When you read a Bitcoin maxi website which reads ‘move over Bitcoin, XRP is the new king’ you know XRP has made some serious waves during October.

October has been a positive month for Ripple and XRP, Brad Garlinghouse interviews, changes to OTC sales and breaking new records on the XRPL.

The XRP ledger is roughly 1,000 times faster per transaction and 1,000 times cheaper per transaction than Bitcoin. XRP is the only example of crypto and blockchain being used at scale. Period.

Brad Garlinghouse

Bitcoin took a nosedive, quickly losing around $1400 at the end of September following the launch of Bakkt, the opposite of what crypto analysts had expected.

XRP price has barely changed Ripple’s Q4 report revealed OTC sales were dramatically slowing down leaving hope for a price rise during November.

Ultimately the digital assets that will survive will be those that offer real-world utility with mainstream adoption and this month the XRPL broke a new ATH.

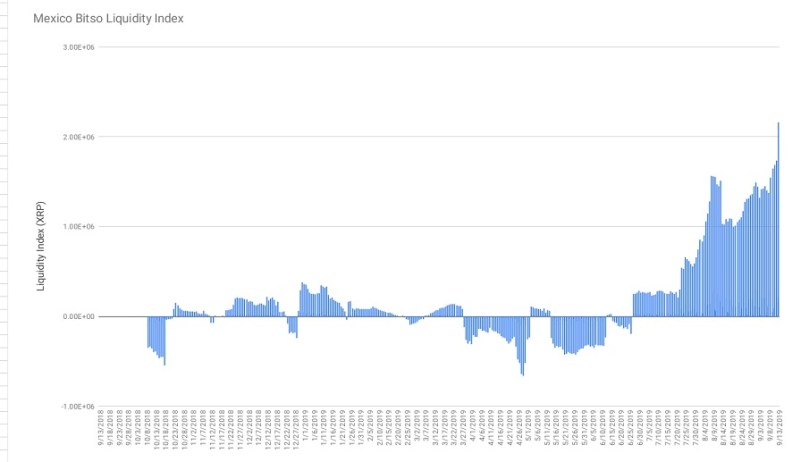

The Mexican Bitso exchange liquidity index reached a record 3 million XRP served for institutions and banks using this liquidity on demand.

As you buy, the price goes up, so the sender has to buy high. The recipient sells, pushing price down. Sender pays more, recipient gets less. So payments larger than available liquidity have high cost. High volume, smaller payments don’t have this problem

David Schwartz – Ripple CTO

Increased liquidity and utility mean XRP can think about conquering systems such as SWIFT, the higher XRP’s price the bigger payments it can target.

Since Ripples investment into Bitso where users can trade mainstream crypto, it has seen XRP usage suddenly rise to over 80% of ALL trading activity.

It is worth adding that this investment and Bitso initiative is running in co-operation with MoneyGram and this is only the beginning so we are told.

There will be many out there scratching their heads as to why XRP’s price has remained largely unaffected by the waves of amazing daily news and progress.

OTC sales of XRP have clearly kept its value unnaturally low, institutions and the wealthy want in too so the price is manipulated, in part by FUD stories.

Under Holmes’s leadership, MoneyGram plays an integral role in enabling more economic opportunity, especially to emerging markets. MoneyGram has expanded their services to Mexico and the Philippines, countries where remittance transfers are high-cost and pain points of cross-border payments are felt by consumers and financial institutions alike

Ripple Website

Momentum builds however and once it reaches the run phase XRP will grow exponentially, Brexit is looming, Christine Legarde’ takes over the ECB.

Also, Ripple’s Q3 report shows a dramatic reduction in XRP OTC sales which should help drive up value as major investors use regular exchanges for trades.

And let’s not forget SWELL where MoneyGram CEO W. Alexander Holmes is penned to discuss the impact of digital assets on the future of payments.