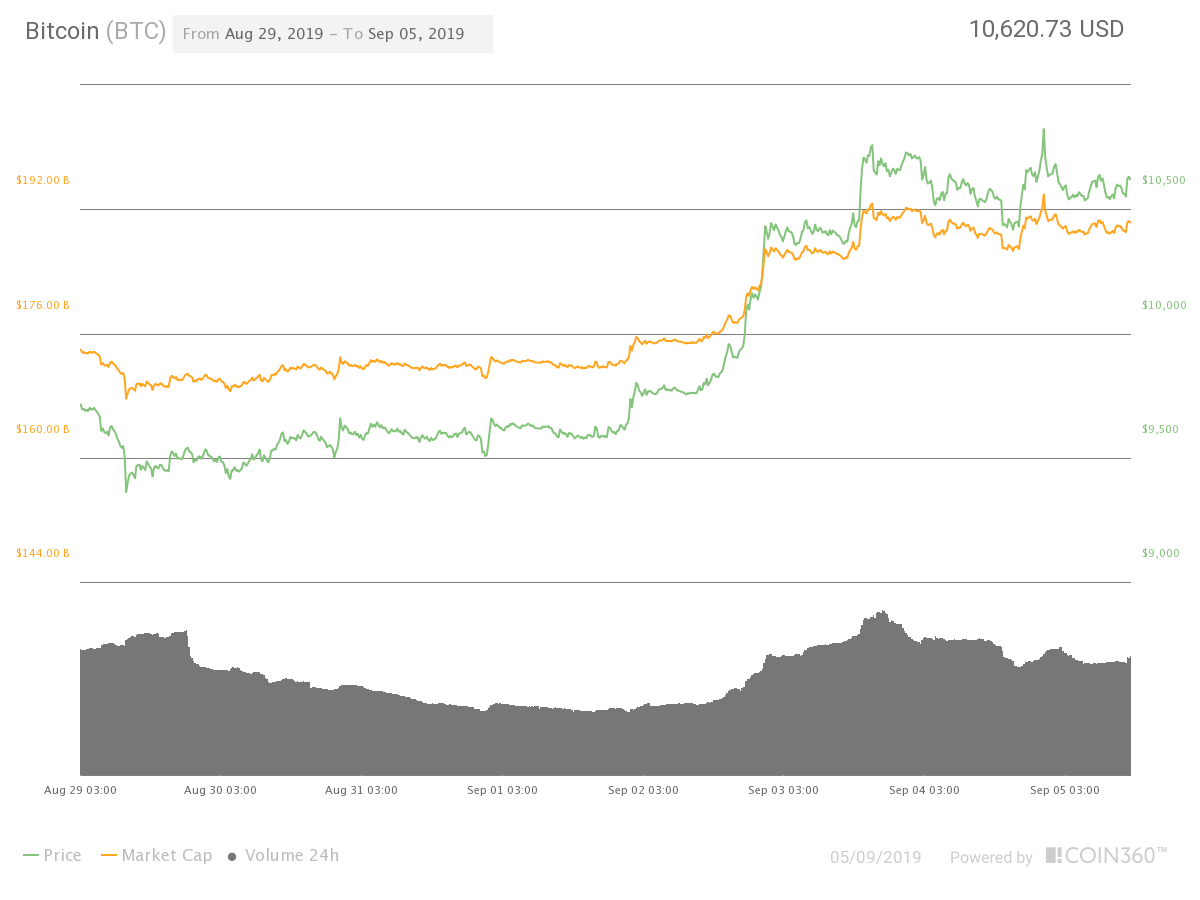

Bitcoin (BTC) price continued to fluctuate around $10,500 on Sept. 5 as the largest cryptocurrency stopped short of breaking $11,000.

Market visualization. Source: Coin360

Bitcoin simmers after latest $11K moonshot

Data from Coin360 showed less volatile action for BTC/USD on Thursday, following the pair’s sudden rise of over $1,000 in the first half of the week.

At press time, Bitcoin traded at $10,620, compared with just $9,350 at the same point last week.

Bitcoin 7-day price chart. Source: Coin360

The 12% seven-day gains excited analysts, who abandoned bearish sentiment to forecast a continuation of upward momentum. A subsequent slowdown in growth has tempered those aspirations, however, with markets now waiting for outside events to sway the mood.

For Filb Filb, a popular Bitcoin trader, the launch of institutional trading platform Bakkt later in September is the closest such deciding moment.

“Bitcoin continues to consolidate above $10k,” he summarized in private comments, adding:

“A lot of people are hoping to get bids filled below $9k; the market rarely gets what it wants and I wouldn’t be surprised if they are forced to buy higher. But let’s see what happens with the launch of Bakkt.”

While opinions suggest demand for Bakkt’s physical Bitcoin futures will be high, activity has yet to kick off, with client deposits beginning on Friday this week.

Altcoins continue to bite the dust

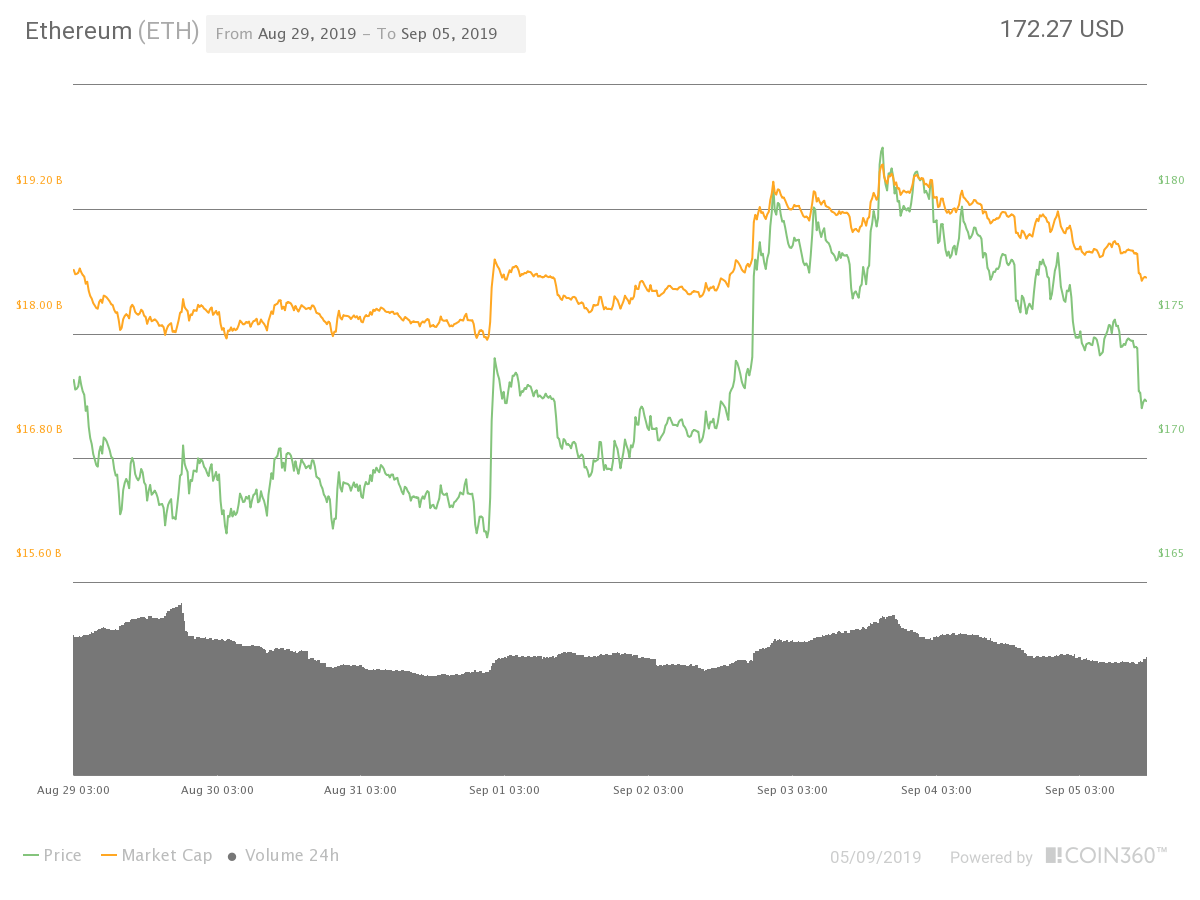

Bitcoin’s latest consolidation meanwhile continues to pile pressure on altcoin markets. Most major tokens lost several percentage points in U.S. dollar terms on Thursday, having failed to rally in line with Bitcoin.

Ether (ETH), the largest altcoin by market cap, fared worse than any in the top twenty, dropping 3.4% to hit $171.

As trader Nick Cote warned on Thursday, a further dip below $160 could even have a knock-on effect for Bitcoin.

“A break below the $160 handle would spell disaster for the bulls. I’d assume most /USD pairs, including Bitcoin would dump as well,” he wrote.

Ether 7-day price chart. Source: Coin360

Others lost between 1% and 3% on the day, while only Monero (XMR) noticeably bucked the trend, delivering 3.2% gains.

Bitcoin’s share of the $267 billion crypto market cap stood at 71% on Thursday, continuing to expand on highs not seen in over two years.