- Walmart’s surprise bid for TikTok coincided with Facebook unveiling the Shops feature on its main app.

- The big-box retailer’s experience in China, where social commerce is more advanced, gives it an edge.

- Walmart’s online ad business stands to benefit, too.

Just days after Facebook (NASDAQ:FB) doubled down on its social commerce ambitions by launching a shopping tab on its main app, Walmart (NYSE:WMT) surprised everyone by partnering with Microsoft (NASDAQ:MSFT) to bid for TikTok.

On the surface, Walmart’s interest in TikTok may seem insane. It is a highly strategic decision and not a random misplaced one, though. To keep growing its e-commerce business, the big-box retailer needs social media channels, and the short-form video app caters to that need.

Unlike with messaging and social networking, social commerce is in relative infancy, and Facebook hasn’t quite sewed up the niche yet. Facebook’s path to achieving its ambitions in this niche becomes more complicated if Walmart and Microsoft’s bid for TikTok is successful.

Why Walmart Wants TikTok

The number of internet users who have bought a product directly via social media platforms has been growing double digits in the last few quarters. Between the fourth quarter of 2018 and the third quarter of 2019, this number rose from 13% to 21%, according to eMarketer.

It is estimated that this category of buyers spends, on average, $300 per year via social media channels.

Social commerce, though, is tiny relative to all online sales. Last year on Cyber Monday, just 2.6% of the $9.2 billion spent online came via social media channels. There’s lots of room for growth, and Walmart wants in on the opportunity early.

China Shows the Way

To get an idea of where social commerce is headed to in the U.S., China offers a good example.

In the world’s second-largest economy, social commerce was worth $186 billion in 2019. It is expected to grow by 30% in 2020 to hit $242 billion.

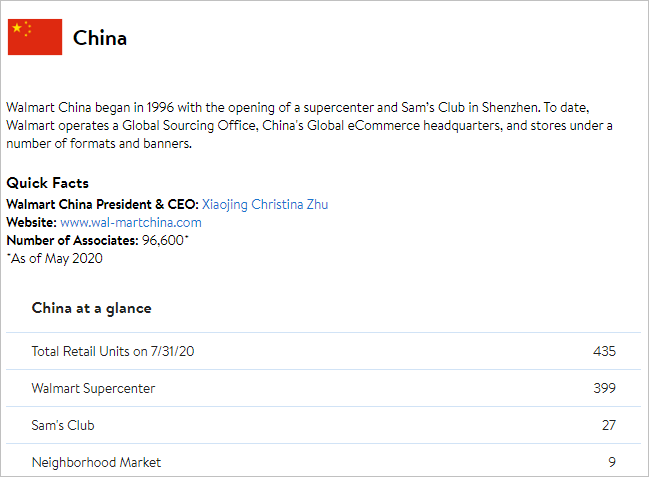

Perhaps because of Walmart’s well-established presence in China, the big-box retailer can see where the niche is headed more clearly than other retailers. After setting up shop nearly three decades ago, Walmart today boasts of 435 retail units and nearly 100,000 employees in China.

Walmart’s Online Advertising Business

In addition to boosting the marketing efforts of its direct sales and third-party marketplace, owning TikTok would aid the retailer’s advertising business, also known as Walmart Media Group.

Walmart’s in-house advertising arm lets consumer goods companies buy ads “onsite on Walmart’s digital properties or offsite across the web and social channels.”

By acquiring TikTok in partnership with Microsoft, Walmart would have one more digital property on which to serve ads, thereby boosting ad revenues. Currently, Walmart generates less than 1% of its revenues from ads in its brick-and-mortar stores and digital properties.

Walmart’s website draws in approximately 160 million visitors per week. In the U.S., TikTok is estimated to have over 80 million users. Roughly 90% of TikTok users access the video app daily, thereby offering a potentially bigger audience than what Walmart currently enjoys.

Additionally, Walmart wants data on consumers, an invaluable resource in today’s world for any consumer-facing business.

Make Walmart Cool

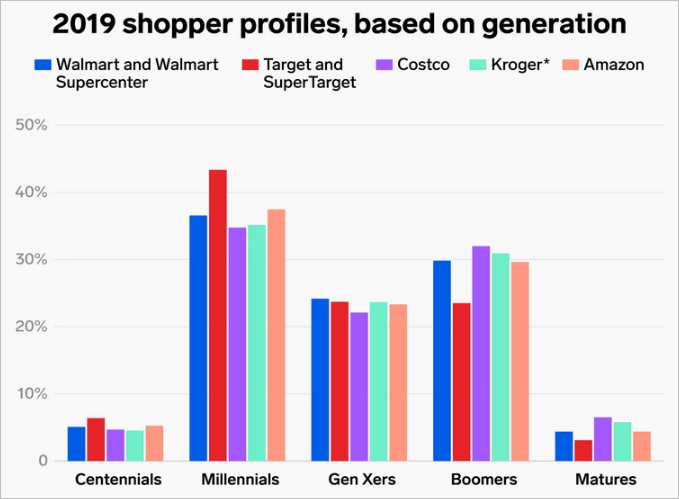

The average shopper at a Walmart store is a 46-year-old white woman. Compared to Target (NYSE:TGT) and Amazon (NASDAQ:AMZN), Walmart is behind in attracting millennials and Generation Z.

About 43% of Target’s shoppers, for instance, were millennials compared to around 35% for Walmart.

As its average shopper continues to age, Walmart needs a younger demographic to balance out.

To attract a younger demographic, the retailer will, of course, have to be where youth spend their time. Owning TikTok is a no-brainer in that regard.

Retailer Throws Facebook a Curveball

If Facebook thought it had the social commerce niche all carved up for itself, Walmart’s ambitions of buying TikTok proves the field is wide open.

For Facebook, it would be worse if Walmart eventually succeeds as this could whet its appetite for other social media properties. Combined with Microsoft’s technological expertise, that would constitute serious competition for Facebook.

As a company that is trying to pivot to e-commerce and payments as an additional revenue stream, Facebook’s social commerce ambitions are unlikely to go as smoothly as it would have wanted.

Disclaimer: The opinions expressed in this article do not necessarily reflect the views of CCN.com and should not be considered investment or trading advice from CCN.com. The author holds no investment position in the above-mentioned securities.