- Yale University’s Stephen Roach has predicted the U.S. dollar’s demise in 2021.

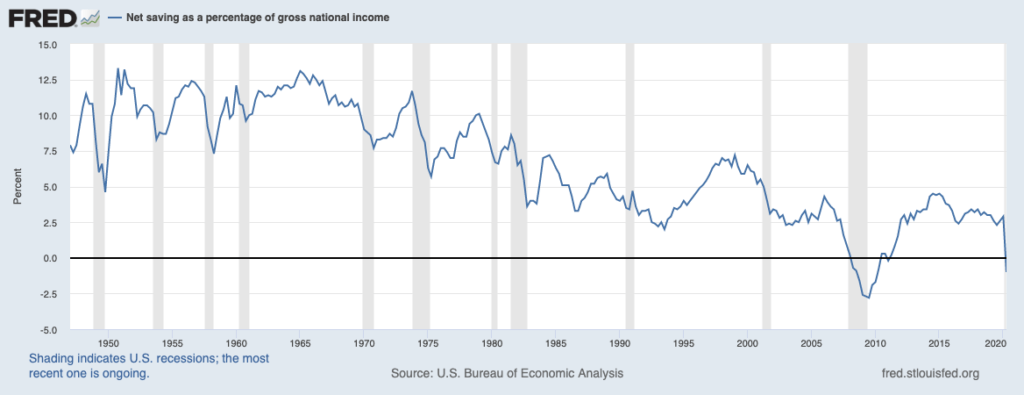

- Roach points to the growing current account deficit and the declining net-national savings rate as the two main factors pushing the dollar down.

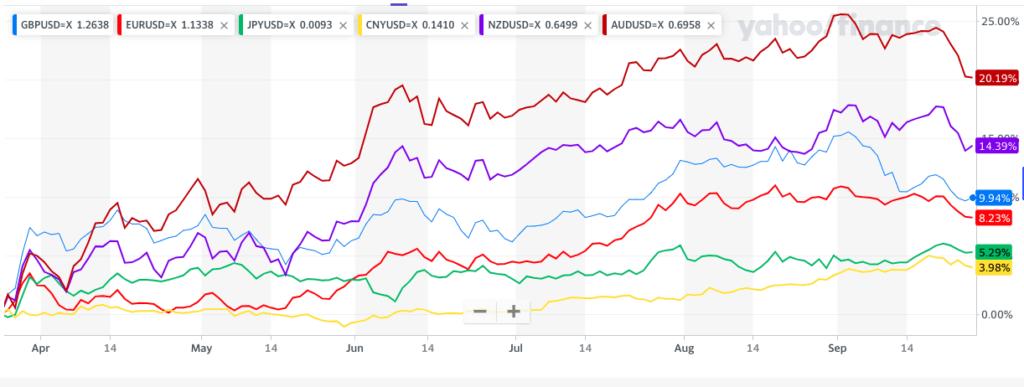

- The dollar has declined against most major currencies over the past six months. Other analysts are also predicting a sharp loss of value.

The U.S. dollar will crash in value by the end of 2021, according to senior Yale University economist Stephen Roach. He also said the probability of a double-dip recession is now over 50%.

Roach echoed similar warnings in June, describing a 35% crash as “virtually inevitable.” But now he sees the indicators of collapse–the U.S. current-account deficit and a decline in savings–as much worse than before.

His dire warnings have become increasingly credible over the past few months. The dollar has weakened repeatedly against G10 currencies; other analysts and currency forecasters have also predicted its downfall.

Stephen Roach: U.S. Dollar Will Crash

Things are going from bad to worse for the already weakened U.S. dollar. Speaking to CNBC, Yale University senior fellow Roach said the following:

We’ve got data that’s confirmed both the saving and current account dynamic in a much more dramatic fashion than even I was looking for.

Roach argues that both of these factors will push the dollar much lower:

The current account deficit in the United States … suffered a record deterioration in the second quarter. The so-called net-national savings rate, which is the sum of savings of individuals, businesses and the government sector, also recorded a record decline in the second quarter.

He noted that the savings rate has entered negative territory for the first time since the global financial crisis. This means there’s a glut of spending, with the excess supply of dollars raising the risk of inflation.

Roach thinks a crash is inevitable, given the “laws” of economics:

Lacking in saving and wanting to grow, we run these current account deficits to borrow surplus saving, and that always pushes the currencies lower. The dollar is not immune to that time honored adjustment.

Signs of Weakening

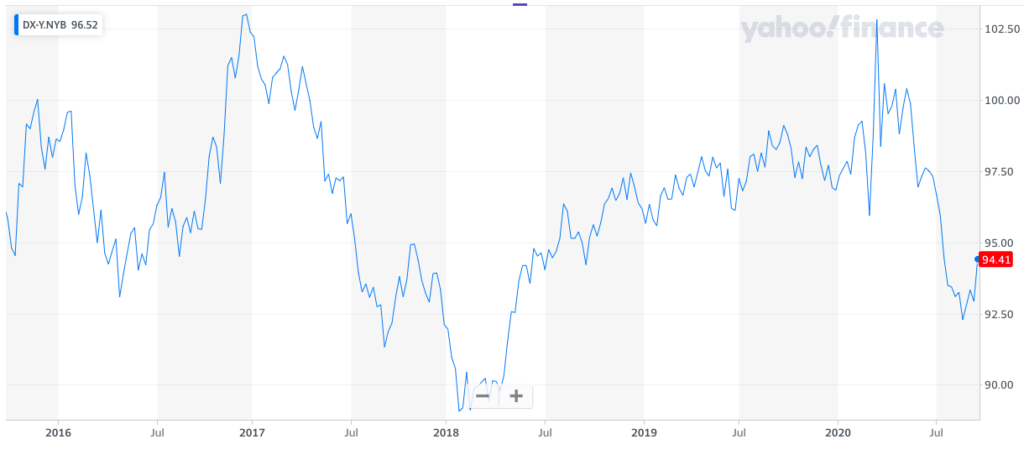

Roach’s forecast is becoming more credible by the day. The U.S. Dollar Index–which tracks the value of the dollar against a basket of currencies–has declined from $102.82 on March 16 to $94.60 today.

The dollar has also declined against G10 currencies over the past few months. The Australian dollar and New Zealand dollar are up 20% and 14%, respectively, against the greenback over the past six months. The pound is 10% up, while the euro is 8% higher.

Other analysts besides Roach are also predicting a U.S. dollar crash. As early as April, UBS predicted a steep decline in H2 2020. Its head of Asia-Pacific equities, Hartmut Issel, said at the time, “the dollar does not have too much to offer anymore.”

A Reuters poll of currency forecasters published in July saw the euro rising against the dollar into 2021. NAB Group’s Gavin Friend told Reuters:

The dollar rises in two instances: when you see risk off or when there is a situation where the U.S. is leading the global recovery, and we don’t think that’s going to be the case anytime soon.

Things look very bad for the dollar. And the longer the coronavirus pandemic continues, the likelier it will be that its status as the world’s reserve currency will be tarnished.

Disclaimer: The opinions expressed in this article do not necessarily reflect the views of CCN.com and should not be considered investment or trading advice from CCN.com.

Sam Bourgi edited this article for CCN.com. If you see a breach of our Code of Ethics or find a factual, spelling, or grammar error, please contact us.