Key Notes

- VALR becomes Africa’s first exchange to offer tokenized US stocks including Tesla, NVIDIA, and Coinbase through xStocks platform.

- The tokens provide 1:1 price exposure to real equities without ownership rights, tradeable against major cryptocurrencies and rand.

- CEO emphasizes breaking financial barriers for previously excluded African users seeking global investment opportunities.

Africa’s largest crypto exchange by trade volume, VALR, has launched xStocks, a tokenized equities product allowing African users to gain exposure to US-listed companies. This landmark move makes VALR the first platform on the continent to integrate tokenized equities into its crypto trading suite.

The xStocks tokens, powered by Backed and launched in May 2025, mirror the prices of prominent US stocks and ETFs like Tesla, NVIDIA, Robinhood, Circle, and Coinbase, without granting ownership or voting rights. These tokens are 1:1-backed representations of real equities and can be traded on VALR’s Spot market against USDT, Bitcoin, Ethereum, and the South African rand.

xStocks <> VALR

We’re excited to welcome @VALRdotcom to the xStocks Alliance, expanding our footprint with our first African exchange, available now to South African users, and soon the entire continent.

This is what investing looks like when it’s designed for everyone. pic.twitter.com/2ulSLenZmn

— xStocks (@xStocksFi) July 31, 2025

xStocks also supports Solana-based deposits and withdrawals, ensuring high-speed, low-fee transactions. This aligns with a growing global trend in tokenizing real-world assets (RWAs), following in the footsteps of platforms like Robinhood and Solana-native decentralized exchange Jupiter, which both initially listed US stocks in early July.

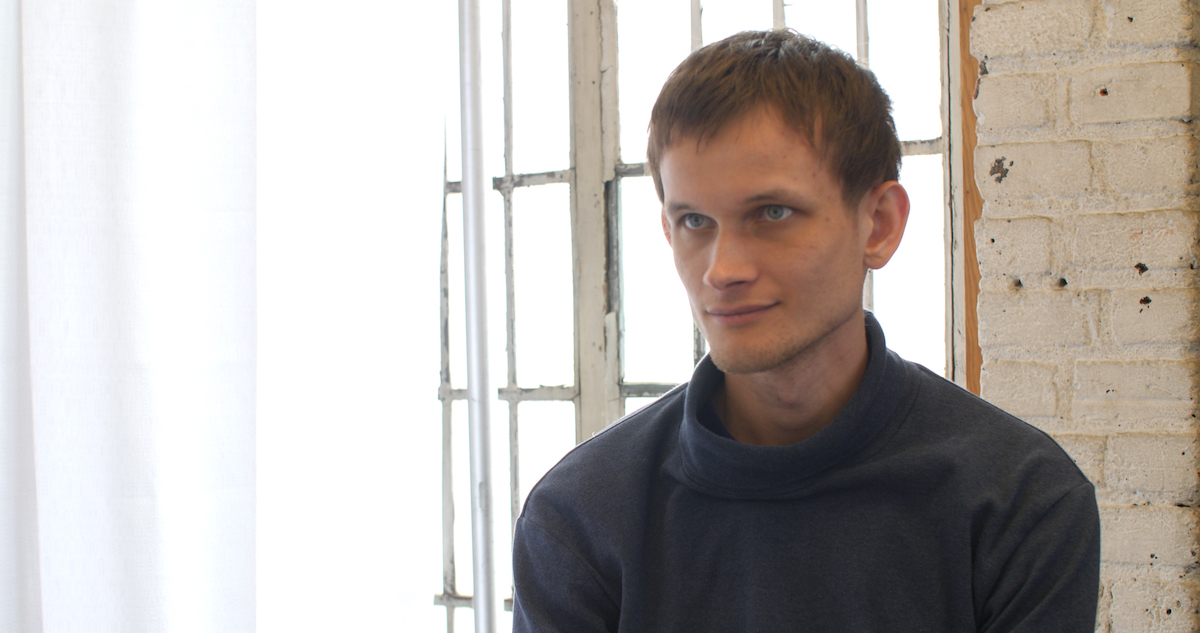

VALR CEO Emphasizes Financial Inclusion Goals

VALR CEO Farzam Ehsani highlighted the importance of xStocks in unlocking access to global financial assets for users previously excluded from such markets.

“The launch of xStocks on our platform represents a pivotal moment in advancing access to innovative products that brings choice and inclusion to people in South Africa, with a plan to make the product available to the continent and globally in the near future. By blending crypto and traditional finance, we are forging a financial system that brings down barriers and serves many more with unprecedented ease,” Ehsani said.

David Henderson, Head of Growth at Backed, also echoed this sentiment, stating: “We’re excited to have xStocks on VALR, marking another step in the xStocks mission to bring tokenised equities to users worldwide, […] We have seen incredible adoption for these assets, and now users from Africa will be able to access them on VALR, participating in tokenised capital markets.”

This development follows VALR’s July rollout of the USDPC token, a yield-bearing private credit asset, emphasizing the exchange’s portfolio diversification strategy.

Founded in 2018, VALR now serves over 1.5 million users and 1,400 institutional clients globally, with over $55 million in equity funding from backers like Pantera Capital and Coinbase Ventures.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Ibrahim Ajibade is a seasoned research analyst with a background in supporting various Web3 startups and financial organizations. He earned his undergraduate degree in Economics and is currently studying for a Master’s in Blockchain and Distributed Ledger Technologies at the University of Malta.