Venezuela is an example of cryptocurrency adoption during an economic crisis. No other economy facing hyperinflation has come near the South American nation in terms of GDP-adjusted activity on peer-to-peer crypto exchanges, according to a new CryptoX Research analysis of data from LocalBitcoins and Paxful, the two largest such exchanges.

Previous reporting from CryptoX has shown that amid platform bans by the government and Venezuelans’ unease toward foreign crypto coverage, peer-to-peer (P2P) transactions remain at the center of the country’s thriving crypto scene. In general, Venezuelans cite a combination of factors for the rise of crypto there including migration, capital controls, risk of government seizure, demand for hard money and exposure to the petro, the cryptocurrency backed by the government.

Whatever the main cause, data indicate unique factors could be driving bitcoin adoption in Venezuela, which is far outpacing adoption in countries experiencing similar economic fallout.

The map above shows a visualization from CryptoX’s GDP-adjusted database of LocalBitcoins and Paxful volume by currency. Venezuela’s dominance is apparent.

Other GDP-adjusted analyses of peer-to-peer bitcoin trading volumes, such as this one from analyst Matt Ahlborg, excluded Paxful, which has become a major platform. In this data visualization from CryptoX, we include both LocalBitcoins and Paxful data and adjust for GDP. Peer-to-peer activity in Venezuela has continued to dominate – with a monthly level at least twice as high as the next-largest market, Nigeria. Paxful’s exit from Venezuela is imminent, but its growth in other parts of the world make it an important component of analysis that looks at peer-to-peer crypto trading on a global scale.

Peer-to-peer crypto exchanges are often where people come to buy their first crypto assets, Ahlborg argued in the same analysis, and so their activities can depict how the crypto asset is adopted on the ground level more truthfully than larger exchanges that are set up for fast-paced, speculative trading.

By and large, this is true in Venezuela. Expats use bitcoin to send remittances back home, where locals convert it to bolivars to buy food and pay bills. With crypto remittances from expats plunging, peer-to-peer cryptocurrency transactions within the country have proven resilient. LocalBitcoins and Paxful trades using bolivars peaked in the first half of 2019, and have since hovered around $20 million.

Continued high volumes are driven by businesses’ demand for bitcoin, according to Gabriel Jiménez, a Venezuelan blockchain entrepreneur who led the development of the petro. Venezuelan businesses often use bitcoin as a medium to obtain foreign currencies like the dollar, he said.

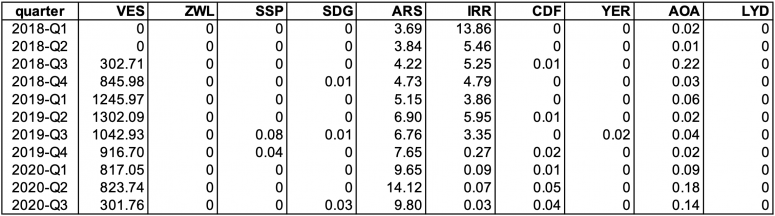

Yet, other countries that also suffer from hyperinflation have not come close to Venezuela in peer-to-peer bitcoin activity. Among the 10 economies that have experienced the highest rates of annual inflation since 2017, according to data from the International Monetary Fund, only Venezuela, Argentina and Iran have shown significant peer-to-peer bitcoin market activity, and none approach Venezuela in size or consistency. Venezuela’s peer-to-peer bitcoin activity has been extraordinary, whether measured as an absolute or relative to GDP.

What sets Venezuela apart may be governmental support of a digital currency. The petro helped loosen Venezuelans’ fear of dealing with services like LocalBitcoins, said Jiménez.

Some high-inflation countries have moved in the other direction. The government of Zimbabwe, where the two largest peer-to-peer bitcoin exchanges have shown zero activity, has made efforts to curb cryptocurrency adoption.

There are other factors: Venezuela’s inflation rate is measured by the International Monetary Fund at orders of magnitude higher than any other economy in the top five by annual inflation rates. It hit 65,374% in 2018. The next-highest rate of inflation tracked by the IMF over the past three years is in Zimbabwe, where it is projected to be 319% in 2020.

“People living in Venezuela are living under a very unstable and predatory government. They suffer from extreme inflation and general economic instability. And here’s a censorship-resistant, inflation-proof asset, so it’s very attractive to people who are looking for a way to maintain value,” said Andrea O’Sullivan, director of tech and innovation at James Madison Institute, a Washington think tank.

Peer-to-peer vs. centralized exchanges

According to Jiménez, Venezuelans prefer peer-to-peer exchanges also because they’re better than other alternatives. Centralized services, for example, have lower liquidity and less-developed trading capabilities due to a lack of service from Venezuelan banks.

The “early bird” factor is yet another reason. LocalBitcoins became such a popular exchange in Venezuela not only because it was inexpensive, but also because it was the first thing available to Venezeulans as soon as government normalization of cryptocurrencies was in the air around 2017, Jiménez added. Veteran LocalBitcoins traders have their ratings, number of successful trades and years of experience visible on their profile pages, which attracts and maintains customers’ loyalty to them and, in turn, both sides’ loyalty to the platform.

In contrast, Paxful only made plans to enter the market by late 2018, and research from CryptoX shows that bolivar-bitcoin trades on the platform have only amounted to less than 1% of their LocalBitcoins counterparts in terms of monthly volume.

Yet, even though it’s slated to cease all operations in Venezuela because of heavy U.S. sanctions against the country, Paxful has been on the rise. In July, trades involving bolivars doubled the June volume, crossing the $100,000 line for the first time since the currency was reissued in August 2018, the research shows. The exchange is also enjoying explosive growth in Nigeria, Ghana and Kenya.

People living in Venezuela suffer from extreme inflation and general economic instability. And here’s a censorship-resistant, inflation-proof asset, so it’s very attractive to people who are looking for a way to maintain value.

That said, Paxful’s monthly volume in each of these countries has only amounted to half of LocalBitcoins’ growth in Venezuela, our data visualization shows. Peer-to-peer activity continues to be most dominant in Venezuela, where it is used to skirt government restrictions and obtain foreign fiats.

It’s possible that, as Jiménez suggested, Venezuela’s peer-to-peer bitcoin activity wouldn’t be where it is today without crypto-friendly initiatives from the government itself. It’s also possible that bitcoin adoption in Venezuela may be driven by the sheer rate of Venezuela’s hyperinflation, which outpaces other crisis economies. As bitcoin’s real-world uses continue to crystallize, yet other factors may emerge as drivers of its adoption.