In a recent trend evident on crypto charts, Bitcoin dominance is once again on the rise, prompting some traders and investors to rethink their strategies concerning altcoins. An in-depth analysis of the data, coupled with insights from prominent crypto analysts, unveils several compelling reasons to exercise caution when considering an altcoin purchase at this moment.

Historical Precedence

Bitcoin’s market dominance – its market cap relative to the entire cryptocurrency market – has historically been a leading indicator of market sentiment. If Bitcoin dominance is increasing, it means that sentiment toward altcoins is waning.

In an analysis today, renowned analyst Rekt Capital has warned of this flashing signal, he shared the following chart and tweeted:

BTC Dominance has left the “retest zone”. Now in the process of entering an uptrend continuation which could see BTC Dominance revisit the 58% mark for the first time in years.

Over the past five months, the Bitcoin dominance saw a consolidation within the ‘retest zone’ after it saw a 10%+ rise since the beginning of the year. BTC dominance pulled back as part of its retest which enabled altcoins to gain some momentum for a short period of time. But, like in mid-2018, BTC is now breaking above the resistance zone, suggesting that 58% could be the next target. Notably, BTC dominance peaked above 71% during the last run in 2021.

Altcoin Liquidity Concerns

When Bitcoin’s dominance rises, it often corresponds to reduced liquidity in the altcoin market. Reduced liquidity can lead to heightened volatility, with price swings potentially wiping out significant portions of invested capital. For investors with a risk-averse profile, such conditions might not be ideal.

Moreover, recent interest appears to be concentrated primarily on Bitcoin. In times of capitulation and boredom, investors often seek the security and liquidity provided by Bitcoin over altcoins. A driving factor for this is that potential catalysts for the crypto market are Bitcoin-specific, like the halving and the potential approval of a spot ETF. As these events play out, Bitcoin will probably continue to outshine altcoins.

More Insights From Top Crypto Analysts

Joshua Lim, the former head of derivatives at Genesis Trading and former head of trading strategy at Galaxy Digital, recently weighed in on the ongoing tussle between Bitcoin and Ethereum. “ETH/BTC spot ratio is a major battleground right now,” Lim noted, adding that the rally in BTC/USD was effectively suppressing Ethereum. He highlighted a significant skew in options volume favoring Bitcoin over Ethereum, emphasizing Ethereum’s diminishing allocator interest (options volume skewed 5:1 towards BTC).

Meanwhile, Miles Deutscher, a well-regarded crypto analyst, offered a condensed perspective on the prevailing market sentiment. “We’re in the most difficult market phase… where time capitulation really starts to set in,” Deutscher remarked. He further cautioned retail participants who have been distancing themselves from the market, suggesting that this might be an inopportune moment to do so.

Deutscher added, “Accept that BTC is likely to lead in the early stages of the bull run… it’s not wise to fade BTC during this period.” He recommended a “top-down approach to the market,” emphasizing a strategy that starts with the foundational assets, Bitcoin and Ethereum, before exploring other altcoins.

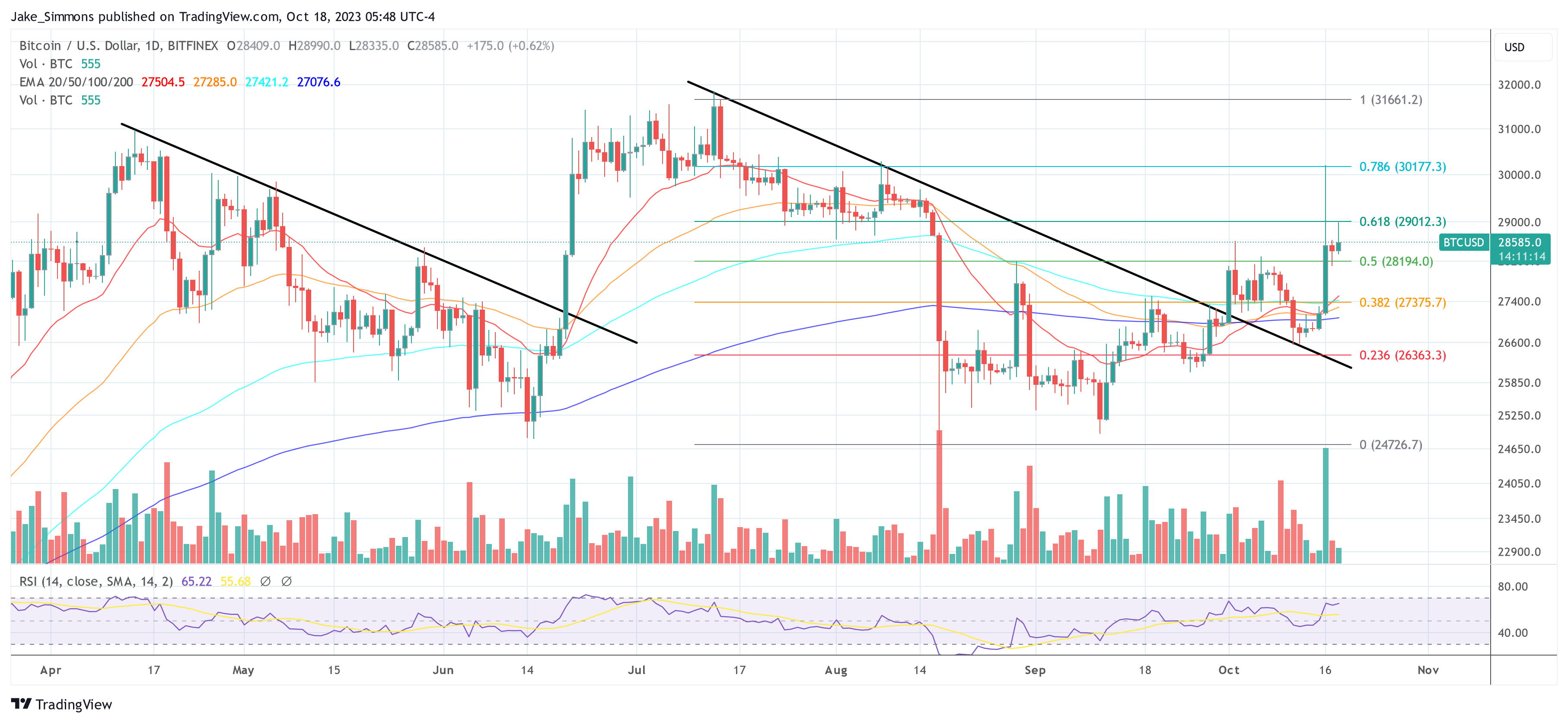

At press time, BTC traded at $28,585.

Featured image from iStock, chart from TradingView.com