The price of bitcoin has been very stable lately, and the crypto asset has been trading in a less volatile range just above $9k per coin for 76 consecutive days. After the third halving, the price of bitcoin has also been far more stable, in contrast to the price action after the second halving. However, bitcoin’s price still seems to be following a similar route to 2016 when the digital asset’s price trended sideways for quite some time, until it eventually led to the all-time price highs in 2017.

Cryptocurrency investors and evangelists have been discussing how bitcoin (BTC) prices have been stable for a long period of time. For instance, on July 14, software developer Jameson Lopp tweeted that “bitcoin has been trading in a range of ±3% for [six] consecutive weeks” with a meme that says: “Look at me, I am the stablecoin now.”

Bitcoiners discussed the subject on Reddit as well, as a number of Redditors conversed about BTC’s stability on an r/bitcoin post called: “Bitcoin price seems like much more stable since the last halving in May.”

Binance CEO Changpeng Zhao, otherwise known as CZ thinks that BTC will see a breakout in the near future. CZ discussed the subject with Bloomberg Daybreak and he called bitcoin a “stablecoin.”

“I think sooner or later it’s going to break out,” CZ stressed in the interview. “But right now bitcoin has been really stable— People have been calling it a ‘stablecoin’ now.” CZ also discussed the correlation with stock markets and equities.

On July 14, analyst Jim Cramer and the American author, stock and commodity trader Larry Williams suggested that the S&P 500 will top on July 27, and possibly dump on July 28. During his interview with Bloomberg, CZ said that the stock market does have a “drag down effect” in regard to the crypto market.

“The stock market is probably a thousand times bigger than the crypto market,” the Binance CEO explained. “When that goes down, and a lot of people are losing a lot of money, many of those people who have crypto investments will want to convert those investments into cash.”

BTC’s price stability has been a meaningful metric to a lot of investors who believe that the price will jump northbound rather than going south. A report published by Kraken notes that BTC is very close time-wise toward entering a massive upward trend.

According to the report from the exchange Kraken, Bitcoin is just a 10% jump away from entering a massive upward trend. Further, the popular trader and bitcoiner on Twitter @Mrjozza recently tweeted about the subject to his 16,000 followers. On July 19, he wrote: “Bollinger band width (BBW) approaching 2-year lows. Are we gonna halve or double this time?”

Many speculators think that BTC’s price is following the same path it did in 2016. At that time in 2016, bitcoin’s price was consolidated and stable for a lengthy period of time until it skyrocketed in 2017. Some traders are talking about certain signals like Mrjozza’s BBW tweet, and they too believe something will happen soon. The ‘bitcoin hodler’ @Moon__capital tweeted about hash ribbons signals on July 11. Moon Capital tweeted:

Hash ribbons have crossed. Buy signal revealed. $288,000 bitcoin incoming.

Although, not everyone is so bullish about BTC’s future among the 5,700+ altcoins in existence. Last month, Blockchair founder, Nikita Zhavoronkov, told his Twitter followers that he believes it will be “the last time we see bitcoin’s dominance level above 66%.”

“From this point on it will fall, probably resulting in bitcoin losing its first place [market cap position] within the next [five] years,” Zhavoronkov further wrote. Zhavoronkov even discussed ETH possibly overthrowing or flipping BTC in the future.

“In order to overthrow Bitcoin, Ethereum needs to grow just 6x compared to Bitcoin,” Zhavoronkov added. “Not at all an impossible scenario (we’re in crypto, remember?). What happens if Ethereum switches to PoS, scales, and becomes #1?”

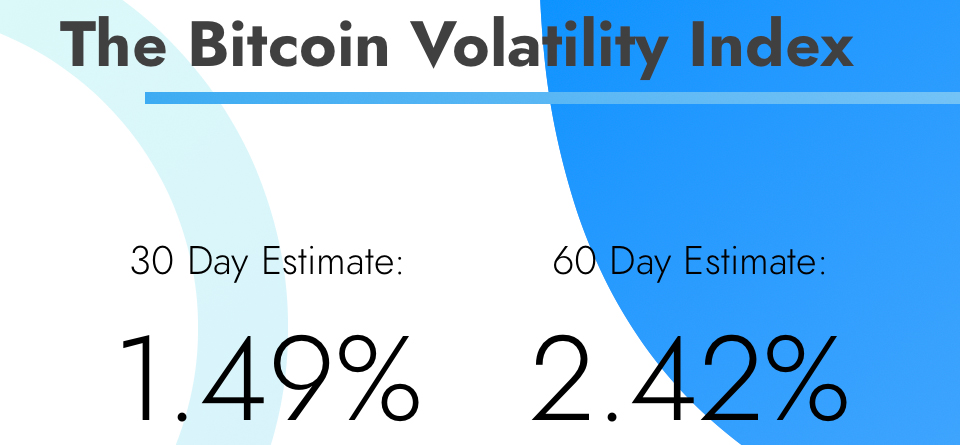

The stability discussion in regard to BTC prices and what it will do next has been a very topical conversation besides the recent Twitter hack fiasco. Some analysts believe that traders should expect a turbulent shakeup soon and they should watch for indicators like the Bitcoin Volatility Index (BVI).

Currently, the BVI 30-day estimate is hovering around 1.49% and 60-day statistics show 2.42%. On Sunday, the founding partner at Bitazu Capital, Mohit Sorout, tweeted about the ‘True Range’ indicator.

“This month is turning out to be one with the lowest True Range in BTC’s entire decade-long price history,” Sorout wrote.

The digital asset management executive at capriole.io, Charles Edwards, agrees with Moon Capital’s assessment about the hash ribbons signal and he believes bullish BTC prices are on the way.

“Bitcoin hash ribbons “buy” signal just confirmed. The post-halving signal is particularly special. It will probably be a very long time until the next occurs. …and so the great bull run begins,” Edwards said.

What do you think about BTC’s 76 consecutive day stability? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Mrjozza, Moon__capital, BVI, Twitter, Reddit,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Cryptox.trade does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.