In summary:

- In the last 24 hours, Bitcoin has fallen from around $9,700 to a local bottom of $9,281.

- The team at Glassnode observed that June 23rd saw the largest flow of Bitcoin from miners to exchanges in over a year.

- 2,650 BTC was transferred to Bitfinex during that time.

Bitcoin’s journey to $10,000 has once again hit another detour as the King of Crypto has once again fallen from comfortable levels of $9,700 to a local bottom of $9,281 – Binance rate. Bitcoin (BTC) is once again depending on the strong support zone of $9,300 and is trading at a value of $9,360 at the time of writing this.

June 23rd Saw the Largest Flow of Bitcoin from Miners to Exchanges

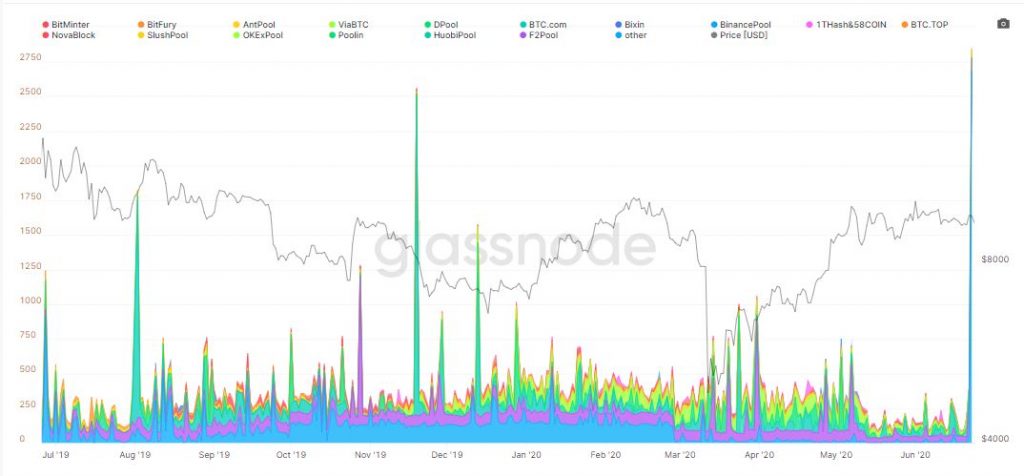

Earlier today, the team at Glassnode tweeted their latest analysis of Bitcoin inflows into exchanges from miners. In their brief analysis, the team observed that yesterday, June 23rd, saw the largest inflow of Bitcoin from miners to exchanges in over a year. The majority of the volume transferred was 2,650 BTC sent to Bitfinex by the said miners.

The tweet by Glassnode further provided a detailed chart showing a spike in Bitcoin transfers by miners into exchanges.

Yesterday we observed the largest flow of #bitcoin from miners to exchanges in over a year.

This was primarily due to large miner transfers to #Bitfinex

, totalling 2,650 $BTC.

Chart: https://t.co/Erw5cYgIOi pic.twitter.com/ns9NsUScal

— glassnode (@glassnode) June 24, 2020

Other Instances of High Bitcoin Inflows to Exchanges By Miners

Further analyzing the chart provided in the tweet by Glassnode, it can be observed that high volume inflows were also observed on the following dates in 2019.

- August 2nd

- October 28th

- November 19th

- December 13th

What then proceeded these dates, was that the value of Bitcoin fell drastically and opened a bear cycle in each instance.

Will Bitcoin Drop Lower?

Going by the last 4 instances that exchanges experienced high inflows of Bitcoin from miners, it can be concluded that Bitcoin might be in for a few rough days or weeks ahead. Back in mid-June, all bets were on Bitcoin losing the $9,300 support zone and kicking off a bear cycle that would see BTC retest the 200-day moving average.

At the time of the analysis, the 200-day MA provided adequate support for Bitcoin at around $8,100. Checking the charts once again, the 200-day moving average for Bitcoin now provides support around $8,300.

A similar analysis of Bitcoin was put forth by @MatiGreenspan via the following tweet.

Been wondering when #bitcoin might see its 200 DMA (blue line again) and was considering support around $8,000.

It seems like the DMA is rising lately and with it our next support line. pic.twitter.com/Wp4QvYkW7g

— Mati Greenspan (tweets are not trading advice) (@MatiGreenspan) June 24, 2020

Disclaimer: This article is not meant to give financial advice. Any additional opinion herein is purely the author’s and does not represent the opinion of EWN or any of its other writers. Please carry out your own research before investing in any of the numerous cryptocurrencies available. Thank you.