Last month Ripple made major changes to their website and product names, dropping xCurrent, xVia and xRapid, now RippleNet encompasses all three.

The most exciting change was the simplification of XRP into ODL or on-demand liquidity, and how it will revolutionize our world and our lives for the better.

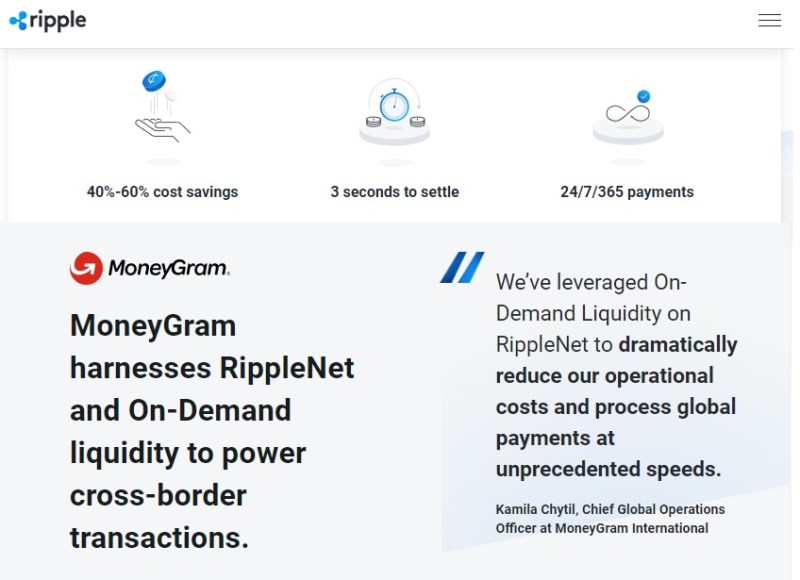

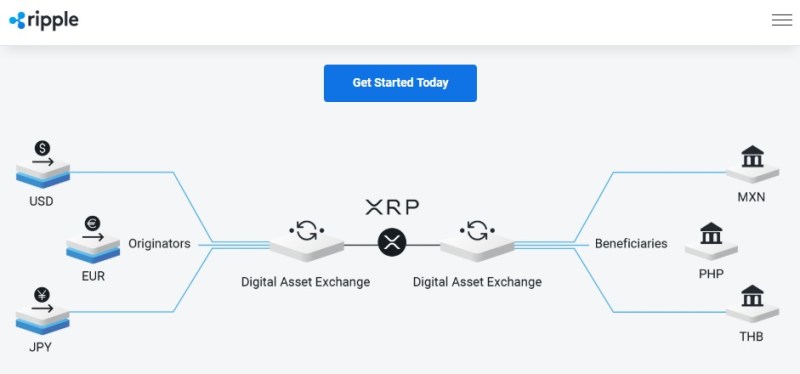

International payments, especially in emerging markets, require pre-funded accounts in destination currencies. It’s a costly endeavor that ties up resources. RippleNet provides an alternative. Any financial institution on the network enjoys reliable, instant and lower-cost transactions, those who use the digital asset XRP to source liquidity can do so in seconds—freeing up capital and guaranteeing the most competitive rates available today

Ripple Website

Liquidity on demand is vital for healthy global markets, the FED recently began printing money to fix the liquidity problems in the global economy.

If banks and financial inst. didn’t have trillions sat in Vostro accounts it could be better used for investment, job creation and hold off the coming collapse.

So let’s look at why ODL and XRP will revolutionize our lives and when you experience that light bulb moment you will see why once it starts it will not stop.

We have a few great examples for youbelow and when the population sees what a transformative technology we have here, mass adoption will accelerate rapidly.

ODL Example A

Situation – You are medium sized company, a larger company makes you a life changing contract worth millions. The catch is, the company needs this order completed within three weeks or the deal is a no go and you need half a million in raw materials. Due to a recent refurbishment all of your cash liquidity is tied up in stocks and shares, releasing this equity will take over one month.

Solution – Your company has an account at SoloGenic, your assets are tokenized even though some of them are in stock markets all over the world. You liquify some of your tokenized shares by converting into XRP which is then paid instantly to your live wallet & converted into dollars. Your company honours the contract & becomes a market leader.

ODL Example B

Situation – You are a huge international bank with tens of billions in locked-up Vostro capital but you find your liquidity has suddenly dried up. You call the FED & ask for more dollars, the FED prints you more & crisis is postponed. Then you hear all of your global partner banks are in the same boat & the FED is printing billions to try & save the economy. (This is currently happening right now)

Solution – Your have recently joined RippleNet & have released 200 billion, just like most other banks. You as well as most other banks have tokenized assets using a platform such as Finastra. You & your partner banks have just successfully prevented quantitative easing from going any further & as a result the economy is saved. Currently, the global financial markets are in freefall, the FED is printing billions every month to try & hold off the coming liquidity crisis. An estimated 10-20 Trillion Dollars is currently tied up in prefunding accounts for cross border payments…

ODL Example C

Situation – Ok its not as mind blowing as the other other two but if you’ve been there the struggle is real. You get the opportunity to buy the car of a lifetime, a Delorianfrom back to the future. You are $5k short, pay day won’t get you anywhere near & the 20k tied up in international shares must be sold when the markets open, the money must be transferred and last time it took a whole month. The car will be long gone by then.

Solution – You have luckily joined SoloGenic, your shares & stocks are fully tokenized. You trade some shares immediately then convert the $5k into XRP then transfer to your live wallet instantly and then transfer direct to the dealer. You manage to get a further price reduction for a super quick payment. You take yourself for a a nice meal & you pay in XRP to celebrate.

Make no mistake this world is already here and its adoption will accelerate exponentially and will be unstoppable, according to Fortune magazine. Read More

Don’t miss out, Fortune magazine says those who went negative on digital assets will be left behind.

This is not financial advice, do your own research and only invest what you can afford.