Quick take:

- Bitcoin’s weighted social sentiment on Twitter is sitting at a 2 year low

- BTC’s recent pullback is one reason many have turned bearish on Bitcoin

- However, such negative sentiment usually precedes a rally as was witnessed with the Coronavirus crash of mid-March

The month of September started on a rough note for Bitcoin with the King of Crypto falling hard from $12k levels to the psychological price of $10,000. BTC would then test this area numerous times leading to the Co-founder and CEO of Gemini, Tyler Winklevoss, declaring that $10k is the new baseline for Bitcoin.

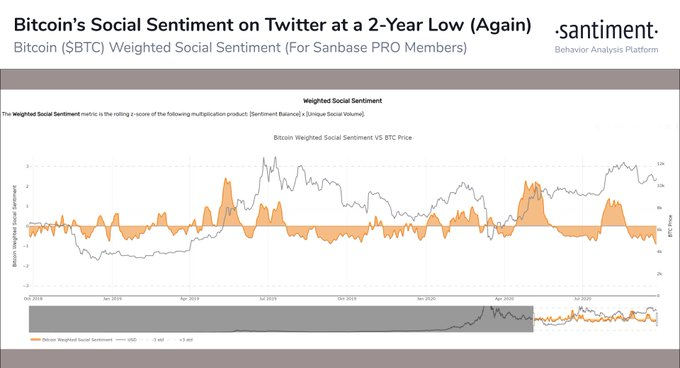

Bitcoin’s Twitter Social Sentiment at a 2-Year Low

According to the team at Santiment feed, this recent retracement in the crypto markets has led to a drop in Bitcoin’s twitter social sentiment. BTC’s Twitter social sentiment is sitting at a two year low with an additional high level of negativity with respect to the future of Bitcoin as a worthwhile investment. The team at Santiment also pointed out that such drastic drops in social sentiment usually precede a significant Bitcoin rally.

The team at Santiment shared their analysis via the following statement and accompanying chart.

$BTC‘s weighted social sentiment for #Twitter, which measures the positive/negative ratio of comments multiplied by the overall frequency of comments, is currently sitting at a 2-year low.

There has clearly been a pattern of non-believers in the community after a pretty aggressive retracement in the #crypto markets.

This level of negativity can often lead to a positive rally, as we’re seeing thus far today. Markets most commonly follow the path of least expected.

Bitcoin Holds Steady Amidst KuCoin Hack

With respect to BTC’s negative social sentiment usually preceding a Bitcoin rally, the Coronavirus crash of mid-March is one example of such a situation. During the latter event, Bitcoin dropped to as low as $3,600 with many crypto traders expecting a further dip to $1,200 levels.

Similarly, and at the time of writing, some crypto traders expect Bitcoin to drop to as low as $7,700 as a result of an uncertain Q4 in the stock markets brought about by the US elections in November.

However, Bitcoin looks set to keep its head above water as was witnessed today as news broke of KuCoin being hacked and over $150 Million withdrawn by the culprits of the crime. What remains to be seen, is whether Bitcoin continues with this stability through the weekly close a few hours away, and the monthly close mid-next week.