For years, my organization, the Cato Institute has supported the idea of a price-based visa category. A sort of “gold card” in which an immigrant pays a fee in exchange for a visa that allows the immigrant to live and work legally in the United States “would create a dynamic, market-based, merit-based, relatively more economically efficient, and self-regulating system that would serve the ever-changing American economy,” wrote my colleague Alex Nowrasteh in 2019.

However, President Donald Trump’s attempts to establish his own gold card program are likely to prove fruitless.

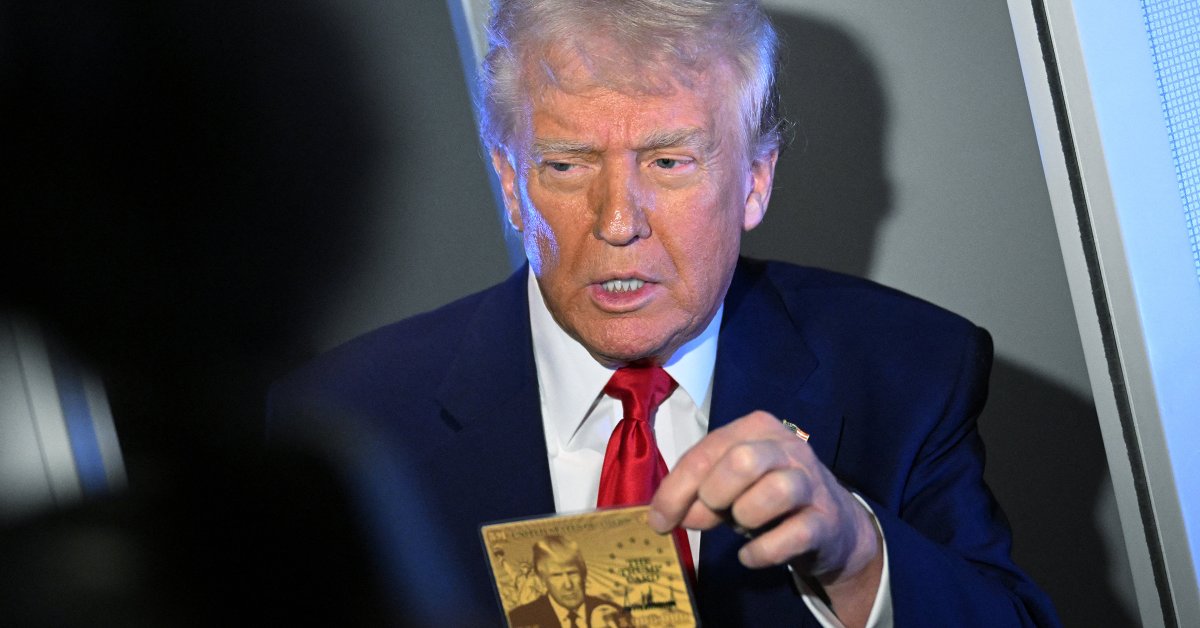

On April 4, President Trump revealed his eponymous “Trump Gold Card” for the first time, which he plans to sell to immigrants for $5 million in exchange for U.S. legal permanent residence starting soon. Although Trump held up a real card, that might be as close to reality as his proposal will ever get. Selling legal residence to immigrants has merit, but Trump’s idea won’t get any takers.

President Trump has stated that he can start issuing gold cards in the coming weeks and is not asking for Congress to act. But for a gold card to become a reality, it must overcome two main obstacles.

First, the President lacks the authority to grant gold card purchasers lawful permanent resident status in the United States. The Immigration and Nationality Act lists precisely which legal immigrants can obtain the coveted “green card,” which denotes permanent resident status.

Whether anyone would have standing to sue to stop the issuance of the Trump Gold Card is a more complicated question. (Who could plausibly claim to be harmed by foreign millionaire immigration?) Regardless, the lack of legal authority feeds into the second major problem: the lack of immigrant demand for a $5 million green card.

Although Commerce Secretary Howard Lutnick asserts that 37 million people worldwide could afford the Gold Card—and Trump thinks he can sell 1 million cards—only about 1.5 million non-Americans have net assets (excluding their primary residence) of $5 million or more.

Numerous economists believe that convincing this group to relocate to the United States would do a lot of good for the country. But these high net worth individuals aren’t going to simply gift their entire fortunes to the United States for the chance to live here. If they are finding financial success where they currently live, they likely have little motivation to move. Indeed, Congress has provided a strong disincentive: U.S. tax law.

Read More on Trump’s 100 Days and Immigration: How America Became Afraid of the Other by Viet Thanh Nguyẽn

Many people with high incomes abroad will not want to move to the United States because that would open their income abroad to U.S. taxation. Trump understands this, so he is proposing to tax gold card holders only on income generated from sources within the United States. But once again, setting aside the issue of how anyone would stop the plan, the President cannot change U.S. tax law without an act of Congress.

If the lack of legal authority for the idea alone is not enough to dissuade potential Trump Gold Card customers—and it should be—there are better existing legal options for this group even if they were willing to move. High-net-worth individuals can easily obtain visas to visit the United States for up to six months at a time while maintaining a residence elsewhere.

If wealthy individuals really want permanent residence here, they have several much easier options. For instance, if they have “sustained national or international acclaim,” they could obtain an EB-1A extraordinary ability green card. If somehow they don’t have the required notoriety, they could easily spend a small fraction of their wealth to generate notoriety.

There is also the EB-5 investor visa. Under EB-5, immigrants can receive permanent residence in the United States if they invest at least $800,000 in a rural or economically depressed area and create 10 jobs over two years. Not only is EB-5 less money, but EB-5 investors recover their investment. The Gold Card would be, from an investing perspective, 100% loss.

In 2024, fewer than 5,000 investors applied for EB-5. President Trump knows that EB-5 is easier, so he’s planning to end the category. Of course, ending a green card category via executive order is as illegal as creating a green card category, but it would create aggrieved parties who could sue and potentially stop the whole policy (including the new “gold cards” that are replacing EB-5).

Issuing Trump’s gold cards is likely illegal, changing tax law is likely illegal, and ending the EB-5 investor visa is likely illegal. But even supposing that the President can get Congress to act, or can evade judicial review of his actions, few high value immigrants are going to hand over their fortunes to Trump.

Read More on Trump’s 100 Days and Immigration: How the U.S. Betrayed International Students by Susan Thomas

The little demand that exists for Trump’s gold card would likely come from wealthy Chinese, Saudi, and Russian businessmen who value freedom in the United States over their continued prosperity under their domestic tyrannical regimes. But Trump is likely to receive little political support from within his own party for encouraging these groups to immigrate to the United States. For instance, many Republicans have already raised objections to EB-5 immigration by wealthy Chinese for fear of letting in a communist.

Unfortunately, Trump is also devaluating this potential benefit of the gold card by revoking green cards for people who oppose its foreign policy views. This means that customers would be paying for a card that would let them move to the United States but could be taken away at any time over political disputes with the President. That will reduce trust in such a gold card and undercut demand.

If Congress does get involved, a slightly different version of the gold pard could work. President Trump wants $1 trillion in revenue, so Congress should set that target and progressively lower the amount required for the gold card until demand is sufficient to reach the revenue target. A more dynamic threshold would eventually raise the revenue and make Trump’s idea workable. Hopefully, the President is open to revisions.