The price of Bitcoin (BTC) is struggling to break past $51,000 on March 8 as the U.S. Treasury yield is rising again while the U.S. Dollar Index (DXY) is at the highest levels in over three months.

The global stock market, including equities in the U.S. and Asia, have pulled back in tandem as the Senate’s stimulus approval sparked inflation fears.

Why is Bitcoin dropping off of inflation fears

As Welt market analyst, Holger Zschaepitz, explained, the bond market turned into turmoil as the 10-year U.S. Treasury yield surged to 1.6% after the stimulus news broke.

The instability in the bond market naturally led to a sell-off of risk-on assets, affecting both stocks and cryptocurrencies. The analyst wrote:

“Bond turmoil continues w/US 10y yields jump to almost 1.6% as the $1.9tn US fiscal package alongside robust Chinese trade data fuel inflation fears.”

Stocks and Bitcoin have seen a tightening correlation in recent weeks likely due to the increasingl unfavorable macro landscape.

Peter Brandt, a long-time futures and FX trader, said he saw many correlations throughout his career. However, he said that correlations can also come to an end “dramatically.”

Hence, in the foreseeable future, Bitcoin could move in tandem with stocks as the markets react negatively to the rising Treasury yield. But on longer time frames, the bull run of Bitcoin could strengthen and gain momentum if the correlation begins to weaken. He said:

“Through my 46 yrs. trading I have seen MANY sacred correlations come and go Gold v. Yen or USD or stocks Silver vs. Gold Interest rates v. stocks or Gold BTC v. whatever Et al When these correlations come to an end, they often end dramatically Study each market with its own chart.”

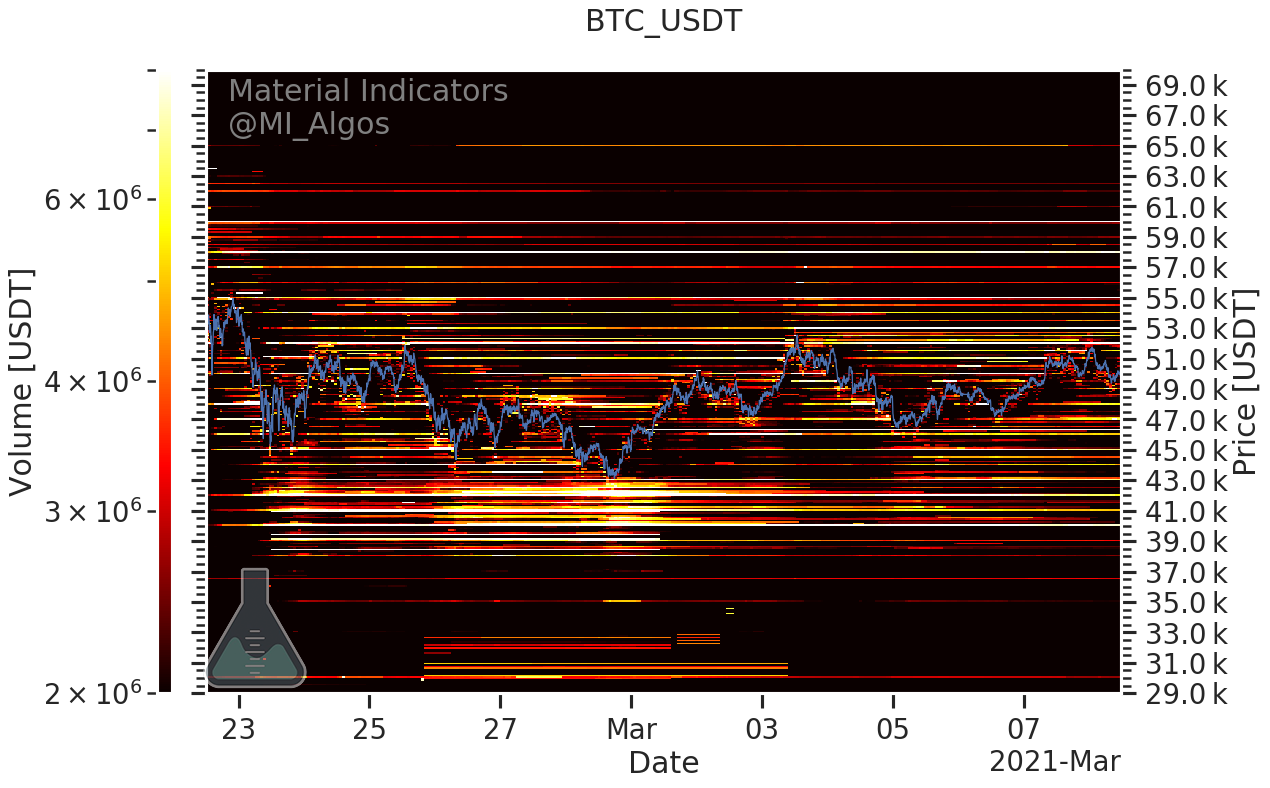

Nevertheless, March may turn out to be a slow month for BTC trading with low volatility.

Is a bigger drop coming?

If the traditional market drops, traders seemingly anticipate a broader Bitcoin pullback in the near term.

For example, pseudonymous cryptocurrency trader Loma said a short-term drop to $48,000, an important support level, cannot be ruled out if the legacy markets continue to show weakness. He wrote:

“Base still forming, I’m liking how everything is playing out. Only concerns are temporary legacy market correlations so if we dump tomorrow, I’d anticipate a re-visit the lows or at least the EQ at ~$48k. Still taking it easy on trading, focusing more on $BTC and $ETH.”

This week, the key for Bitcoin is whether the DXY sees a pullback after a week-long rally, providing the risk-on market some room for a relief rally.

As Cryptox previously reported, the Treasury yield is also approaching a key resistance area, and if it gets rejected, Bitcoin could regain momentum in the near term to rally above the next big resistance areas at $52,000 and $53,000.