The Bitcoin (BTC) price remained relatively sideways last week and not once did it test resistance or support of the descending channel identified in last week’s analysis.

As such, today I’m looking at a new bullish case for Bitcoin that could see the leading digital asset see incredible growth if $7,200 resistance is broken as far as the technicals are concerned.

However, last week proved a massive fundamental turning point for Bitcoin that very few are talking about.

Daily crypto market performance. Source: Coin360.com

Bitcoin’s old path

BTC USD daily chart. Source: TradingView

If Bitcoin has resumed the bear trend from July 2019, then over the next week we should see $5,600 get tested.

This $5,600 level represents the middle of the descending channel, and from here I would be looking for either a large rejection or a freefall to $4,100 as confirmation that this channel is still valid.

If this channel is still valid, then this puts the resistance at $7,200, and I would be once again short-term bearish — perhaps even until the end of the year — expecting $3K Bitcoin to be an area we should not only expect to reach but an area we could possibly stay in for a while.

A new path at $7,200

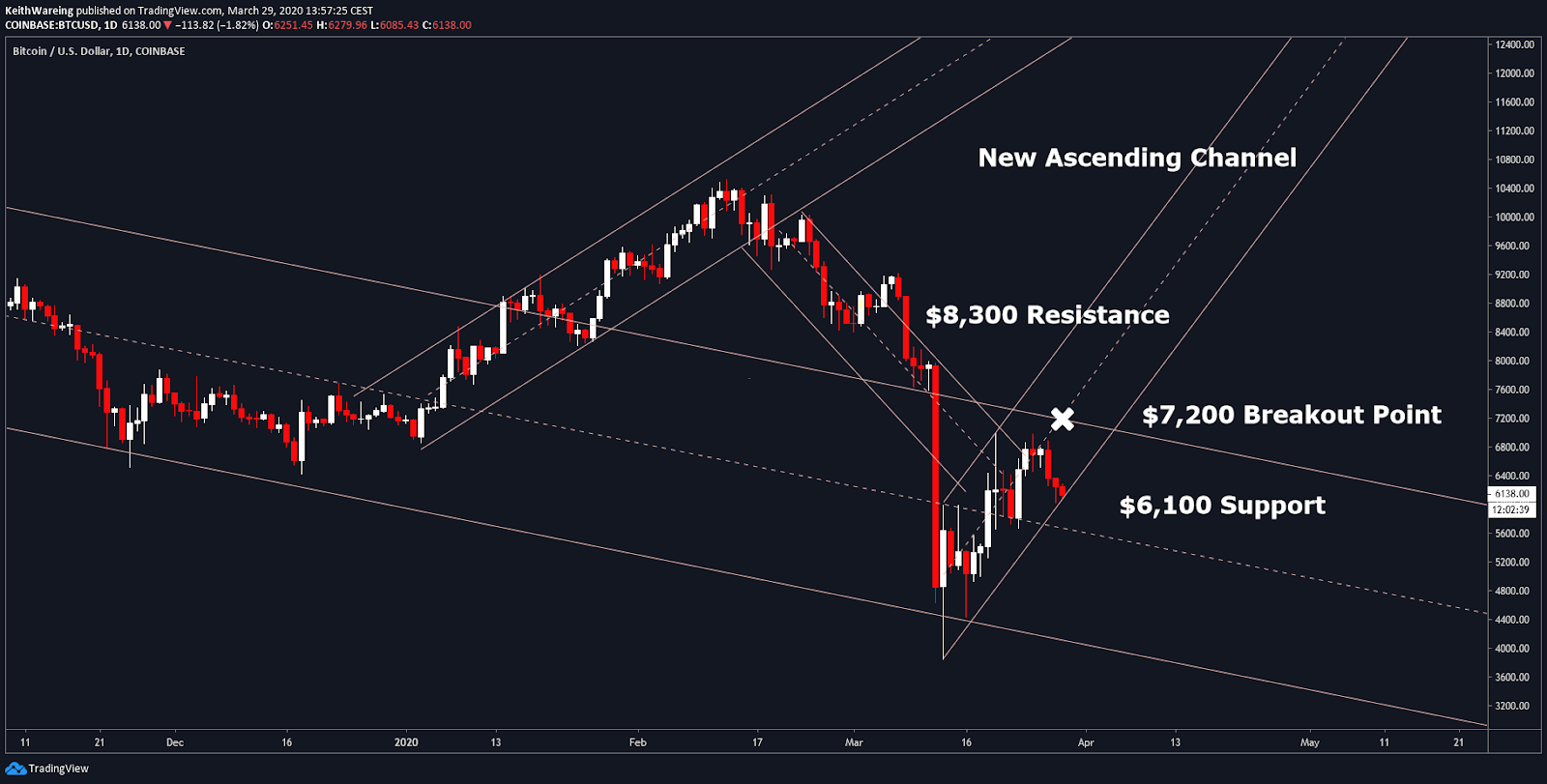

BTC USD daily chart. Source: TradingView

On a more bullish note for Bitcoin price, there is a seemingly valid ascending channel opening up, which might catch many off guard, as the resistance on the descending channel is the moving average of the descending channel.

As such, $7,200 could be a critical turning point for the king of cryptocurrencies, which could lead to a new resistance level of $8,300.

If this is the case, it would put support today around $6,060 and around the $6,100 level next week; and holding these levels would certainly be incredibly bullish for Bitcoin. And it’s not just the technicals that are strong either.

Last week, gold-bug Peter Schiff sent a smug tweet addressing all Bitcoin holders that read:

“Congratulations Bitcoin hodlers. It looks like #Bitcoin may actually be living up to its status as a non-correlated asset after all. Every asset class is rallying today except Bitcoin!”

However, unknowingly to Schiff, he just made the most fundamentally bullish case for Bitcoin. As the global markets rising last week was a direct result of trillions of dollars being printed out of thin air, Bitcoin, however, doesn’t need “stimulus packages,” “quantitative easing” or “bailouts.”

Bitcoin bounced back 80% from its recent bottom, showing that Bitcoin has something a lot more powerful than these things. It has believers in its value proposition.

This to me is a great sign that Bitcoin will emerge from this global pandemic stronger than its ever been, but we might not be out of the woods just yet.

The Weekly MACD isn’t bullish just yet

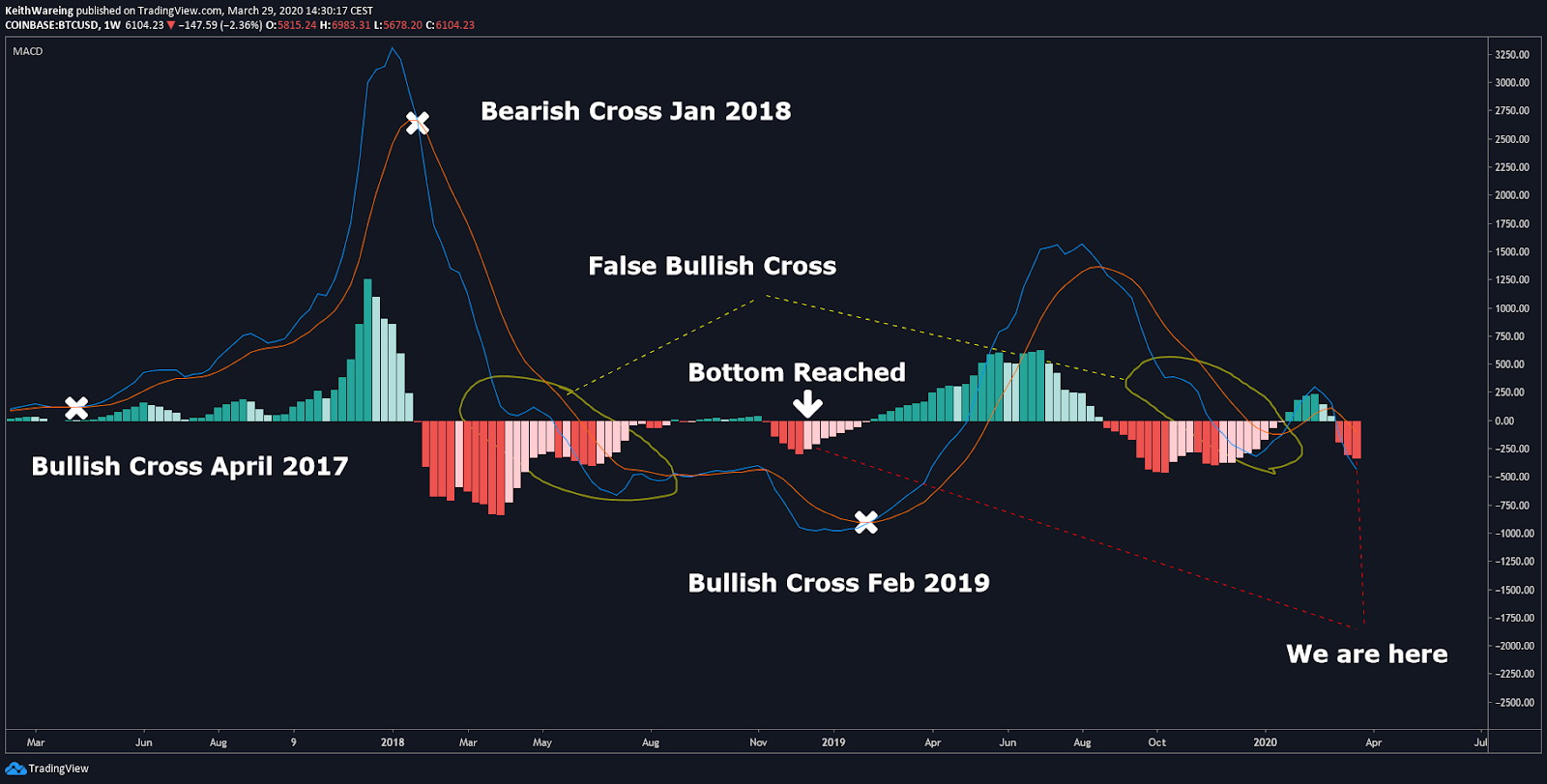

BTC USD weekly MACD chart. Source: TradingView

One of the best indicators for knowing when to buy or sell Bitcoin is the weekly Moving Average Divergence Convergence ( MACD) indicator. As can be seen from the chart above, it crossed bullish eight months before the all-time high (ATH) and crossed bearish a month after the ATH.

It also crossed bullish when Bitcoin was at its bottom in Feb. 2019. However, there can be false crosses, and this is what I warned people of in my analysis on Dec. 8, 2019. Here I pointed out that the MACD was mimicking the patterns we saw around the last false bullish cross, which saw Bitcoin fall from over $8K to under $4K and as it happens, that’s exactly what happened again this month.

As such, it would suggest that perhaps the MACD is telling us once more, that the bottom is in, and that now is the time to buy Bitcoin aggressively before the next bull-run.

However, I would personally like to see the MACD and Signal lines pinching before getting too excited, but if the new ascending channel remains valid, then that is exactly what we will see happen.

The bearish scenario for Bitcoin price

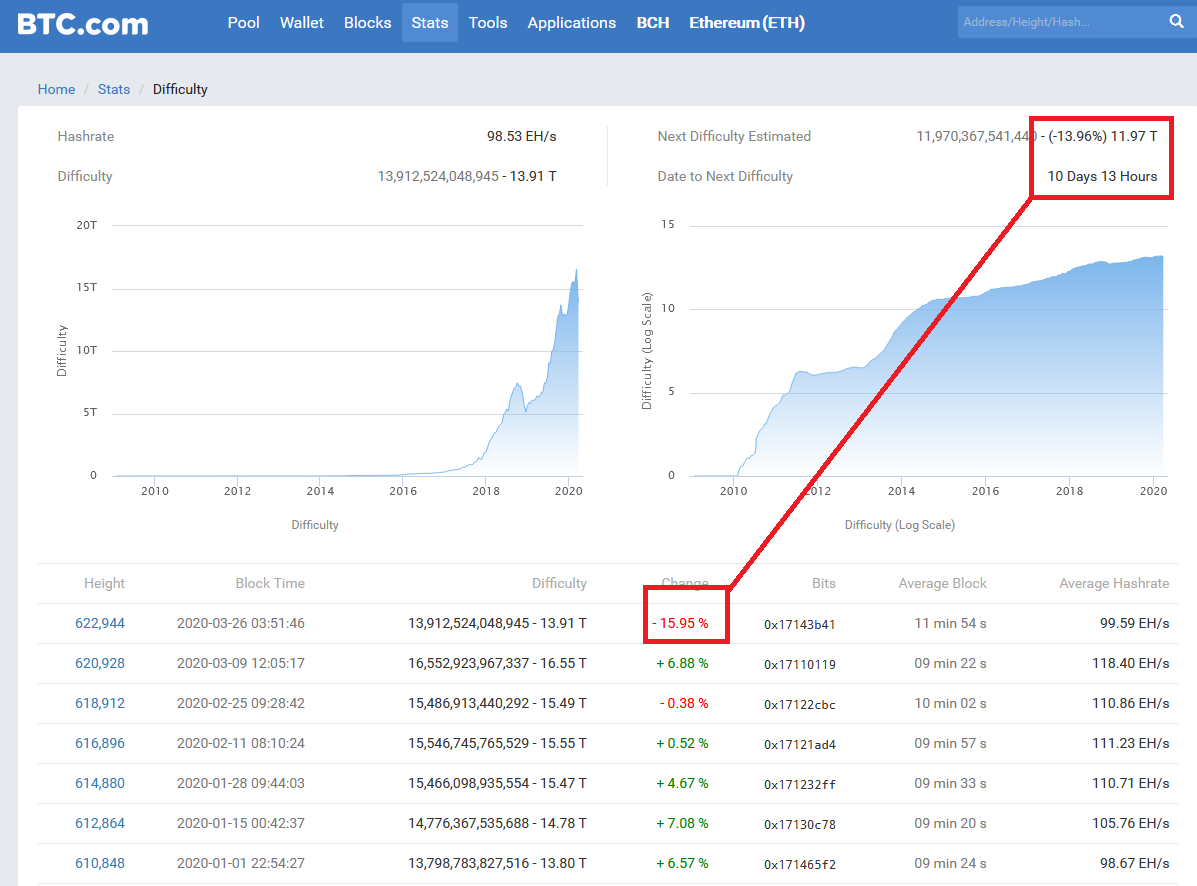

BTC mining difficulty. Source: BTC.com

Despite all my bullishness, you cannot ignore that the Bitcoin mining difficulty had its biggest drop since December 2018, and it looks as if another big drop is on the cards for April.

This could point to either more downside for Bitcoin, or it could be pointing for more profitability for miners, which would reinforce my theory on why miners crashed Bitcoin earlier this month. Should this have a detrimental effect on the price of Bitcoin, then this will invalidate the ascending support of $6,100 and put $5,600 and $4,100 as the levels to defend over the coming week.

The bullish scenario for Bitcoin price

If $6,100 support holds, then the next level to flip is $7,200. If this level becomes support next week, then $8,300 is where I am looking for a breakout that could put $10K back on the cards.

The views and opinions expressed here are solely those of @officiallykeith and do not necessarily reflect the views of CryptoX. Every investment and trading move involves risk. You should conduct your own research when making a decision.