In this issue

- Did Satoshi Nakamoto just cash in some BTC?

- TRON 4.0 receives cool response

- Davos org unveils ‘Blockchain Bill of Rights’

- In China: Ant Financial’s new smart contracts; state to invest billions in ‘new infrastructure’ like blockchain and IoT

- VC highlights: car-sharing in Singapore, and fintech in India

From the Editor’s Desk

Dear Reader,

Two significant developments this week in blockchain and technology reinforces one of the biggest themes we are tracking at Forkast.News: technology and geopolitics are colliding.

China has begun the arduous task of mapping out its economic roadmap amidst the ravages of Covid-19 and the turmoil of U.S.-China tensions and global decoupling. Its annual planning event for the country, a meetup of the National People’s Congress usually scheduled for March, was a couple months delayed. No matter. The path remains clearly marked when it comes to technology infrastructure, including blockchain, as a key to China’s future. Coronavirus has hit the world’s second largest economy hard. For the first time since 1976, after decades of enormous growth, China reported its economy shrunk in the first quarter of this year by 6.8%. The same devastation is occurring in every major economy in the world, so nothing special there. We are all in the same boat. What’s different, however, is the steadfastness of China’s investment in developing new information infrastructure this year — which includes blockchain, 5G and IoT. While the monetary figure is not huge (about US$84 billion), the political capital injected by China’s leadership is the real driver for technology innovation in the country.

Globally, there appears to be no formidable counterparty rising to this challenge. At a time when global organizations may have been poised to unite, plan and address, Covid-19 and the politicization of response have distracted many global organizations by forcing them to attempt to put out internal fires. So when the World Economic Forum published its Blockchain Bill of Rights last week to establish “a global baseline … (to) respect participant rights, safeguard data and protect users,” there was little fanfare. While commendable, the real power that will drive these concepts must come from unified voices of global regulators of aligned nations. The only sovereign signatory on WEF’s Blockchain Bill of Rights came from the Presidency of Colombia. And the last time blockchain or cryptocurrency was even discussed on the global leadership stage was back in June 2019, in a time before Covid-19, at the G20 summit in Osaka, Japan.

At the time, the one notable observation on Forkast.News was that nations could no longer ignore that “science fiction is becoming a fact.” It was impressive back then, that cryptocurrency discussions even made it on the agenda. Fast forward, and one must reflect on how quickly we’ve accelerated in knowledge, acceptance, and development… and how far global leaders still have to go. There is little proof that there is collective political will to go forward together. Unilaterally, at least in China, it’s become increasingly clear the nation will go at this alone. The possible bifurcation of future technology-based organizational systems between two politically-driven camps has already started.

This week’s Current Forkast notes the man-made political shadows on the horizon. The technology is being championed, but there will be a battle for control.

Until the next time,

Angie Lau,

Founder and Editor-in-Chief

1. Did Bitcoin’s creator just go to his ATM?

By the numbers: Satoshi Nakamoto — over 5,000% increase in Google search volume.

Satoshi sighting alert? Eagle-eyed BTC watchers noticed that 50 bitcoins have been transferred from a wallet that had been dormant since 2009, leading the community to speculate that the pseudonymous creator of this granddaddy of all cryptocurrency may be on the move again. Although the initial Whale Alert tweet announcing the alleged Satoshi visit to his bank reported 40 bitcoins, later media reports updated the amount to 50 bitcoins moved from the wallet, with a 40-10 split in two instances.

- The legal team representing Ira Kleiman’s estate in its lawsuit against Craig Wright, the Australian whose claims of being Satoshi has been widely mocked, is now alleging: “Wright has the ability to open the encrypted file, but won’t because it will contain evidence of the partnership and its bitcoin holdings.”

- The long-dormant address that cashed in the bitcoin, ‘17XiVVooLcdCUCMf9s4t4jTExacxwFS5uh’ is one of the addresses Wright claimed to own in a court document listing over 16,000 addresses.

- Craig Wright has since officially denied moving these 50 bitcoins.

- Meanwhile, 145 of the earliest Bitcoin addresses, which Wright claimed to own, all posted a message signed with their respective keys calling Wright a “liar and a fraud.” These 145 addresses are part of the “Tulip Trust,” wallets that hold some of the first bitcoin mined, which Wright claimed to own.

- Also dating back to the early days of Bitcoin, the community celebrated “Bitcoin Pizza Day” on May 22, to remember Laszlo Hanyecz, the Bitcoin developer who participated in the first commercial bitcoin transaction. Hanyecz bought two Papa John’s pizzas for 10,000 BTC in 2010, when bitcoin was worth less than a penny. At today’s bitcoin prices, Hanyecz paid almost $90 million USD for those two pizzas.

Forkast.Insights | What does it mean?

With the identity of Satoshi Nakamoto shrouded in secrecy since Bitcoin’s creation, super-sleuths have been trying to figure out who he/she/they really are. So far, even the most serious inquiries — including forensic analysis of Nakamoto’s writing and scouring through immigration databases — have come up empty-handed. In 2014, when the weekly magazine Newsweek relaunched, its inaugural rebirth issue contained an expose that claimed to reveal who Nakamoto really was. But the report was based on flimsy research and was quickly debunked, tarnishing the magazine’s image.

In this absence of any plausible explanation of whom Nakamoto might be, attention seekers and bad actors have filled this vacuum. To keep himself in the headlines, John McAfee on an almost yearly basis teases that he knows the true identity of Nakamoto but chooses not to share the great reveal. Australian computer scientist Craig Wright, a career fabulist who has embellished prior details about his academic and professional achievements, enjoys trying to fool whomever will listen about his part in the creation of bitcoin. Wired Magazine published a long writeup on Wright’s role in the cryptocurrency’s creation, but it was also quickly debunked. In what surely gave satisfaction to the many who are tired of Wright’s schemes and claims, in 2019 a U.S. judge slammed him for committing perjury and for failing to produce any credible evidence to back up his many claims.

As tantalizing as it would be to know the true identity of Satoshi, the fact is, after all this time and the many failed attempts to find him, we’ll probably never really know who he/she/they really are. There will be clues, like this transfer of crypto, and “false prophets” like Wright, but sometimes having a mythology instead of the man is OK too. The technology was given to the world. It wasn’t patented or claimed by one person. Satoshi Nakamoto clearly doesn’t want to be found, and that’s something we will just have to accept.

2. TRON 4.0 gets tepid welcome

By the numbers: TRON 4.0 — 1,900% increase in Google search volume.

TRON CEO Justin Sun has announced the coming of TRON 4.0. Head of protocol Marcus Zhao teased that the upgrade would include privacy features supported by TRON Virtual Machine (TVM), 2-level consensus mechanisms, cross-chain, and enterprise edition. Sun’s “keywords” for TRON 4.0 are: privacy, blockchain interoperability, high scalability and enterprise applications.

- The controversial TRON CEO also made it into a personal challenge by directly tagging Vitalik Buterin on his social media posts.

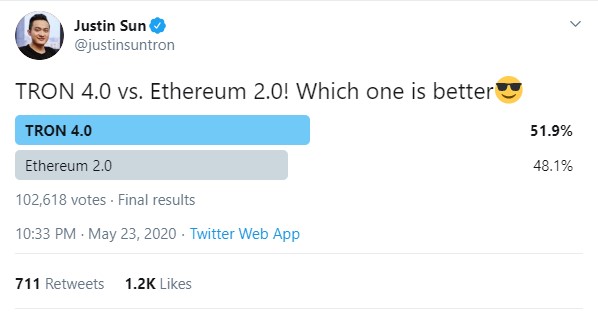

- Unfortunately for Sun, a Twitter poll that he also posted did not go well initially. The poll kicked off with over 70% of the first 20,000 votes believing that Ethereum 2.0 — which has not yet been released — is still “better.” The end poll results showed TRON making a miraculous comeback, eking out a victory over Ethereum with 52% of votes cast. The community however, questioned the legitimacy of the last-minute pro-TRON rally and alleged that paid bots had stuffed the Twitter ballot box.

Forkast.Insights | What does it mean?

For all of TRON’s potential, there seem to be more missteps than bona-fide advancements for the company. Questionable acquisitions and a lack of coherent communication strategy means the company is fighting multiple fires at the same time.

The acquisition of BitTorrent in 2018 left many scratching their heads. But only later did this acquisition make sense when TRON announced that it intended to use the underlying technology to create the BitTorrent File System, a logical melding of the highly efficient file transfer protocol with the trend of blockchain-based distributed storage systems. STEEM might have been another success story with HIVE, but poor communication with stakeholders fostered a rebellion and exodus, leaving the platform without a user base to create value.

Technically speaking, TRON, which began as a fork of Ethereum, now has a platform that rivals if not surpasses it: TRON is able to process 2,000 transactions per second compared to Ethereum’s 20, thanks to its use of ”delegated proof-of-stake” consensus algorithm. It also has more dApps than Ethereum and a higher volume of dApp transactions. But that’s only one way of looking at it. With a different set of metrics, TRON looks much shakier. Trade volume data from aggregator Messari shows that the 24-hour trade volume of TRON comes in at around $39 million, whereas Ethereum’s is $394 million. Over on GitHub, Ethereum has around 2,000 GitHub watchers and roughly 445 developers contributing to the ETH codebase. TRON has about 309 GitHub watchers and 118 developers.

TRON certainly has its fans and followers, but Ethereum is in no danger of being usurped as a blockchain. That’s not to say that TRON doesn’t have potential. It’s still a very interesting technology with a solid set of goals. But one has to wonder whether with a different circumstances, without the megalomania of Sun distracting from the project’s merits and fundamentals, the ratio of missteps to advancements might be a bit different.

3. Blockchain Bill of Rights

By the numbers: Blockchain Bill of Rights — 100% increase in Google search volume.

The World Economic Forum (WEF), the organization behind the annual global powerfest in Davos, has published the Blockchain Bill of Rights. The value statement has been signed by 15 entities and counting, including Deloitte, ConsenSys, Andreessen Horowitz and the country of Colombia.

- The “Presidio Principles” sets forth 16 user rights to provide a global baseline. The principles include:

- Transparency and accessibility: the right to information about the system

- Agency and interoperability: the right for participants to own and manage their data

- Privacy and security: the right to data protection

- Accountability and governance: the right for participants to understand available recourse

- Following the WEF’s 2019 Global Blockchain Council, the Blockchain Bill of rights was a year in the making, including a public comment period on GitHub to obtain opinions from developers.

Forkast.Insights | What does it mean?

Where was the ‘Blockchain Bill of Rights’ in the Web 2.0 era?

Tying companies that made their fortune on the commodification of user data to these principals would have done a lot to make them self-regulate before they got carried away and governments had to step in. As the old saying goes, “if you’re not paying for it, you’re the product.” Facebook and Google’s tracking of users across and outside their platforms is how they make money. But getting carried away with the granularity of the tracking is how scandals like Cambridge Analytica can happen (though we have to be clear if the firm is really acting outside the end-user licence agreement of Facebook).

But the business model of many blockchain companies and their dApps does not revolve around monetizing the user. There isn’t the ethical question of privacy versus profitability when data is being monetized; the business model is something else entirely. It’s not to say that these principals aren’t important or shouldn’t be thought of in the development process, it’s just that the same sense of urgency isn’t there.

While the “Blockchain Bill of Rights” might not outlive a few news cycles, the underlying principles are important. Let’s hope that they are respected, and not just within the blockchain space but beyond.

4. In China: Ant Financial smart contracts; state pours billions into blockchain, IoT and other ‘new infrastructure’

Ant Financial’s blockchain technology team announced a blockchain contract service opening for small and medium-sized enterprises on its official WeChat account. The post was read 6,844 times within a day and prompted coverage in 68 Chinese news media outlets.

- The Ant Blockchain Contract has blockchain technology’s core characteristics — it cannot be changed once the contract is signed. In conjunction with China’s leading eSignature platform, esign (e签宝) which also uses blockchain identity authentication technology, Ant Financial’s contract service aims to prevent the use of fake signatures or company chops to defraud others.

- At present, Ant blockchain contract has been applied in human resources, procurement, leasing and financial contracts of small and medium-size enterprises (SME).

- Alibaba Group announced that they will use Ant Blockchain Contract for future cooperation and contract signing.

Forkast.Insights | What does it mean?

Smart contracts have been lauded as a tool to improve the efficiency of commerce by automatically fulfilling a contract once certain terms are met, reducing delays and the need for human intervention. An obvious use case is escrow, as the title of an item or property could be transferred as soon as the payment is received. There is no need for someone to do the transfer manually, and there is no space for bad actors to interfere in the process.

Despite this potential, smart contracts have not yet been deployed in a serious way. There just hasn’t been enough business interest to make their inclusion into the software stack a reality.

This may change with Ant Financial’s initiative. By integrating smart contracts directly into an e-signing platform, this substantially reduces transactional friction and encourages implementation. For instance, a subcontractor that is hired to do development work would have their contract recorded directly to the blockchain via this smart contract, and subsequently could be paid immediately once code to a satisfactory level has been received. No waiting around for the accounts receivable and accounts payable team to process the invoice.

Given the scale of Ant Financial and its parent Alibaba, this is an excellent proof-of-concept pilot to demonstrate the technology’s efficiency. If successful, it will likely encourage adoption elsewhere.

“New infrastructure,” including blockchain, was mentioned in this year’s Annual Report on the Work of Government for the first time, implying that the central government will keep it as the key program in China’s future planning. On May 22, when the report was introduced, Chinese media published over 3,000 stories on this topic.

- Premier Li Keqiang shared this year’s Report on the Work of Government in the plenary session of the National People’s Congress. The report shows that the Chinese government plans to invest 600 billion yuan, or about $84 billion USD, in developing new infrastructure and new information infrastructure this year. Also, the central government will issue 3.75 trillion yuan, or $526 billion USD, in special bonds to local governments, an increase of 1.6 trillion yuan over the last year, to build new infrastructure and new information infrastructure.

- New Infrastructure, according to the Chinese government, contains three sub-categories: (1) information infrastructure — including blockchain, 5G and the internet of things (IoT), (2) integrated infrastructure — including emerging technology like AI or big data — that improves or transforms traditional infrastructure, and (3) innovation infrastructure, which is aimed at supporting scientific research and development of technology and products that benefit the public.

- Many Chinese media commentators as well as academics regarded this action as a signal that new infrastructure is the focus of China’s future planning. As Zhiguo He, Fuji Bank and Heller professor of finance at the University of Chicago Booth School of Business recently wrote in Forkast.News: “as a part of the “new infrastructure” stimulus program launching soon in response to the Covid-19 pandemic, blockchain technology can support multi-party business activities or international collaborations (e.g., supply chain finance, global trade) to buffer against pandemic shocks like Covid-19 and trust rifts exacerbated by ideological differences.”

Forkast.Insights | What does it mean?

As China’s economy slows, the necessity for wide-ranging economic stimulus grows. At the same time, one of China’s national priorities is to reduce its dependence on foreign technology, which means that a sizable portion of the stimulus funds will be earmarked for technology development.

But with this comes the potential for a galvanized world of technology. Huawei’s technical proficiency in 5G, and the hostility of the U.S. and other western nations to implementing the company’s technology in their telecommunications systems would likely mean the existence of a bifurcated, forked 5G divided on lines of allegiance.

China’s investment into blockchain technology, symbolized by the launch of the Blockchain Service Network means that China will have a seat at the table — perhaps even the head of the table — when it comes time to write the international standards for the next generation of blockchain technology. As Forkast.News has reported before, the scale of the BSN is also going to put China ahead of the curve for forcing standards on the world. While the International Organization for Standardization (ISO) is headquartered in Geneva, the “ISO of blockchain” might be in Guangzhou. Will this result in the same level of galvanization? Or will other nations come to respect China’s leadership in this field?

China’s blockchain infrastructure will indeed support international collaboration and assist in bridging the gulfs of trust. But all of this will be on China’s terms. China’s lack of liberalization in its capital market means that the USD’s hegemony is in no risk of disruption. However, the U.S. hegemony in rulemaking and standards-setting within the region could be eroded if the technology infrastructure push by China results in standards and platforms that are widely adopted.

5. VC highlights in Singapore and India

ShuttleOne — Seed, $500,000 USD, Singapore

Fintech firm ShuttleOne announced the closing of a $500,000 round led by Singaporean firm Sirius Venture Capital. German management consulting firm Andromeda also participated in the round, a first for the company. ShuttleOne is developing a blockchain-based technology layer that works with merchants to simplify the card/electronic payment process, while also providing credit line and remittance services. The company was founded in 2018 by a team of Singaporean entrepreneurs with experience at bulge-bracket banks, academia and online media.

MVL Chain — Series A, $2.8 million USD, Singapore

Blockchain-focused transportation firm MVL Chain announced that it had closed a $2.8 million round led by South Korea’s Shinhan Bank. This brings the firm’s total capital raised to $10 million. The company proposes to license and tokenize data from different parts of the mobility industry, namely car sharing, ride hailing, and taxis, in order to find efficiencies in the market. Data and customer records will be stored on the blockchain for safekeeping and preservation. Participants will be rewarded for good behavior — such as safe driving and regular vehicle maintenance — as well as driving in ways that would not strain the road infrastructure (i.e., avoiding rush hour, or taking alternative routes). The company counts Korean ride-hailing service Tada as a reference customer. In a press release, MVL stated that the funds would go toward expanding the brand’s “mobility ecosystem” and allow the company to internally focus upon finance and tech development.

Authlink — Seed, $300,000 USD, India

Indian fintech firm Authlink announced that it had closed a $300,000 funding round from Bharath Corp House, a recently opened tech VC firm, making this the firm’s inaugural investment. Authlink states that the round will assist the 2019 startup’s outreach and research development. The company operates a proprietary, asset-agnostic blockchain network, focusing on supply chain and retail product management, promising safer management of electronic payments. Authlink also plans to expand into the cybersecurity sector in the near future, prioritizing the transfer of high-end luxury goods, automobiles and educational certificates.

Forkast.Insights | What does it mean?

There are two major themes in this week’s closed funding rounds: finding efficiencies, and preserving records. ShuttleOne is looking to find efficiencies in the payment processing industry by cutting down the middlemen (and there are many) between a merchant and the customer’s money. Authlink and MVL Chain (amongst other things) are trying to build a better records system for supply chain and product management, and mobility and transportation. These are two very different industries that require very different processes, but there is potential for value creation by improving the recording process. These funding rounds demonstrate how blockchain can help corporations provide better services, not just newer ones.