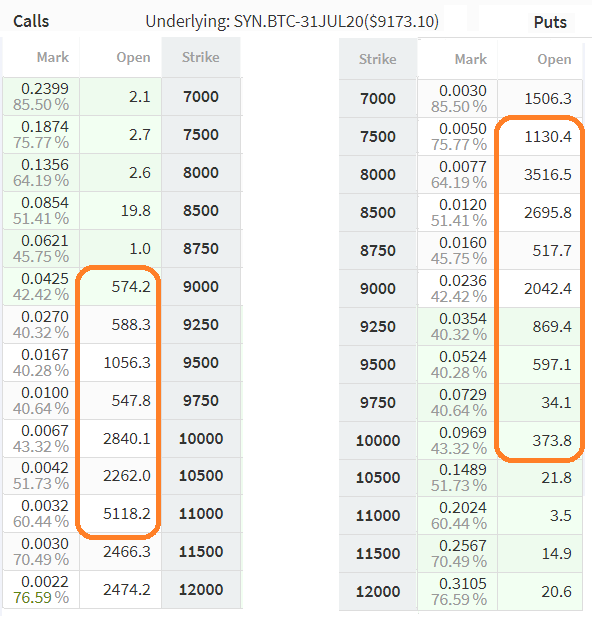

Deribit July Bitcoin options open interest. Source: Deribit

At the moment, call options up to $11,000 BTC total 13K, slightly more than the 12K puts open interest down to $7,500 BTC for July expiry. The following month the situation is even more biased with 18K calls open interest versus a mere 3.5K put options.

This shows that not much is being traded on the put options side, in comparison to the bullish call options. This ratio somewhat diminishes the importance of the skew curve.

Futures markets remain bullish

Another way to gauge professional investors sentiment is by looking at futures markets premium to perpetual and swaps. Longer-term contracts tend to trade somewhat higher, in a situation known as contango, signaling a healthy market.

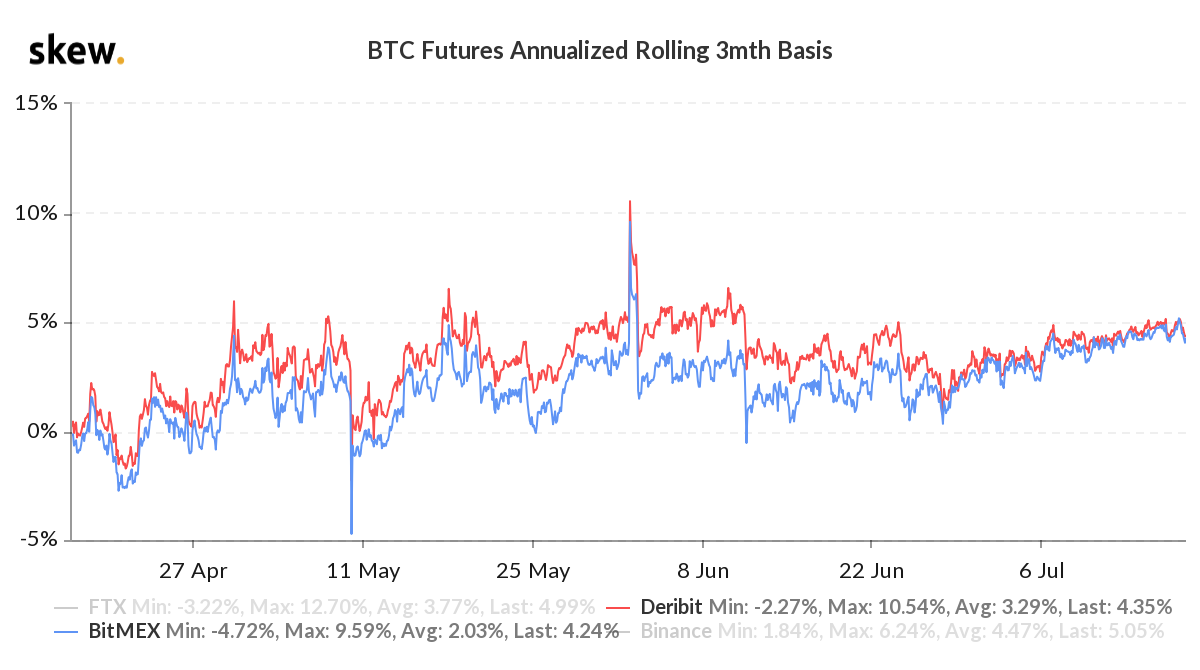

Bitcoin futures annualized 3-month basis. Source: Skew

The 3-month annualized premium has been at a firm 4% level, its highest in 30 days, therefore, there is no evidence of fear or investors leaning bearish on the futures markets.

Be cautious when reading signals and analysis from pundits

It’s improbable for a single derivatives indicator to provide a clear market picture as the Bitcoin (BTC) options market is still a nascent industry. Furthermore, a single exchange currently encompasses 80% of BTC options open interest.

Distortions could also be caused by the current exposure of options market makers who may not be interested in adding risk at the current level of implied volatility.

By measuring the put/call open interest for each expiry, one can get a better glimpse of professional investors’ bets, and both the July and August expiries are favoring bullish positions.

A 25% delta skew by itself should not be interpreted as a bearish indicator, so be wary of those who suggest it is.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cryptox. Every investment and trading move involves risk. You should conduct your own research when making a decision.