Binance CEO Changpeng Zhao (CZ) has agreed to resign after pleading guilty to money laundering charges following a lengthy legal dispute with U.S. authorities.

As part of the settlement, Binance will pay a fine of $4.3 billion, and CZ will personally pay $50 million. This has caused significant volatility in the crypto market, resulting in a correction of altcoin prices after a strong run-up over the past month.

Despite this, the market is optimistic about a quick recovery, with some believing that this is the final shakeout to pave the way for a more legitimate, secure, and transparent industry, potentially leading to Bitcoin spot ETF approvals in January.

As a result, the current market conditions may present a profitable opportunity to purchase altcoins before the next significant surge.

Considering market trends, regulatory status, price, use cases, tokenomics, and other factors, we have compiled a list of crypto projects investors can explore:

Toncoin

Toncoin, despite the turbulent market conditions, is one of the few top 20 cryptos to remain in the green across the past hour, day, and week. This illustrates traders’ confidence, hinting it could rally once the broader market recovers.

TON is a layer-1 blockchain developed on Telegram, allowing scalable transactions. It has over 550 dApps and 800K users, with a user-friendly interface. TON is easy; users can connect it to their Telegram account, making it more convenient than other layer-1 chains.

What makes TON exciting is that Telegram has over one billion users, so TON’s seamless user experience could potentially move crypto closer to mass adoption.

The Toncoin ecosystem includes decentralized finance (defi) applications such as loans and crypto exchanges, gaming apps, gambling platforms, shopping tools, social media dApps, and much more.

Toncoin has a $8.1 billion market cap and is trading at $2.36, up 1.26% in the last day, 4.76% this week, and 11.6% this month.

Bitcoin ETF Token

According to JP Morgan, the main vocal point causing the market’s recent pump is the widely anticipated Bitcoin ETF approvals, which will likely occur in January.

Bitcoin ETF Token aims to leverage the hype around the potential approval of a spot Bitcoin ETF.

The project has garnered a lot of attention from the community, raising $1.3 million in two weeks.

Analysts are also showing support, with Crypto Boy predicting the token to rally.

The project has three main features, including a burning mechanism that destroys 5% of tokens at five Bitcoin ETF milestones, amounting to 25% of its total supply.

Additionally, a 5% burn tax is in place to encourage long-term holding and make it deflationary over time.

A Bitcoin news feed also provides users with real-time updates on Bitcoin and Bitcoin ETF developments, creating a more active and engaged community.

In addition, there is currently a staking mechanism that offers an 186% APY. This mechanism aims to create a utility demand.

In the current presale round, BTCETF is available for $0.0056.

Hedera

Hedera is a blockchain known for its scalability that has formed partnerships with major companies worldwide. This success indicates a commitment to regulatory compliance and legal stability.

Hedera’s statistics include 3-second transaction finality, 3.7 million mainnet accounts, and an average transaction cost of $0.0001.

Its partnerships include Google, LG, IBM, Ubisoft, and Deutsche Telekom, as well as a recent partnership with Taekion, a platform funded by the U.S. Department of Energy, the U.S. Department of Defense, and the National Science Foundation.

Hedera’s partnerships with U.S. government-affiliated entities make it a lower-risk project in regulatory uncertainty.

Its scalability and widespread use suggest that it could perform well in the upcoming bull market, particularly as fees on Ethereum increase and market participants seek faster and more affordable alternatives.

Hedera is trading at $0.06031, up 22% this month, with a market cap of $2 billion.

TG Casino

TG Casino is gaining attention for its use case and growing adoption.

Currently in the presale stage, the project has raised $2.8 million in seven weeks, with a recent daily raise of over $300K.

TG Casino is a Telegram-based casino that allows users to gamble anonymously and securely while still being regulated and licensed.

It also has security-focused features like a publicly known team and an audited smart contract audit.

TG Casino token (TGC) holders receive free rewards, access to exclusive games and rooms, 25% cashback on losses, and a 205% staking APY.

Additionally, the platform features a buyback mechanism to repurchase TGC tokens from the market.

Analyst Little Mustacho speculates that TG Casino can rally, even competing with Rollbit.

In the presale, TGC is available for $0.165.

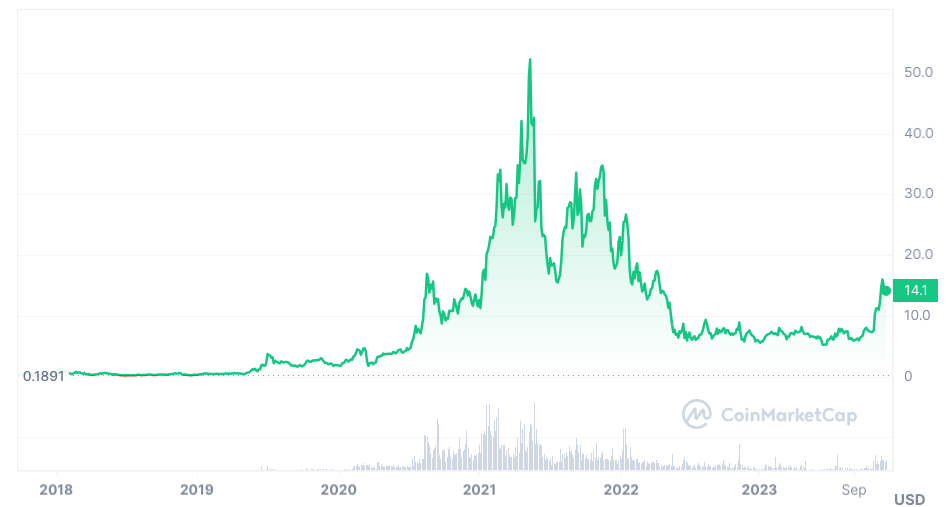

Chainlink

Chainlink (LINK) has held up well despite recent market volatility. While Bitcoin (BTC) and Ethereum (ETH) are down 2.6% and 1.3%, respectively, LINK is relatively stable, shedding 0.7%.

Chainlink is an essential component of the blockchain infrastructure as it provides off-chain data on-chain in a decentralized manner. With tokenized “real-world assets” growing in popularity, like equities and loans, the demand for Chainlink’s services is increasing.

Moreover, Chainlink has recently introduced the Cross Chain Interoperability Protocol (CCIP) that enables the seamless flow of data and liquidity between blockchains, thus addressing the fragmentation issue in the crypto industry.

CCIP fees are linked to LINK, which enhances its utility.

Chainlink is also introducing Chainlink Staking v.0.2, which creates staking-driven demand and reduces its circulating supply.

At the time of writing, LINK is trading at $14.17, up 46% this month and 134% this year. However, it remains at 73% from its all-time high.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.