The open interest on Bitcoin (BTC) options is just 5% short of their all-time high, but nearly half of this amount will be terminated in the upcoming September expiry.

Although the current $1.9 billion worth of options signal that the market is healthy, it’s still unusual to see such heavy concentration on short-term options.

By itself, the current figures should not be deemed bullish nor bearish but a decently sized options open interest and liquidity is needed to allow larger players to participate in such markets.

Total BTC options open interest. Source: Skew

Notice how BTC open interest has just crossed the $2 billion barrier. Coincidentally that’s the same level that was achieved at the past two expiries. It is normal, (actually, it’s expected) that this number will decrease after each calendar month settlement.

There is no magical level that must be sustained, but having options spread throughout the months enables more complex trading strategies.

More importantly, the existence of liquid futures and options markets helps to support spot (regular) volumes.

Risk-aversion is currently at low levels

To assess whether traders are paying large premiums on BTC options, implied volatility needs to be analyzed. Any unexpected substantial price movement will cause the indicator to increase sharply, regardless of whether it is a positive or negative change.

Volatility is commonly known as a fear index as it measures the average premium paid in the options market. Any sudden price changes often cause market makers to become risk-averse, hence demanding a larger premium for option trades.

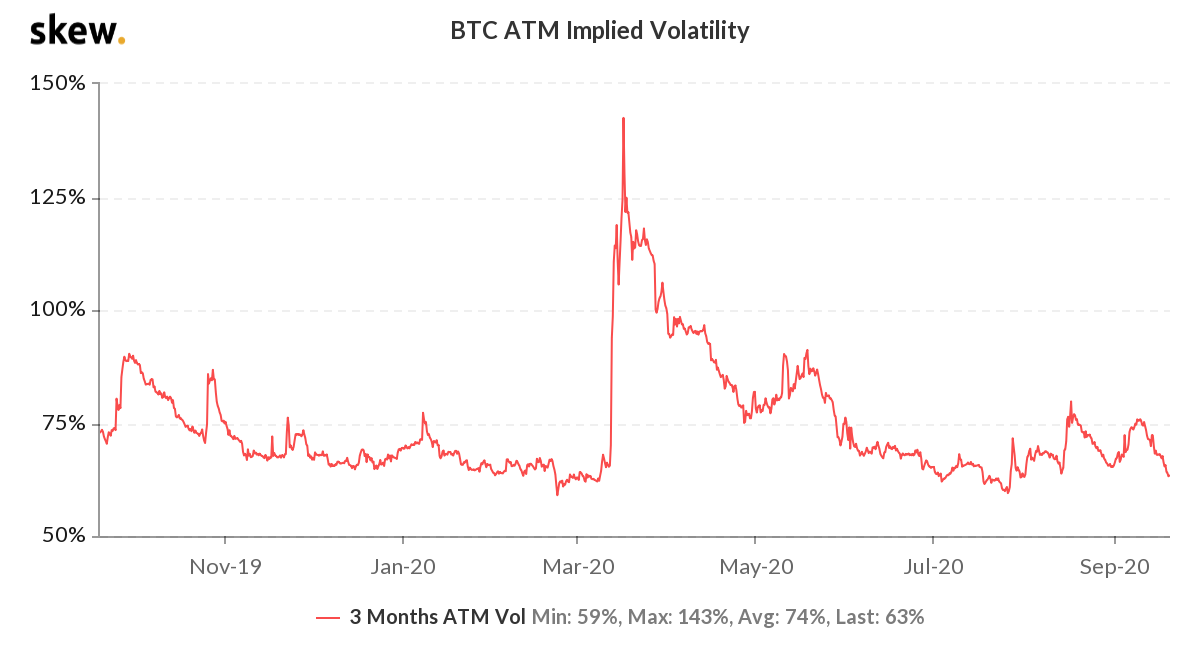

BTC 3-month options implied volatility. Source: Skew

The above chart clearly shows a massive spike in mid-March as BTC dropped to its yearly lows at $3,637 to quickly regain the $5K level. This unusual movement caused BTC volatility to reach its highest levels in two years.

This is the opposite of the last ten days, as BTC’s 3-month implied volatility ceded to 63% from 76%. Although not an unusual level, the rationale behind such relatively low options premium demands further analysis.

There’s been an unusually high correlation between BTC and U.S. tech stocks over the past six months. Although it is impossible to pinpoint the cause and effect, Bitcoin traders betting on a decoupling may have lost their hope.

BTC (red) correlation to the U.S. technology sector (blue). Source: Tradingview

The above chart depicts an 80% average correlation over the past six months. Regardless of the rationale behind the correlation, it partially explains the recent reduction in BTC volatility.

The longer it takes for a relevant decoupling to happen, the less incentives traders have to bet on aggressive BTC price moves. An even more crucial indicator of this is traders’ lack of conviction and this might open the path for more substantial price swings.

There’s an unusual concentration of short-term options

Most of the relevant Bitcoin options mature on the last Friday of every month and some concentration on the shortest ones is expected due to covered call trades.

This strategy consists of buying BTC either via spot (regular) or futures markets and simultaneously selling call options.

A covered call is closer to a fixed-income trade, aiming to pocket the substantial option premiums on BTC markets. At expiry, this trader will be liquidating both his positions on spot, futures, and options markets.

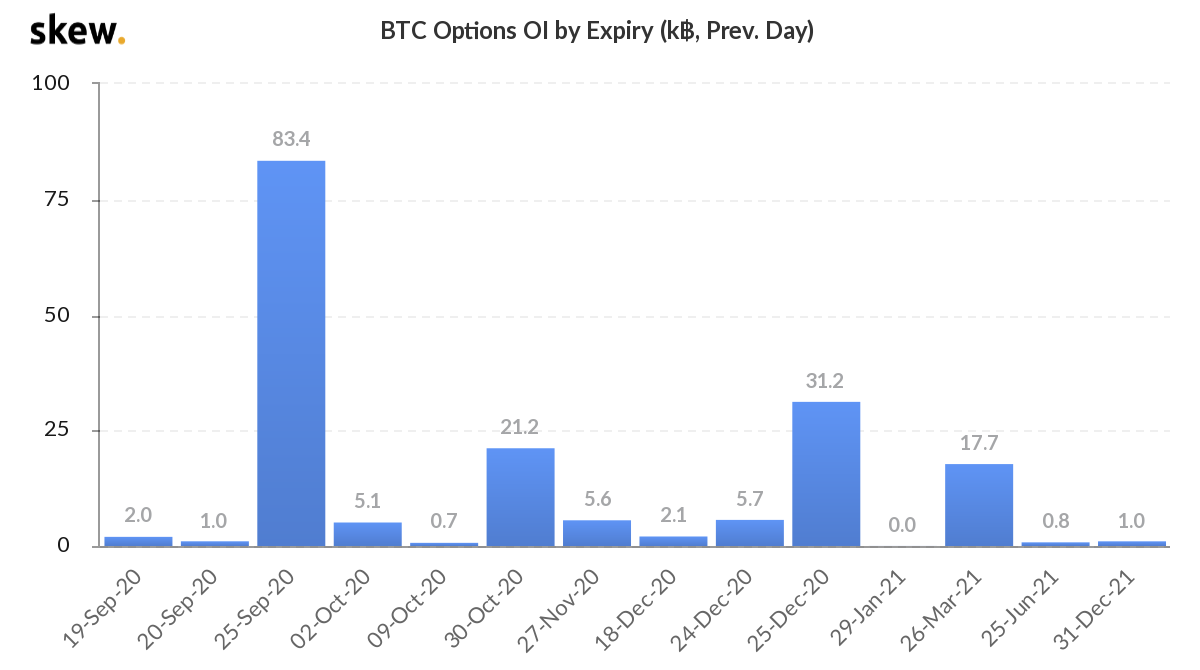

BTC options by open interest. Source: Tradingview

The unusual situation displayed on the chart above shows how 53% of the 2020 calendar options are set to mature on Friday, Sept. 25.

By comparison, this is roughly the same amount of open interest for Ether (ETH) options expiring in Sept. and Dec.

There might never be a reasonable explanation for why BTC options are so heavily concentrated but a similar phenomenon occurred back in June which cut BTC options open interest by $900 million.

As of now, there are no signs of weakness from options markets, but as Ether options stand at $450 million, any number below $1.5 billion would certainly not look desirable for Bitcoin.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cryptox. Every investment and trading move involves risk. You should conduct your own research when making a decision.