CryptoX is preparing for the invest: ethereum economy virtual event on Oct. 14 with a special series of newsletters focused on Ethereum’s past, present and future. Every day until the event the team behind Blockchain Bites will dive into an aspect of Ethereum that excites or confuses us. Today’s intro is written by CryptoX research analyst Christine Kim.

This year, 2020, is proving to be wildly successful for Ethereum in terms of market performance and technological development.

Since January, ETH has so far tripled in value, beating out the gains made by the majority of the top crypto assets by trade volume. The only other crypto asset in the CryptoX 20 that has outperformed ETH in the markets year-to-date is the LINK token, which is based on the Ethereum blockchain.

A growing number of stablecoins, which are crypto assets that track the value of one or more base assets such as the U.S. dollar, are beginning to be issued primarily on Ethereum. As of the end of September, 70% of stablecoins were issued from Ethereum. The collective demand for these assets has also grown significantly over the last nine months. Total stablecoin market capitalization has tripled year-to-date and now exceeds $20 billion.

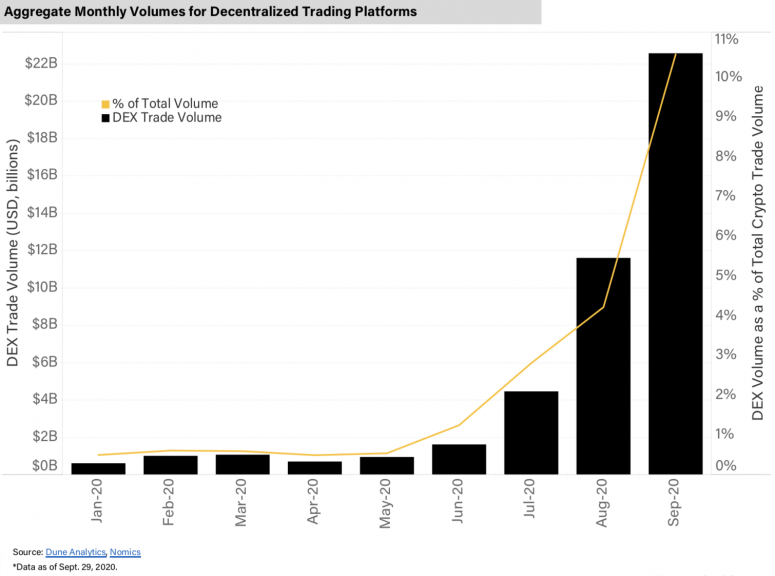

But it’s not only Ethereum-based tokens that have seen a surge in demand this year. The underlying utility of new decentralized applications on the network have increased dramatically too. Trade volume on decentralized exchanges such as Uniswap and Curve Finance has soared from $4 billion to over $22 billion from January to September. As of Sept. 29, monthly aggregate DEX volume makes up for over 10% of total trade volume.

As if the growth in value and network activity on Ethereum wasn’t eventful enough, core developers building the next phase of Ethereum’s base layer technology expect to see the first phase of “Ethereum 2.0” go live before the end of the year. To this end, users are beginning to explore what options are available to participate in the seminal launch of the new Ethereum blockchain.

For a full rundown of the main Ethereum-related trends and events of 2020, download the full research report, featuring additional chart visualizations about the network and its upcoming 2.0 launch, here.

Also, be sure to tune in to the virtual event invest: ethereum economy tomorrow.

Featured panel

The move to ETH 2.0 will bring the Ethereum network ever closer to fulfilling its original vision: that of a “world computer” that plays host to a parallel, decentralized financial system. This system has taken the crypto world by storm recently, but has been limited by ETH 1.0 infrastructure. Will ETH 2.0 be the rocket fuel that takes this nascent financial engine mainstream?

Vitalik Buterin will go live, kicking off invest: ethereum economy, at 9:00 a.m. ET tomorrow.

Ethereum 101

With final preparations for the launch of Ethereum 2.0 soon to be underway, CryptoX’s Christine Kim spoke with lead developer at Prysmatic Labs Raul Jordan and project lead at DAppNode Eduardo Antuña Díez about what’s left to do and what comes next.

Raul Jordan, who has been building Ethereum 2.0 software for over two years, explained his team would be wrapping up all feature development by Oct. 15.

“At that time, it’s all hands on deck to just have good documentation, good user experience, fix up security holes [and] basically prepare for launch. That’s where we are today if all remains on track,” said Jordan.

The final features currently in development by Prysmatic Labs and other software development teams include making sure different code implementations of Ethereum 2.0, also called “clients,” are interoperable and can be used interchangeably by a user without running the risk of losing validator rewards.

It’s not only client developers who are beginning final preparations for this network upgrade. Ethereum startups building hardware and tooling for users to participate in the Ethereum 2.0 launch are also working on adding last-minute features to their products.

Díez said, “The most important thing that we realized after the first [Ethereum 2.0] testnet is that people need to know the status of their validators. Having a good monitoring system to be able to know when your validator is down … we are working in that direction.”

Before Ethereum 2.0 goes live, Jordan and Díez both noted a new contract will be created on the current Ethereum blockchain to receive deposits of 32 ETH. Only once this contract accumulates a minimum of 524,288 ETH, which is worth roughly $181 million at time of writing, will the new Ethereum blockchain officially kick-start at midnight UTC the following day.

About the security of the deposit contract, Jordan said, “There’s no way to retrieve [funds]. … It’s considered a burn in the short term. It’s not like there’s any sort of admin key or any sort of way to take those funds out. There’s no way somebody can take all the ETH that is locked in there.”

The ledger

Christine Kim and colleague Shuai Hao put together a history of Ethereum in five charts. Originally published this summer, an excerpted version is reprinted here.

Part 1: A Bloodless Secession

Not one year after the launch of Ethereum, a seminal event split the community in two – resulting in the creation of a new cryptocurrency called “ethereum classic,” cloned from the original Ethereum codebase.

Ethereum classic was created July 20, 2016, after $60 million worth of ether was stolen from users of a dapp known as The DAO. After weeks of deliberation, Ethereum developers reached a consensus that they should turn back the clock – reverse The DAO hack transactions and restore users’ lost ETH.

The changes could only be implemented through a network-wide upgrade, also called a hard fork. Those who opposed the change argued in favor of retaining the integrity of the original blockchain’s history of transactions and balances – hacked funds and all.

On July 20, 2016, when the upgrade to restore user funds was executed, the Ethereum blockchain split in two. The portion of the community that retained the original log of transactions and balances from The DAO hack and did not upgrade the software created a parallel network, Ethereum Classic.

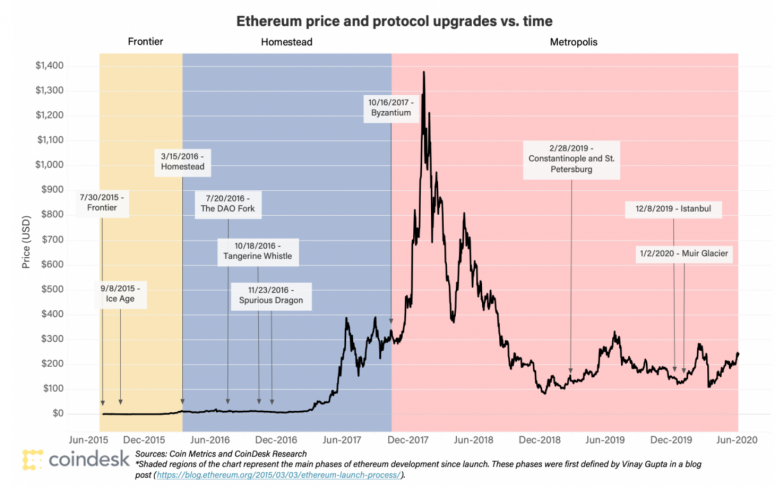

Since the split, the Ethereum network has hard forked seven additional times, though none of these subsequent upgrades have reached the same level of controversy as “The DAO Fork” of 2016.

Part 2: Those Darned Cats

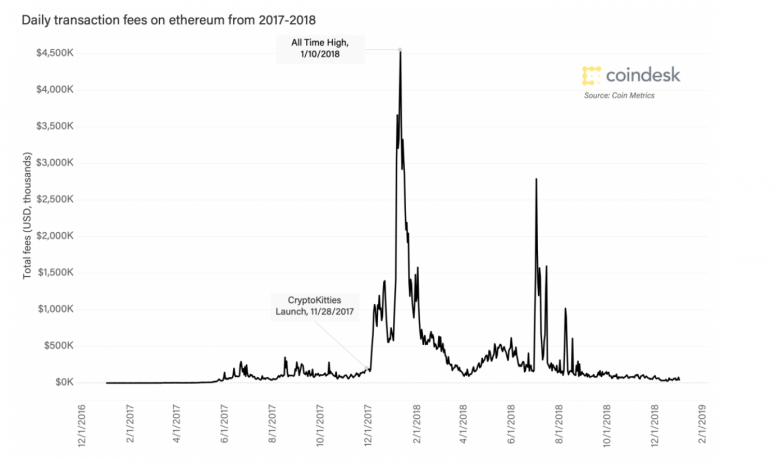

The first dapp on Ethereum to gain real user traction was a collectibles game known as CryptoKitties. At the height of their popularity, tokenized cats were trading on Ethereum for upwards of $200,000. However, the influx of users and a high volume of transactions from this one viral dapp clogged the Ethereum blockchain to unprecedented levels.

A backlog of 30,000 transactions had piled up by December 2017, meaning that users would have to wait days for their transfers of ETH to be confirmed.

The developers behind CryptoKitties hastened to help stem the tide of new users by increasing game fees. Shortly after CryptoKitties’ launch, Ethereum saw the highest total for daily transaction fees in its history, on Jan. 10, 2018. Over $4.5 million was collected in fees by Ethereum miners that day.

In many respects, the CryptoKitties craze was the rude awakening that reminded Ethereum developers of the platform’s technical limitations.

Part 3: Testing the Limits

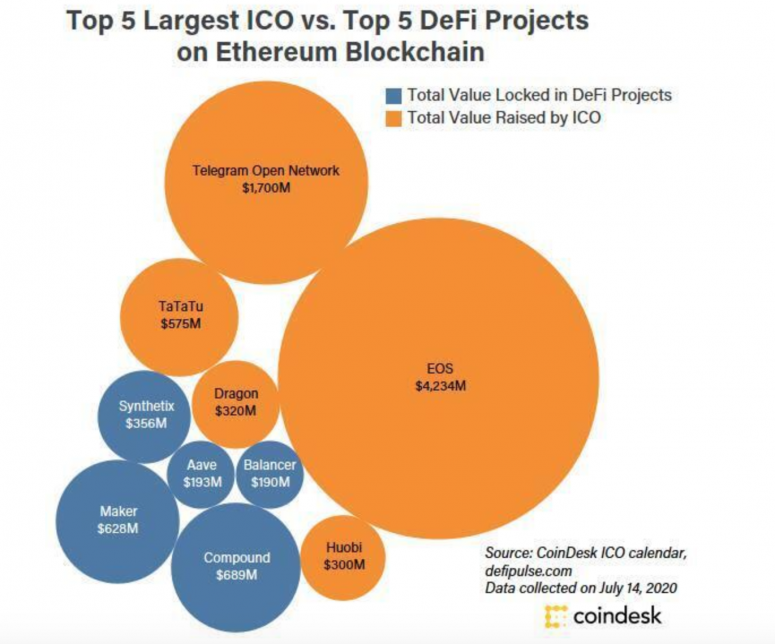

The popularity of initial coin offerings (ICOs) – a way to crowdfund early stages of a cryptocurrency project – by dollar amount raised reached its peak in 2018. A total of $7.8 billion was raised for over 1,000 projects that year. According to ICObench, over 80% of all ICOs rely on the Ethereum blockchain to create their tokens and issue them to investors.

Trends like the ICO boom of 2018 are indicative of the ways blockchain technology can be leveraged in more ways than simply peer-to-peer electronic cash. Ethereum, as the world’s first general-purpose blockchain platform, has become the central hub where dapp developers congregate to build any and all types of use cases for blockchain, be it gaming- or finance-related.

In order to ensure interoperability between different dapps on the network, common frameworks were developed – like the ERC-20 and ERC-721 token standards. These innovations have blazed the trail for other general-purpose blockchain platforms to emerge since Ethereum’s birth in 2015.

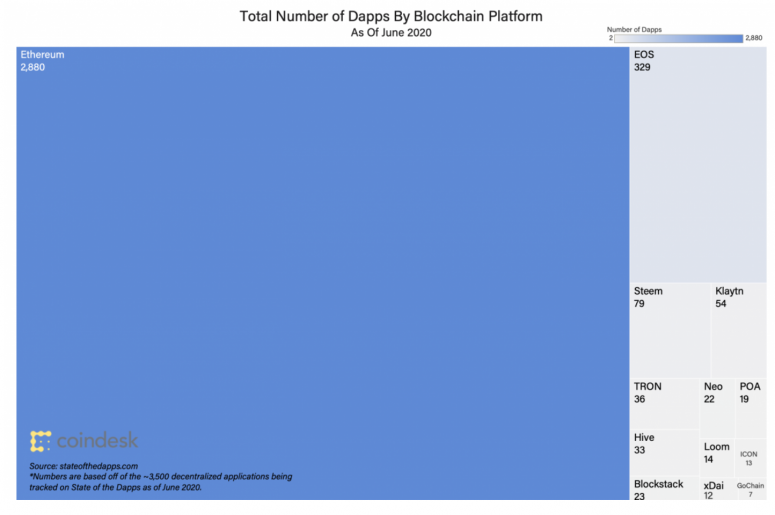

EOS, stellar, tezos and tron are four cryptocurrencies in the top 15 by market share that also feature dapp creation and deployment. Despite the growth in the number of alternative dapp platforms, Ethereum remains the most popular general-purpose blockchain both in terms of number of users and dapps, as shown in the chart above.

Ethereum hasn’t fulfilled its vision yet, however. Developers are convinced that the current blockchain infrastructure as it currently exists is wholly inadequate to handle an influx of millions, if not billions of users around the world.

Part 5: The Long Road to 2.0

The Ethereum 2.0 roadmap is almost as ambitious as the original one which brought the first dapps into existence. While the launch of this technology is forthcoming, an important part of understanding Ethereum’s five-year history lies in studying the many iterations that Ethereum 2.0 underwent in its years of planning.

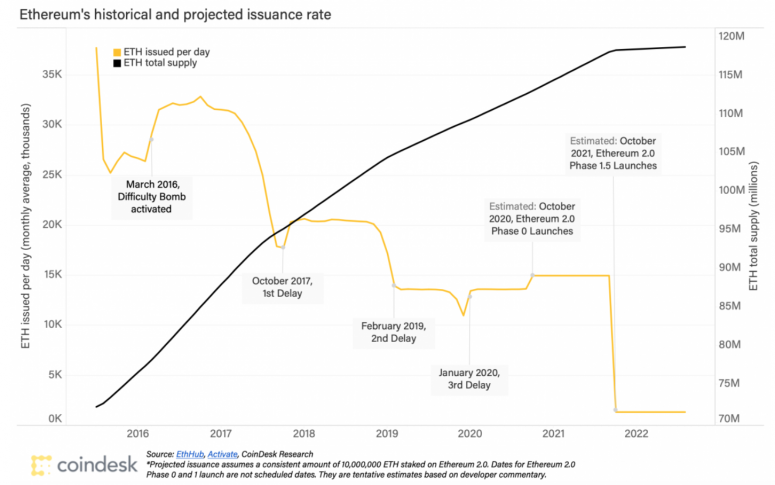

Originally, Ethereum 2.0 in 2015 was thought of as the final development phase for the project and dubbed “Serenity.” Serenity was tentatively expected to be rolled out 16 months after initial mainnet launch (which would have been November 2016). The upgrade would transition Ethereum from its reliance on a computationally intensive process for block production inherited from Bitcoin, known as “mining,” to a more energy-efficient process of validating.

To this end, developers created what is called the “difficulty bomb” to slowly but surely encourage this transition away from mining. The bomb, which was activated on March 14, 2016, increases the difficulty levels for miners to find an Ethereum block over time. This schedule at which this bomb slows block production has been delayed three times over the course of the last five years as developers re-worked plans for launching Ethereum 2.0.

While there is no telling what new technologies and standards of blockchain practice will be innovated as a result of Ethereum 2.0, looking back at the first five years of the network’s development does give some indication. In that time, Ethereum has undergone network-splitting upgrades, faced crippling technology bottlenecks, advanced new forms of fundraising for crypto projects and formalized a launch plan for migrating to Ethereum 2.0.

At stake

Ben Edgington, an Eth 2.0 adviser for ConsenSys, reflected on the year of testing and configuring the Beacon chain, the first real implementation of Ethereum 2.0. His conclusion? It’s time for Ethereum 2.0 to launch.

Skin in the game

We’ve spent the last nine months testing the life out of this thing. The year began with huge, long-running single client testnets: Sapphire, Topaz and Onyx networks run by Prysmatic Labs. In April, there were small multi-client networks: Schlesi, Witti and Altona – all named after subway stations, in keeping with Ethereum testnet tradition.

And then the big one, the Medalla testnet. Named after Medalla Milagrosa on the Buenos Aires Underground, it has been running for over two months, with four different client implementations involved throughout that time. It continues to run today with over 50,000 validators actively participating, making it one of the largest decentralized consensus networks in existence.

Progress has not all been smooth. A few days after the start of the Medalla testnet, one of the clients suffered a critical issue that disrupted the chain for a few days. But this is what testnets are for. We kept the chain running and were able to bring it back to full health, with a slew of lessons learned.

Perhaps the biggest lesson? It is hard to faithfully replicate proof-of-stake on networks that are not incentivized. Participation in these testnets is completely free, which is not at all realistic. On testnets, stakers can neglect their nodes with no real consequences; they can register thousands of validators then just switch them off and they can put down stakes but never join the network.

On the real beacon chain, with significant value genuinely at stake, we expect user behavior to be quite different.

This is why it is now time to go live with the beacon chain. We have tested everything else in every way we can: the deposit contract has been formally verified; the deposit tools have been audited; the specification has been audited; the beacon chain has been formally modeled; the node discovery protocol has been audited; the networking protocol has been audited; the crypto-economics have been simulated; we are running incentivized attack nets; we’ve been doing fuzz testing; every client has undergone at least one third-party security audit. Hundreds of pairs of eyes have scrutinized the whole process over the last year.

However, the real beacon chain will have real rewards and real penalties, and we simply can’t simulate these with testnets.

We’ve tested these things as far as we can in the lab: Now it’s time to run it in the wild.

Top shelf

G20, CBDCs

The Group of Twenty (G20) – an organization of finance ministers and central bank governors representing the European Union and 19 countries across every continent – is working with the International Monetary Fund (IMF), the World Bank and the Bank for International Settlements (BIS) to formalize the use of central bank digital currencies (CBDCs) in banking systems. Well-designed CBDCs could be interchangeable with existing money, settle high volumes of transactions instantaneously, be impervious to cyberattacks and lead to greater monetary oversight. There are also privacy concerns the industry must reckon with. The G20’s regulatory stablecoin and CBDC framework are expected in 2022.

Coinbase backspin?

Tennis superstar and investor Serena Williams may have shed her stake in popular U.S.-based cryptocurrency exchange Coinbase, according to a Business Insider report. The website of Williams’ venture firm, Serena Ventures, no longer displays Coinbase among its portfolio firms. The company first listed the investment in Coinbase in April of last year. William has also tweeted about the investment at the time. If indeed her VC firm has divested its stake in Coinbase, it may come as the result of a recent statement from Coinbase CEO Brian Armstrong, who effectively banned employee activism at the exchange and said the firm would focus solely on its financial mission.

HBCUs & blockchain

Dozens of historically Black colleges and universities (HBCUs) are exploring the next phase of decentralized technologies in a bid to put Black students at the forefront of new blockchain protocols. “These schools see it as a way to participate in Web 3.0,” said Tonya Evans, chairperson of the MakerDAO Foundation and visiting professor at Penn State’s Dickinson Law School. “We were not participating in the dot-com era. Most of the Black community didn’t know about it at the time.” Ryan Cooper, a graduate of Bowie State University who started a campus blockchain group, said, “On the East Coast, certain majority-white colleges do this with their spare time anyway. At HBCUs, you have to incentivize this.”

$1.7T boost

Blockchain technology stands to boost the global economy by $1.7 trillion in the next decade, according to a new report by consulting company PricewaterhouseCoopers. PwC economists forecast a tipping point in 2025 if blockchain technologies are adopted at scale across the world, and expect blockchain applications to boost global gross domestic product (GDP) by $1.76 trillion, (1.4% of global GDP) by 2030. “Serious activity around blockchain is cutting through every industry across the globe right now,” Steve Davies, global Blockchain leader at PwC, said in the report. According to the report, blockchain will make the biggest impact on Asia’s economy with China, India and Japan driving adoption in the region.