Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Bitcoin could reach an all-time high price of $80,000 in 2024, according to a prominent analyst. Let’s dive into this optimistic forecast.

Analysts say a trifecta of catalysts could push Bitcoin price

Potential approvals of Bitcoin spot ETFs, the Bitcoin halving set for April, and growing demand from enterprises could drive Bitcoin to $80,000 by the year-end according to AllianceBernstein.

Bitcoin rallied by over 150% in 2023 and has continued to show strength through the beginning of 2024, tapping $46K for the first time since April 2022.

However, it remains 33% from it’s all-time high (ATH) established in Nov. 2021.

Industry experts believe the Securities and Exchange Commission (SEC) will approve Bitcoin spot ETFs by 10 Jan.2024.

This is the deadline for the applications filed by ARK Investments and 21Shares, but analysts believe the SEC will approve applications from other players to prevent a first-mover advantage.

Fox News journalist Eleanor Terrett recently is one of those speculating Bitcoin ETFs may be approved this week.

In the report, AllianceBertstein said that ETF approvals may be followed by a “fairly brief and shallow selloff” as some traders take profits.

However, the availability of spot Bitcoin ETFs could draw increasing institutional liquidity inflows, pushing up the Bitcoin price as the year advances.

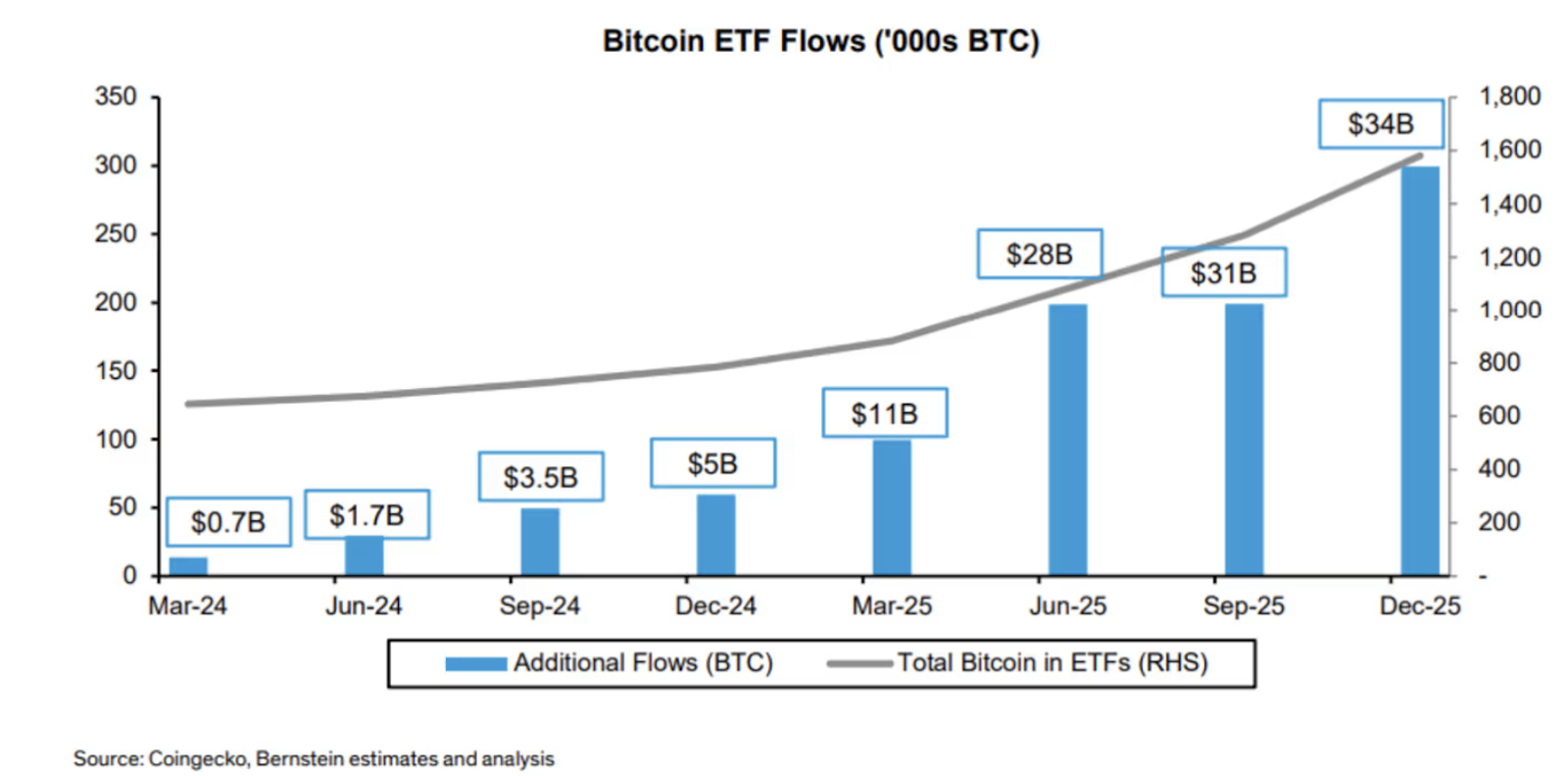

AllianceBernstein analysts explained, “Bitcoin ETF flows build-up could be gradual, but the applicants will be fighting hard to get a lead into this massive asset accumulation game, tuning up advertising and Bitcoin branding leading to a snowball effect.”

The analysts expect up to $5 billion in inflows to enter Bitcoin from ETFs in the first half of 2024 and $10 billion in the second half.

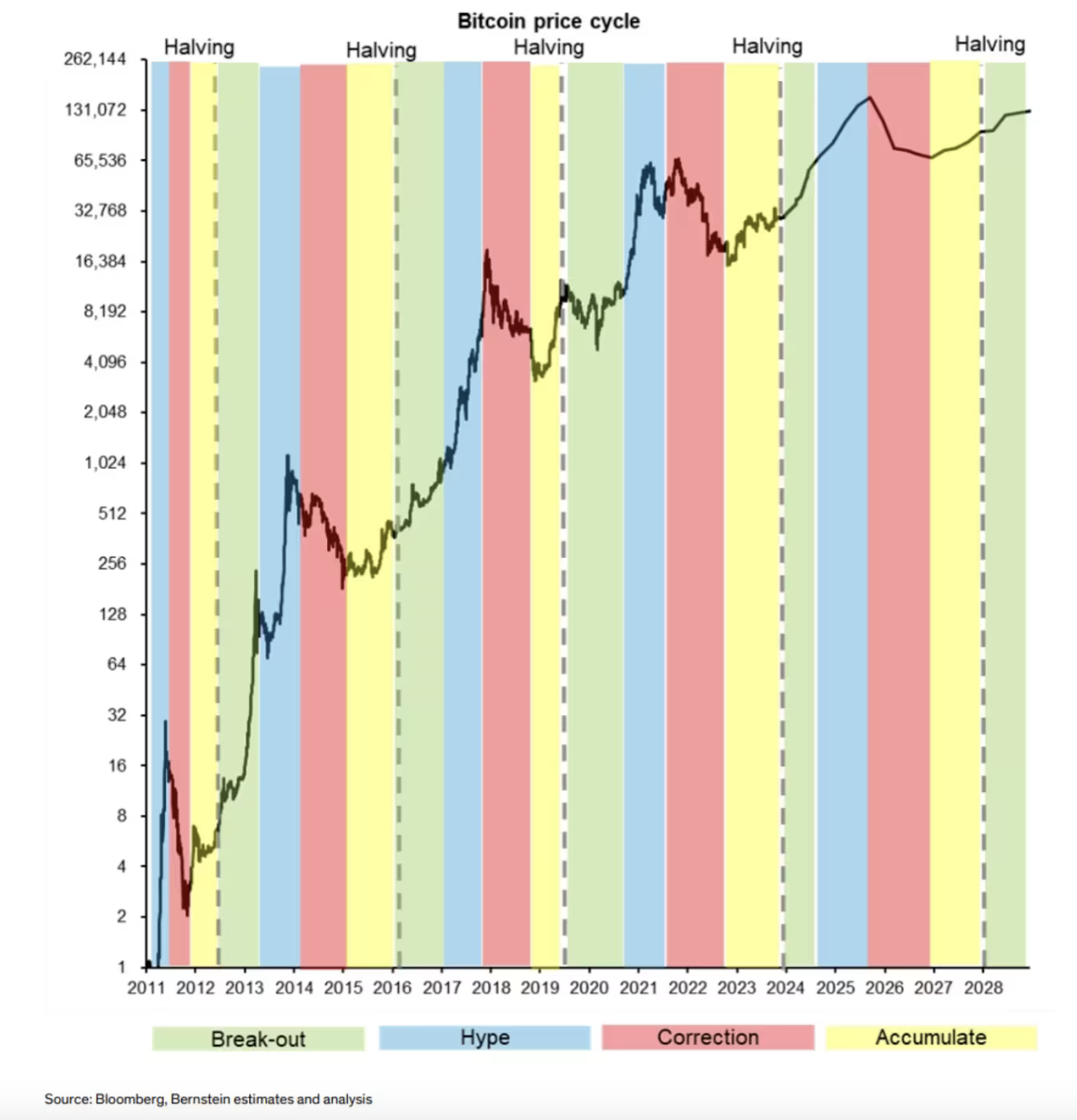

Meanwhile, the April 2024 Bitcoin halving will cut new rewards given to miners in half, creating a gap between demand and new supply entering the market.

Historically, this has commenced a bull market, but the added detail of Bitcoin spot ETF demand could enhance the upcoming market cycle’s potential.

The current market environment has excited leading analysts, but some traders are backing newer Bitcoin-related project Bitcoin Minetrix for even higher upside potential.

According to a recent estimate, Bitcoin Minetrix could rally after its presale.

Bitcoin Minetrix presale raises over $7.2 million

Bitcoin Minetrix is a new project that will allow users to cloud mine Bitcoin effortlessly.

It is an Ethereum-based platform, so users can get started with just a MetaMask or other EVM-compatible wallet.

Furthermore, there are no technical expertise or hardware requirements, making it ideal for beginners.

The platform works by users staking BTCMTX in exchange for Bitcoin mining credits. They can then burn these credits for cloud mining power, translating to free Bitcoin.

Besides its simplicity, another advantage of Bitcoin Minetrix is that no money changes hands. Users simply stake BTCMTX to earn rewards, eradicating the risk of scams common in earlier cloud mining solutions.

These factors have supported the ongoing presale which has raised over $7.2 million. The project has also amazed a vibrant community comprising 15.7K followers on X and 10.6K Telegram subscribers.

The anticipated rise in Bitcoin’s price means Bitcoin Minetrix’s rewards may also rise in tandem, likely bolstering the BTCMTX price.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.