The Bitcoin resistance at $40,000 may be a new inflection point for the coin to soar to the new heights that it has always been projected to reach.

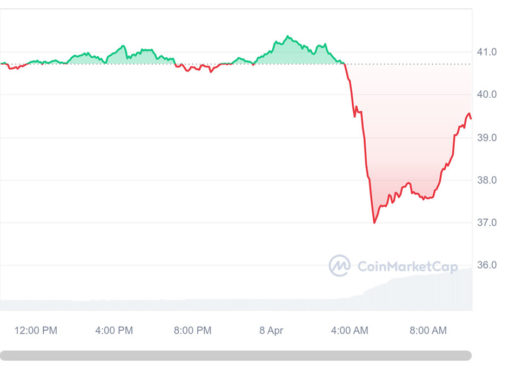

Bitcoin (BTC) gave a short-lived inclination that it was ready to break free from the bear market it has been plunged into from the beginning of the week as it retests the $40,000 resistance in the late hours on Thursday. The move signifies an attempt by the market bull to regain the plummeting price and push it back toward and beyond the $42,000 all-time high (ATH) price it recorded a few days ago.

Sentiments in the cryptocurrency market are high particularly around Bitcoin which is constantly being flaunted as a viable asset that can help corporations hedge against inflation as well as the constantly devaluing fiat currencies. This has formed the basis for the institutional buy up of Bitcoin and the genesis of the ongoing bull season.

At the time of writing, Bitcoin has retraced from the $40,000 price level but is still in the positive range in relation to the previous day’s performance. It has gained 1.12% in the past 24 hours and currently trading at $38,361 per coin.

Sentiments around Impending Stimulus Package

With the US President-elect Joe Biden set to take office in a matter of days, there has been an increase in the brewing anticipation with respect to the roll-out of new coronavirus stimulus packages. It has been indicated that the pursuit of new COVID-19 stimulus deals will be at the forefront of the Joe Biden administration and the possibility of scaling through is high seeing the Democrats have majority control of the House and Senate.

The US economy has been awash with stimulus monies including a $2 trillion deal signed back in March 2020, followed by a $900 billion deal completed in December 2020. The new deal being flaunted by Joe Biden and his team will consist of a $3 trillion package that will see each eligible American cash out $2,000 in cash. Although the new deal will be a compliment to the $600 cheques that were dished out in the December deal.

The implication of these stimulus packages is an incessant money printing endeavor which has been highlighted as the source of devaluation for the US Dollar and a boost for Bitcoin, which is now gaining traction amongst corporations as a reserve asset.

Bitcoin Resistance at $40,000, New Path to New Moon

The creation of a Bitcoin resistance at $40,000 may be a new inflection point for the coin to soar to the new heights it has always been projected to reach. The year 2020 set the stage for the industry bigwigs, and 2021 has been noted by Michael Saylor, the CEO of MicroStrategy Incorporated (NASDAQ: MSTR), as the coin’s season where it will be more adopted as a more compelling institutional safe have asset.

“Bitcoin is emerging in 2021 as the new, compelling institutional grade safe haven asset. Excess cash is a drag on shareholder value in the current monetary environment, so we can expect more firms to adopt Bitcoin as a treasury reserve asset,” noted he.

Bitcoin has been tipped to surge beyond $146,000 in the long term.

Benjamin Godfrey is a blockchain enthusiast and journalists who relish writing about the real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desires to educate people about cryptocurrencies inspires his contributions to renowned blockchain based media and sites. Benjamin Godfrey is a lover of sports and agriculture.