The VIX volatility index, the stock market’s main risk indicator, skyrocketed to 55 on March 9. This is the highest level since 2009. Meanwhile, Saudi Arabia’s talks with OPEC member Russia soured, triggering a price cut competition. This led Brent Crude, the international oil benchmark to trade at $36.20, down 20% from the previous session.

The Dow Jones Industrial Average tanked 6.9% — heading for it’s biggest daily loss ever recorded — while the UK’s FTSE is trading down 7.7%. Asian markets overnight performance also were not so much different as Japan’s Nikkei closed down 5.1% below Friday’s close.

Another ominous signal was the yield on the 10-year US Treasury note dropping below 0.5% for the first time in history, a strong indicator that investors are desperately looking for safe harbors.

Gold and Bitcoin react to global panic

Gold prices remained flat over the day at $1.673 per ounce after reaching a historic high at $1,700 last night. The commodity is up 5.6% in March, displaying a healthy performance during the Coronavirus epidemic which has now spread to nearly every country on the planet.

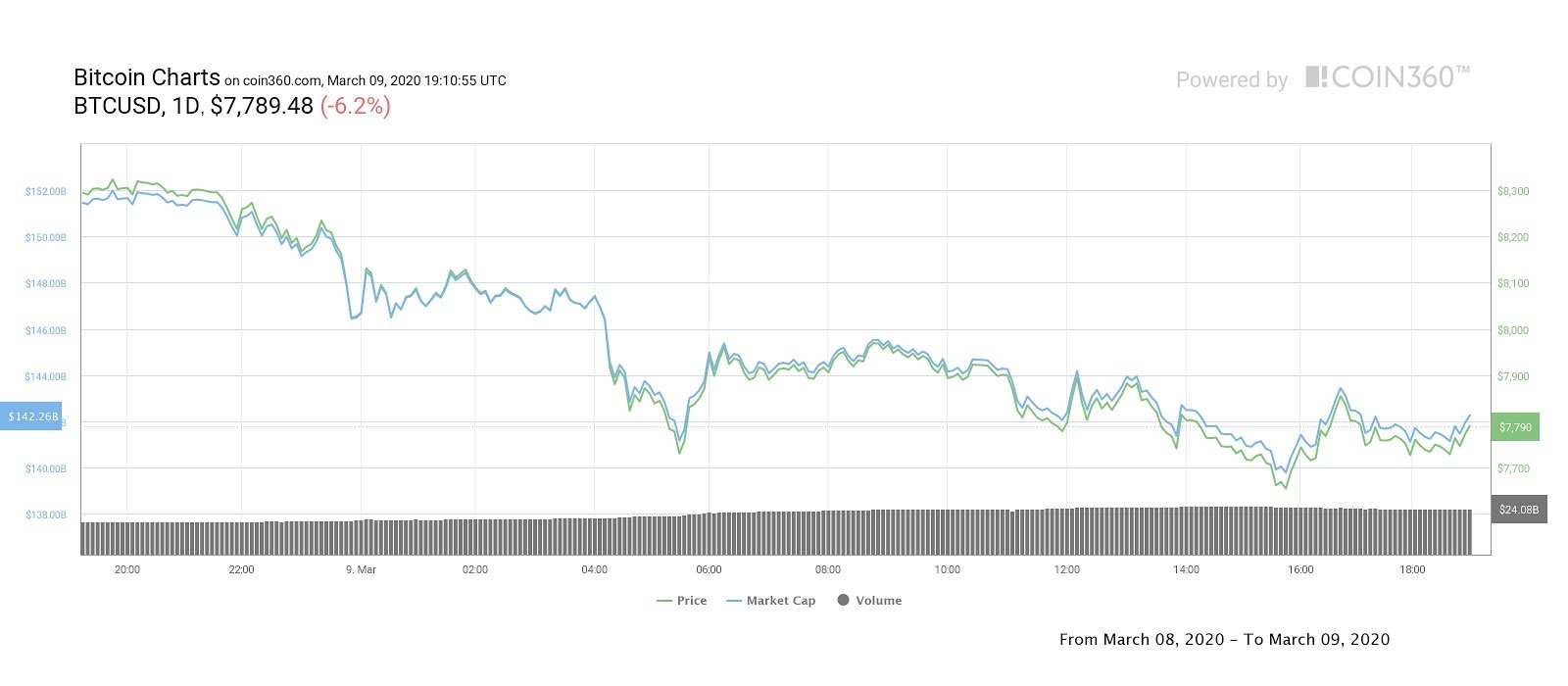

On the other hand, Bitcoin (BTC) is down 13% in 48 hours, testing its lowest level since early January at $7,750.

BTC USD 6-hour chart. Source: TradingView

Brian Armstrong, co-founder and CEO at Coinbase, was caught off guard by the recent price move as expressed by his shock by tweeting:

“Surprised we’re seeing the Bitcoin price fall in this environment, would have expected the opposite.”

BlockTower co-founder Ari David Paul, also tweeted that despite a recent 25% drop in less than 30 days, Bitcoin remains up 7.5% year to date.

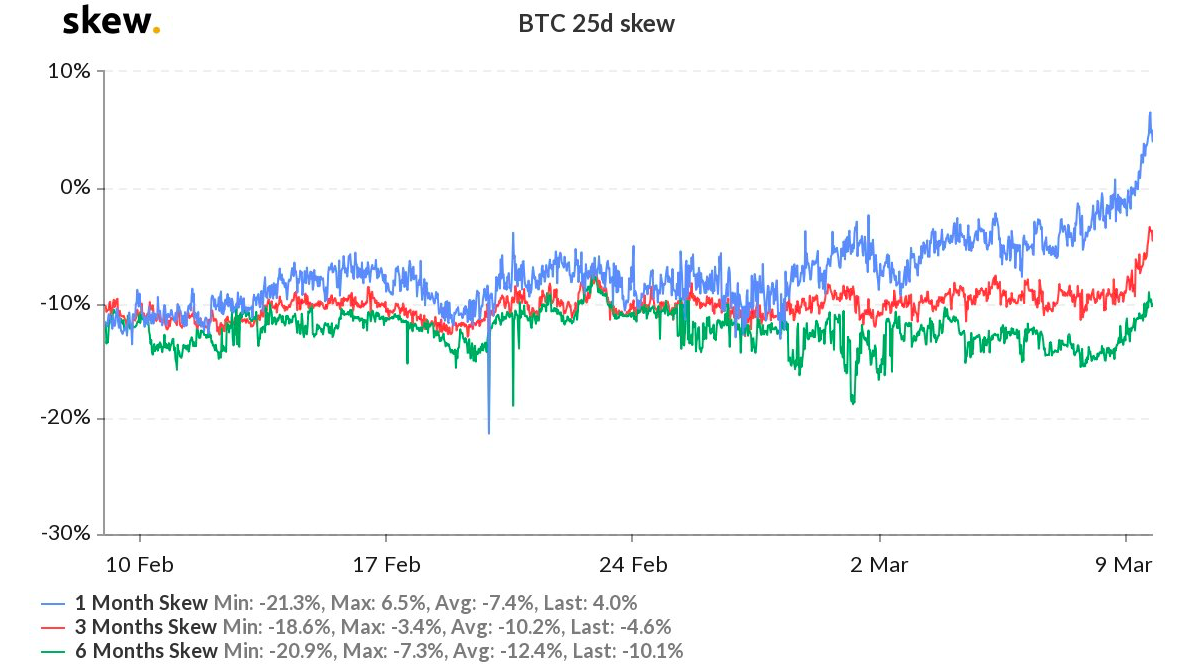

Earlier in the day derivatives trader Tony Stewart tweeted that options skew indicator – an important he interprets as a good measure of fear – rose significantly over the past week. According to Stewart, “this skew measures a fear for further downside moves.”

Bitcoin 25d skew. Source: Skew.com

Analysts warn that the financial crisis could deepen

Dennis Dick, head of markets structure and proprietary trader at Bright Trading LLC, raised a red flag on the potential outcome of today’s market reaction. Dick said:

“There is potential that we could be at the start of a financial crisis part two… It’s a possibility right now that wasn’t on the table until we had this oil plunge over the weekend.”

Bitcoin daily price chart. Source: Coin360

As Bitcoin price corrects, altcoins have also taken on heavy losses. Ether (ETH) has dropped 8.86%, Bitcoin Cash (BCH) is down 7.72% and Litecoin (LTC) lost 10.42% to trade below $50.

The overall cryptocurrency market cap now stands at $222.2 billion and Bitcoin’s dominance rate is 64%.