In summary:

- Bitcoin is exhibiting a good level of bullishness above $11k

- However, Bitcoin’s correlation to stocks and gold could be a bad thing with the US elections two weeks away

- A drop in the stock market and/or gold could mean a similar fate for Bitcoin in the short term

The end of the weekend is once again upon us and so is Bitcoin’s weekly close. The King of Crypto has once again held its own in the markets and a close above $11,200 would be a good sign that the narrative of Bitcoin as a store of value is still intact.

Bitcoin (BTC) Could Be Pulled Down By Weakening Stocks and Gold

However, 2020 still has one mega event for Bitcoin in the form of the US elections on the 3rd of November. This means that Bitcoin could be in for a very volatile two weeks based on its correlation to the traditional markets and gold.

In terms of Bitcoin’s relationship with the stock markets, the team at Weiss Ratings has warned that the next few days could be very volatile and risky for Bitcoin due to the aforementioned US Elections.

We’ve noticed a high correlation of #BTC to equity markets. This is bad, because currently – due to US election rapidly approaching – stock market has a lot of headline risk, and correlation transfers all that needless volatility to #Bitcoin.

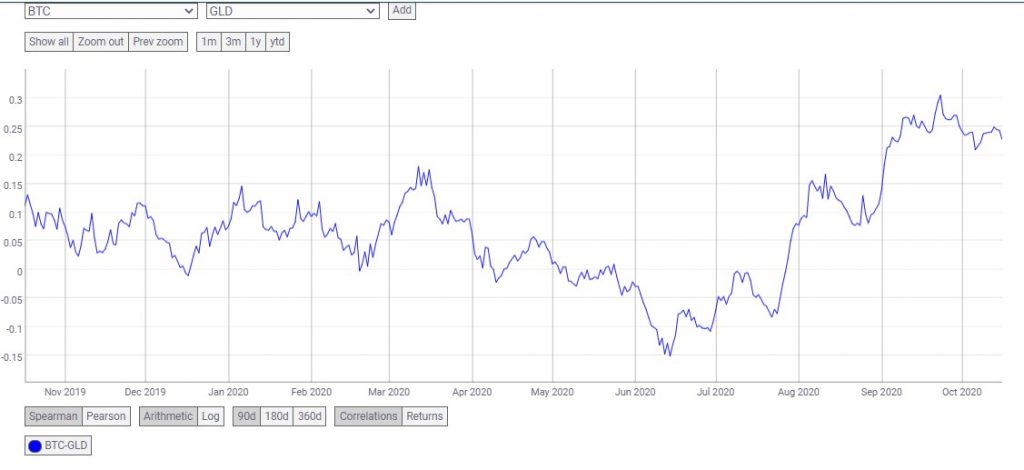

Additionally, the correlation between Bitcoin and Gold has continued to increase since mid-June as can be seen in the following chart courtesy of CoinMetrics.io.

Furthermore, the current state of Gold in the markets is one of short-term bearishness with the price of Gold currently trading at $1,898 and below the 50-day moving average. From the weekly chart, the value of Gold is very overextended after its recent peak at around $2,077 as seen in the weekly chart below. Also from the weekly Gold chart, it can be observed that the MACD is showing signs of weakness as well as the weekly RSI.

Conclusion

Summing it up, Bitcoin is exhibiting signs of bullishness as it continues on its slow but sure climb above $10k and $11k. However, the next two weeks leading up to the US elections might pose to be a short-term threat to Bitcoin’s momentum given BTC’s correlation to stocks and gold. The latter two assets could be negatively affected by the November 3rd elections bringing down Bitcoin with them.

Therefore, Bitcoin traders and investors are advised to be cautiously optimistic until a winner of the elections is declared. Once a winner is known, the stock markets will adjust accordingly and eventually stabilize thus giving Bitcoin a chance to continue thriving.