Before this year, crypto was a cult. In 2021, crypto became culture.

The movement was both catalyzed and led by the standard-bearer of digital art, Mike Winkelmann, known to the world as Beeple. No one in crypto had predicted that art would be what would bring crypto into the mainstream before this year, but here we are, and I am very grateful for the new energy and new entrants into our community.

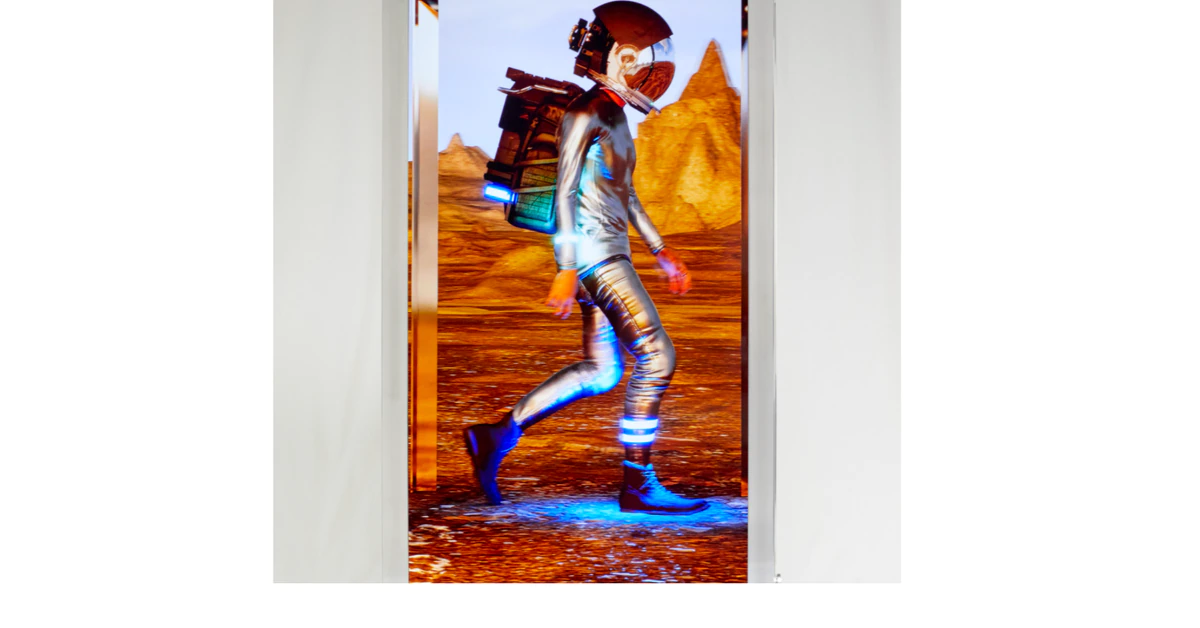

Human One, Beeple’s masterpiece digital sculpture, capped the year as perhaps the most important non-fungible token (NFT) ever minted and, according to Jehan Chu, the leading voice in the crossover between crypto and fine art, “the most important piece of art in this century, so far.”

Ryan Zurrer is founder and managing director at Dialectic AG, a bespoke invite-only crypto-wealth multi-family office. This post is part of CoinDesk’s Culture Week.

The first native of the metaverse, Human One is an important meditation on mankind’s first steps into this new virtual realm and invites deep questions about our relationship between our digital identities in relation to our real-world selves. The introspective conversation that Human One invokes is timely and poignant in our society as each individual must wrestle with this new sense of self and find a balance between these worlds we now occupy simultaneously.

During the NFT.NYC conference in New York, Human One was a pilgrimage, attracting thousands to see it. The lines outside the Christie’s showroom give us a data point of just how much Human One resonates and inspires people from all walks of life.

The physical renditions of digital art that Beeple thoughtfully builds with 3D printers, laser cutters and robotics at his futuristic campus in Charleston, South Carolina, also add a new layer to the design space between the metaverse and our physical reality. I was lucky enough to travel to Beeple’s sprawling campus where Mike (Beeple), his brother Scott and a selection of artists and aerospace engineers are innovating at a wild pace. It literally felt like taking a trip through some crazy mix of Andy Warhol’s studio and Bell Labs in their respective primes.

A living, evolving artwork

When an artist signs their work, it signifies that it is completed. While Beeple’s team has signed Human One, Mike and Scott still haven’t, signifying that their work is not yet completed. I think the world didn’t really understand that Beeple will update Human One regularly and for the rest of his career. This fundamentally changes the relationship between artist and collector, another first in the history of art. By the end of Beeple’s career, Human One will actually be many thousands of his works.

Further, we already see that Beeple is a true master of his craft, constantly evolving, innovating and improving. I made a bet here that Beeple’s future pieces will be even better than his previous work.

For the laughs

Beeple captures pop culture with the deft lens of Warhol, has the wide-sweeping range of skills of Jeff Koons and the irreverent scale of ambition of Damien Hirst, all in one. But even more amazing, he is a wonderful, humble and hilarious human being. A huge part of the value for me is that I get to have a 30+ year journey with my good friend. This investment will pay for itself in belly laughs many times over.

Metcalfe’s Law applied to NFTs

I’m frequently asked why NFTs garner such significant premiums compared to their comparable physical contemporaries. This phenomenon draws some rationale from Metcalfe’s Law, the law that a network’s value is the square of the connections in said network, but loosely applied to art.

Because there is a massive and very well-capitalized audience that can bid for any piece at any time, we have purer price discovery, which has driven prices higher. An example: If you held a special Picasso in your home, the chances that someone would walk by the artwork who has both the means and desire to make you a compelling offer is incredibly low.

Read more: Most Influential 2021: Beeple

Even if you take it to auction, there is a minuscule fraction of your potential market that will actually have awareness of the piece. With NFTs, anyone globally can deeply analyze any piece and make any offer at any time to you for your works. A result of this market dynamic is that online marketplaces such as SuperRare are significantly outperforming Sotheby’s and Christie’s this year as many artists have A/B tested how best to sell their works. Expect this difference to become more pronounced moving forward.

What to expect in 2022

I predict a series of events to take place over the next 18 months and offer a roadmap on how I intend to navigate these uncharted waters:

First, we’ll see a broadening of the use cases of NFTs. Expect music NFTs to enter the spotlight. However, intellectual property, full feature films, spatial NFTs using augmented reality and virtual reality (AR/VR) and many other forms of media and digital assets will emerge as NFTs. This is wonderful because one of my favorite outcomes of the NFT movement is how it has created a meaningful new wealth distribution in crypto. Another new cohort of creators will now have a path to financial and creative independence. Overall, the market will expand quite substantially beyond today’s primary categories of gaming, collectibles and fine art that caught fire in 2021.

However, we will also be forced into specialization. In our own collecting at my family office Dialectic, the gaming decisions are made by different professionals than the art decisions and so on. I suspect specialization will proliferate.

Second, at some point, we will inevitably have a washout and migration towards quality. Like initial coin offerings (ICOs) in 2017 and essentially all emerging industries before, 90% or more of the assets and projects that went parabolic in the hype-cycle upswing will prove nearly worthless over time. However, let’s remember that the roughly 10% that does survive goes on to be incredibly valuable and important.

In order to navigate this reckoning, my own North Star is defined by a concept I call “Proof of Art Work.” If we draw on a crypto example, one could argue that the very baseline minimum value of a proof-of-work crypto network, such as Bitcoin, is the sum of the capital expenditures and operational expenditures, i.e. the “work” that it took to bring the codebase and ledger to the present moment. At Dialectic, we look at artwork the same way, and we ask ourselves how much time, effort, collaboration, innovation, artistic merit and training went into the piece at hand. I ask myself, is it rare? Is it culturally important? Is it innovative either technically or in the story it tells and the emotions it evokes?

This selection protocol causes me to miss some of the cheekier pieces that may capture memetic tailwinds, but I am left with high-quality innovative digital art that I can quietly enjoy irrespective of market movements. That is why I lean into a historic piece such as Human One.