In an interview with Bloomberg, ARK Invest CEO and CIO Cathie Wood recently discussed why her flagship fund, Ark Innovation (ARKK), is adding to its position in shares of Coinbase (COIN) after the SEC sued Binance, one of Coinbase’s biggest competitors.

ARKK purchased nearly 330,00 shares of COIN on June 6, 2023, worth about $17 million at the time, according to disclosure statements. Two other funds, Ark Fintech Innovation ETF and Ark Next Generation Internet ETF, also bought 35,700 shares, worth $1.8 million, and 53,900 shares, worth $2.8 million, respectively.

Across all three funds, ARK’s average entry price is $272.75 – $282.93, with their total position being currently valued at $1.77 billion. At the time of writing, COIN is trading at $53.90. Needless to say, the fund is deeply in the red on this trade so far.

As far as why she’s still bullish, her reasoning boils down to this: SEC enforcement will lead Coinbase to become the only game in town when it comes to cryptocurrency exchanges in the USA. Of course, this assumes that Coinbase will triumph in its own legal battles with the SEC.

Wood explained that she sees a difference in the accusations being brought against the two exchanges. While both are facing lawsuits by the SEC over the alleged trading and staking of unregistered securities, Binance may also be facing more serious charges.

Binance CEO Changpeng Zhao, or CZ for short, was faced with a civil enforcement action filed by the US regulator for derivatives in March. The action alleged that CZ and three of the exchanges affiliates violated the Commodity Exchange Act (CEA) and several CFTC regulations.

These types of allegations “have nothing to do with Coinbase,” according to Wood. Therefore, she believes that Coinbase will survive the storm and emerge victorious, with its biggest competitor out of the picture.

It’s hard to say whether or not Wood’s conviction on COIN can be considered well-justified. While some analysts share her view, others do not. The analyst consensus on the stock is a Hold rating with an average price target of $58.49, or roughly 12% to the upside from current levels.

Several notable analysts have come forward with more bullish price targets of $70, including John Todaro and Atlantic Equities.

The RSI is perfectly neutral at a reading of 49.7, suggesting no decisive direction for COIN at this time.

It could be possible that COIN is the best and, soon-to-be only, option when it comes to US-based cryptocurrency exchanges. But this alone may or may not lead to share price appreciation.

When evaluating the future prospects of an equity, most analysts tend not to look at one factor in isolation. Basing an investment thesis on the sole premise that a company’s competitors may be doomed can lead analysts to ignore other, and perhaps even more important, factors.

Could Coinbase also face criminal charges going forward?

It’s worth repeating that Coinbase is also facing a lawsuit from the SEC regarding the trading and staking of unregistered securities. This could eventually lead to the exchange being deemed to have participated in illegal activities.

But perhaps even more concerning than SEC enforcement actions is the allegation that Coinbase may have invested in projects it planned to list on the exchange before they became available to the public.

After Coinbase CEO Brian Armstrong spoke with The Wall Street Journal on June 10, rumors have been circulating that the company may have done just that. In the interview, Armstrong gave no adequate answer to a question concerning whether or not Coinbase invests in tokens listed on the platform.

It’s no secret that almost every single time a new token gets listed on Coinbase, the price tanks.

If this was, in fact, due to an orchestrated pump-and-dump, it could constitute a financial crime of epic proportions.

The question is: does any potential evidence exist for such a serious accusation?

Well, yes and no.

Looking at Coinbase Venture’s portfolio, it does appear that as many as 30 projects that appeared in the company’s investment portfolio were also listed on the exchange. However, Coinbase Ventures claims that they do not “coordinate with review and listings teams,” and are “run and staffed separately from the main business.”

Factcheck: @brian_armstrong dodged the question on whether @Coinbase invests in tokens on the platform.

I went through Coinbase Venture’s entire portfolio, and found that these 30 projects were both part of their investment portfolio, as well as traded on @Coinbase exchange https://t.co/UCqy6kGpvK pic.twitter.com/ltPlhAh74x

— Pledditor (@Pledditor) June 10, 2023

While this does not necessarily mean that Coinbase used its exchange as a giant pump-and-dump scheme, it may point to one more thing for financial authorities to consider investigating. Needless to say, news of such an investigation would probably not bode well for the share price of COIN.

Related: SEC asks for more time to respond to Coinbase call for crypto clarity

Bitcoin to $1 million?

In her conversation with Bloomberg, Cathie Wood reiterated her view that “Bitcoin is a hedge against inflation.” Yet she also noted that she sees deflation as a substantial risk going forward. Despite this, she remains bullish on the Bitcoin price,holding firm to her 1 million USD target.

Bitcoin experienced a golden cross back in February, with the 50-day EMA moving above the 200-day EMA. Volumes have been declining, along with the Chaikin Money Flow, suggesting the potential for sideways trading for the time being.

Even in a deflationary environment, Bitcoin can still outperform due to it being “an antidote to counterparty risk in the traditional financial system,” according to Wood.

Given that 3 of the 4 largest bank failures in US history have occurred in the last 3 months, she could have a point.

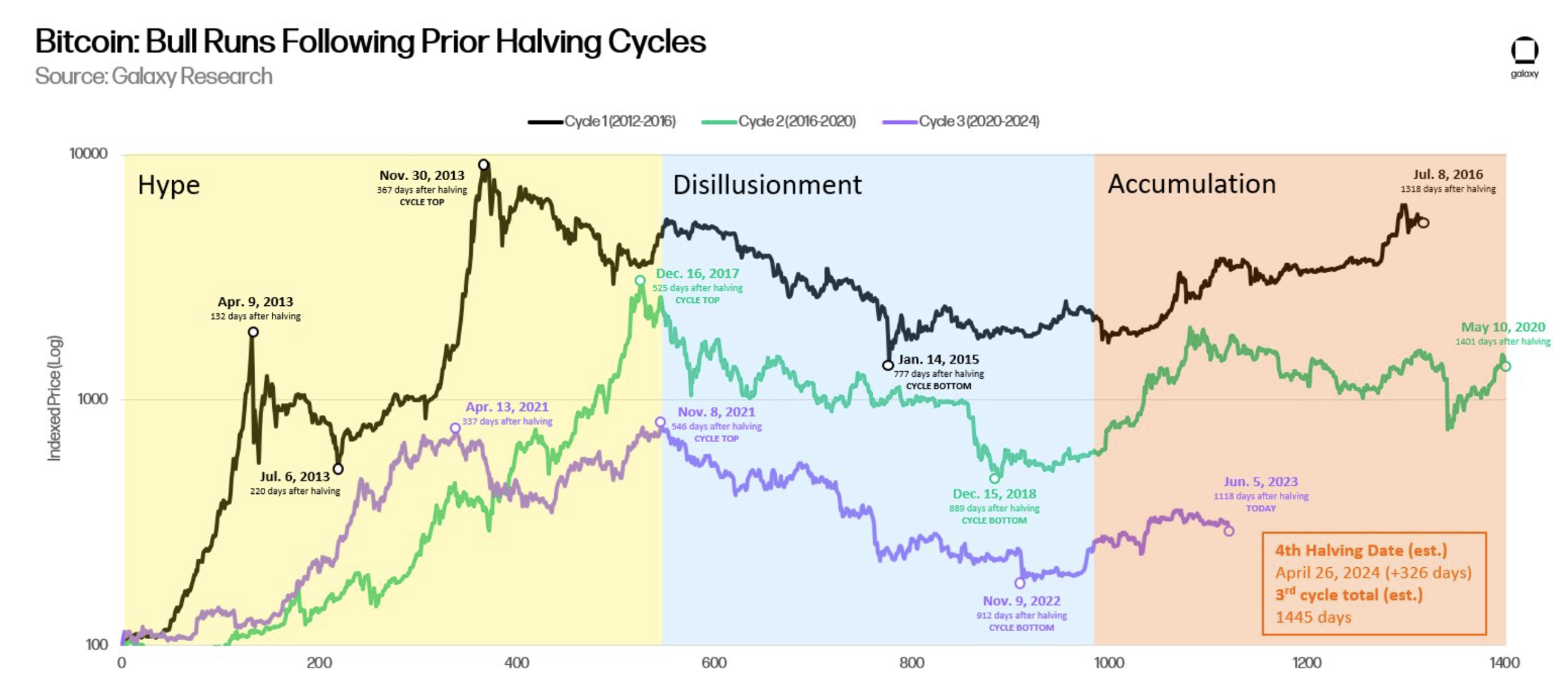

The next Bitcoin halving event is less than one year away. Investors are currently in the “accumulation” phase of the cycle, as seen in the graph below.

Will the next cycle top see Cathie Wood’s $1 million price prediction come to fruition?

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.