Bitcoin (BTC) stayed around $7,500 on Nov. 27 after a surprise bullish reversal took markets $700 higher the previous day.

Cryptocurrency market daily overview. Source: Coin360

Bitcoin clings to surprise gains

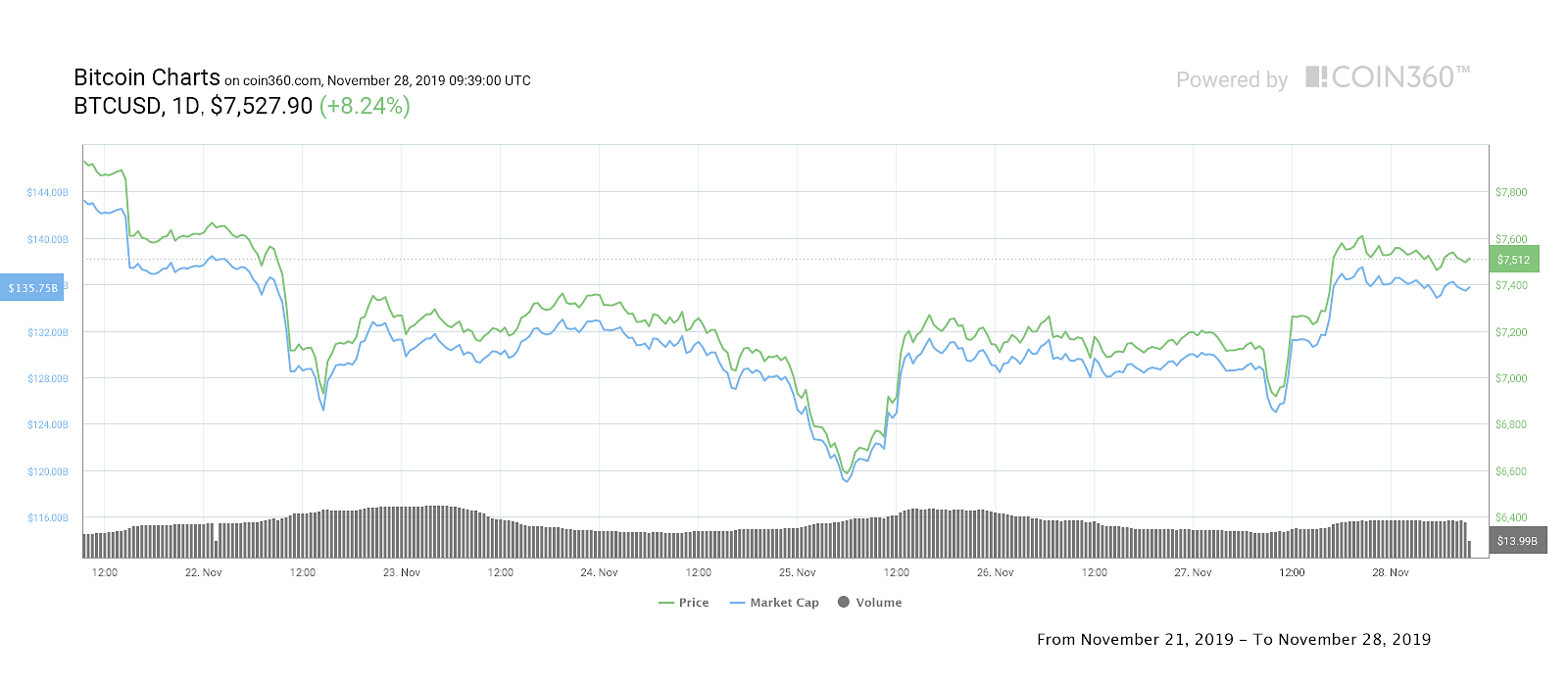

Data from Coin360 showed BTC/USD come down slightly from Wednesday’s local highs of $7,640 to trade just over $7,500 at press time.

The largest cryptocurrency took traders unaware during the previous session, jumping from below $6,900 when many braced for further drops.

Bitcoin seven-day price chart. Source: Coin360

Prior to that, pressure had been building on Bitcoin after news that major South Korean exchange Upbit had suffered a loss of funds worth over $50 million.

The fresh run-up appeared to already impact sentiment among traders, with well-known social media entities hinting the mood had changed from shorting price decreases to long positions.

“Earlier this year, bitcoin went from $4,000 to $14,000 in less than three months. But one pullback, and everyone forgets,” analyst Rhythm summarized about Bitcoin’s movements in 2019.

Despite price action, not everyone appeared concerned about the future. As CryptoX reported, institutional investors were piling into Bitcoin futures more than ever this week, with Bakkt’s product setting giant daily trading records.

Miners, too, still saw bullish potential in Bitcoin’s short-term future, despite BTC/USD breaking below their assumed breakeven point over the past week.

Altcoins benefit from BTC upside

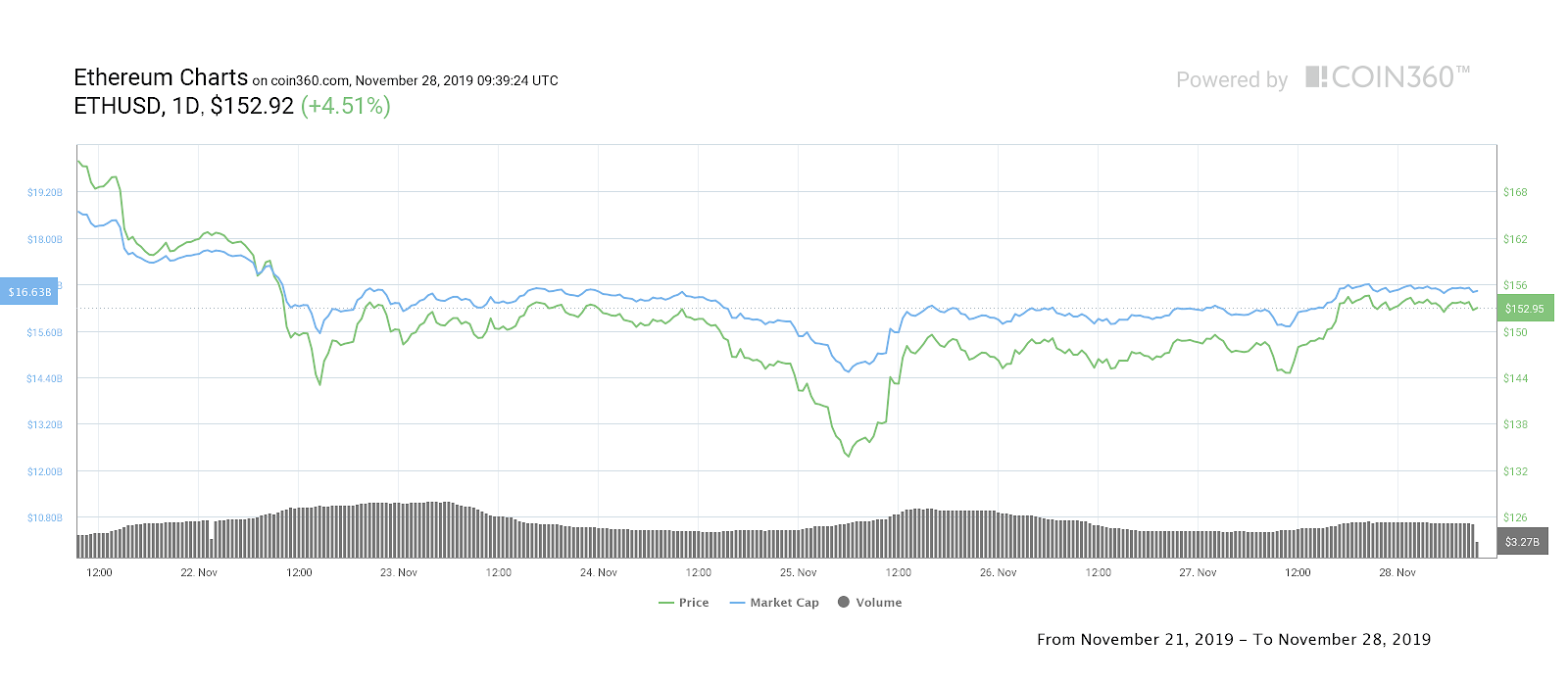

Bitcoin’s 8% daily gains ricocheted around altcoin markets on Thursday, with many cryptocurrencies gaining around 5%.

Ether (ETH), the largest altcoin by market cap, was up 4.5% at press time, trading at $152.

Ether seven-day price chart. Source: Coin360

Others performed better still, with EOS (EOS) gaining 6.5% and Tron (TRX) 9.4%. The clear winner on the day was Algorand (ALGO), which spiked 25% to challenge $0.27.

The overall cryptocurrency market cap was $205.5 billion, back from losses that previously sent it under $190 billion. Bitcoin’s share totaled 66.5%.