The price of Bitcoin (BTC) dropped sharply on Nov. 26 following a mass sell-off from whales. Data from on-chain data firms, namely Santiment, Intotheblock, and CryptoQuant, show heightened levels of whale exchange inflows.

Whales selling right under Bitcoin’s all-time high, particularly when the market sentiment was overly euphoric, led to a massive drop. Roughly $1.8 billion worth of futures contracts were wiped out, as Cryptox reported.

Some exchanges, like Binance as an example, recorded $400 million worth of liquidations within merely several hours.

According to Santiment, whales sold quickly after Bitcoin surpassed $19,300. Many of these high-net-worth individuals sold so aggressively that they are no longer in the whale category of holding over 1,000 BTC.

The overleveraged derivatives market started crashing as soon as the price of Bitcoin saw a relatively minor drop. Eventually, BTC dropped to as low as $16,200 on major exchanges. Analysts at Santiment said:

“$BTC whales with 1,000 or more coins held (currently $16.7M or more) sold off nearly immediately after the $19.3k price top two days ago. 11 of these whales actually sold off enough to no longer be in this 1,000+ coin category, just as prices peaked.”

Researchers at Intotheblock spotted a similar trend. The drop in the price of Bitcoin matched the moment when whales transferred 93,000 BTC into exchanges. When the price of BTC was at the yearly peak, 93,000 BTC were worth $1.8 billion.

Whales have been moving $BTC into exchanges.#Bitcoin has faced a steep correction since Wednesday’s highs of $19,600

This drop started as soon as whales began to deposit BTC to exchanges. More than 93 thousand Bitcoin’s were deposited into centralized exchanges. pic.twitter.com/ntq1yIlDeV

— intotheblock (@intotheblock) November 27, 2020

Subsequent to the rapid crash of the Bitcoin futures market, the outlook on Bitcoin from traders and analysts remains divided. Some believe that BTC is headed for a deeper pullback, possibly to the $13,800 support level. Others, however, say that buyers now have the incentive to bring BTC above $18,000 to tap the liquidity above.

Bearish cases for Bitcoin in the short term

The bearish case for Bitcoin in the near term mainly revolves around two things. First, during previous bull markets, BTC historically dropped 30% or more before seeing a continuation of the rally. If BTC sees a similar trend, that would mean a drop to at least $14,500.

Second, short-term investor activity is increasing as the price of BTC consolidates. In the past, a spike in the number of young addresses marked a bearish trend.

Cryptocurrency trader and technical analyst, Edward Morra, emphasized that previous bull markets saw multiple corrections that were even more severe, such as by 30% to 40%. Furthermore, the trader also said that the Fibonacci sequence 0.618 level is $13,500.

Based on the combination of these two data points, Morra explains that a drop to $13,500 would be a “fantastic” opportunity. He said:

“Assuming we’re in a bull-market, 0.618 Fibs are usually fantastic buy opportunities. Let’s take a look at the period of mid 2015 to late 2017. 6 out of 7 pullbacks we had landed at 0.618 Fib (last pullback only went to 0.5). All dips were 30-40%. Currently, 0.618 Fib level is around ~$13500. That would be a fantastic buying opportunity if it happens. We already had some mini-version of that earlier this year which corrected to 0.618 Fib too.”

Josh Olszewicz, a chartist and a cryptocurrency investor, meanwhile says that local Bitcoin tops usually occur when unspent transaction outputs (UTXOs) aged one to three months reach 10%.

The investor notes that it is currently at 8%, which has historically signaled a market top. He noted that “similar to BDD, more young on-chain coin movements are generally bearish.”

Bull cases in the near future

Nevertheless, the market sentiment around Bitcoin remains generally bullish. Many analysts that anticipate BTC to fall in the near term still expect the dominant cryptocurrency to hit an all-time high by the year’s end. Considering this, some traders are also optimistic about the short-term price trend of BTC.

A pseudonymous trader known as “Byzantine General” noted that the liquidity for Bitcoin is now in the $17,500 to $19,000 range. Liquidity emerges when traders in the futures market sway to one side of the market. Since the liquidity is higher up, it indicates that traders are likely shorting BTC and the liquidation prices of overleveraged shorts are located around $18,000.

Stop hunts and cascading liquidations can work both ways. If mass long contract liquidations caused BTC to drop on Nov. 26, short liquidations could trigger BTC to rally. Given that BTC/USD has dropped substantially in a short period, a relief rally is certainly possible. With liquidity near $18,000, the probability of this happening remains high.

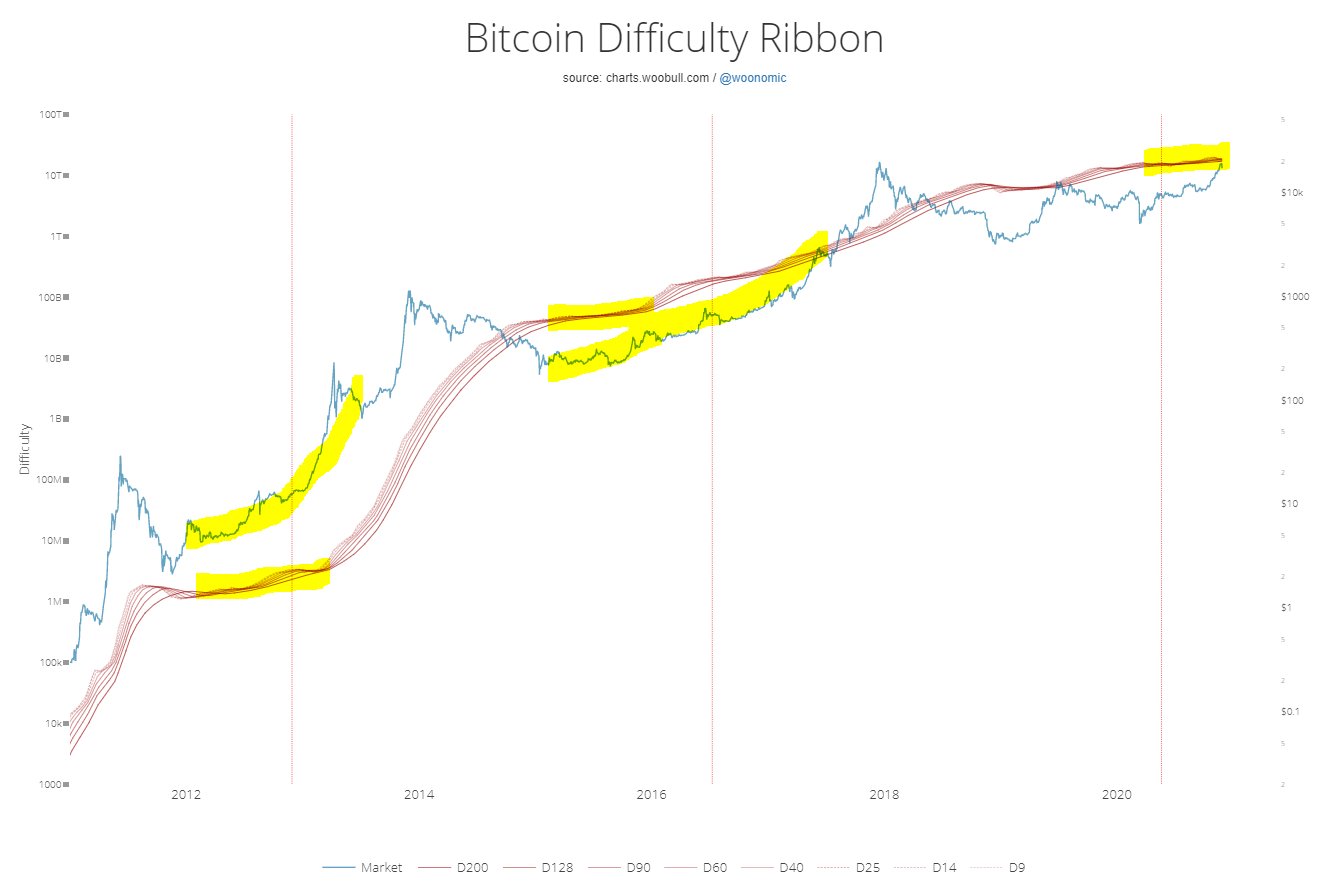

Former Credit Suisse banker Mira Christanto added that the medium to the long-term outlook of BTC remains strong. She pinpointed the Bitcoin Difficulty Ribbon indicator, which suggests the price of BTC has been suppressed for a long time. The indicator signifies an acceleration of mining difficulty, which as seen in 2013 and 2016, marked the start of bull cycles.

The biggest variable is stablecoin inflows

Whale exchange deposits have continuously remained high throughout November, which was the main source of selling pressure. But, the one variable that could offset the sell-off from whales is stablecoin inflows. In the latest note to its clients, data analytics firm CryptoQuant said that the number of stablecoins deposited into exchanges rose sharply in recent months.

For the rally of Bitcoin to continue in the near term, two main factors are critical. BTC needs to stay above the $16,200 support region, which it has defended so far with a strong reaction from the market.

It also would need to see higher stablecoin inflow in the next several days, which would indicate that sidelined capital is returning to the market. The note read:

“Over the last few months, the amount of stablecoins that have been deposited onto exchanges has risen sharply. This has resulted in sell pressure decreasing since the end of September, and staying low. Currently, the sell pressure is increasing slightly, and this could indicate a correction, but with the Exchange Whale Ratio remaining low, it seems that it won’t be large. Analysts utilizing CryptoQuants tools, looking at the long-term outlook, are anticipating bitcoin to reach and pass the previous high of $20,000.”

At least in the foreseeable future, it is critical for BTC to remain stable above $17,000 and consolidate. This would allow the derivatives market to see a potential resurgence in momentum and the open interest to build up. So far, there aren’t too many signs that a massive correction must occur and that the road toward a new all-time high in the medium term has been hindered.

Moreover, the culmination of negative news, including Coinbase CEO Brian Armstrong’s tweet thread about U.S. regulation and Chinese police seizing $4.2 billion in BTC and other cryptocurrencies from the PlusToken Ponzi scheme, hit the market in recent days to fuel bearish sentiment.

However, as the impact of this negative news wears off, the fear along with selling pressure on Bitcoin and other cryptocurrencies could decrease in the upcoming weeks