Bitcoin miners continue to take advantage of the falling GPU prices to upgrade their mining equipment as they aim to remain competitive in the fierce competition.

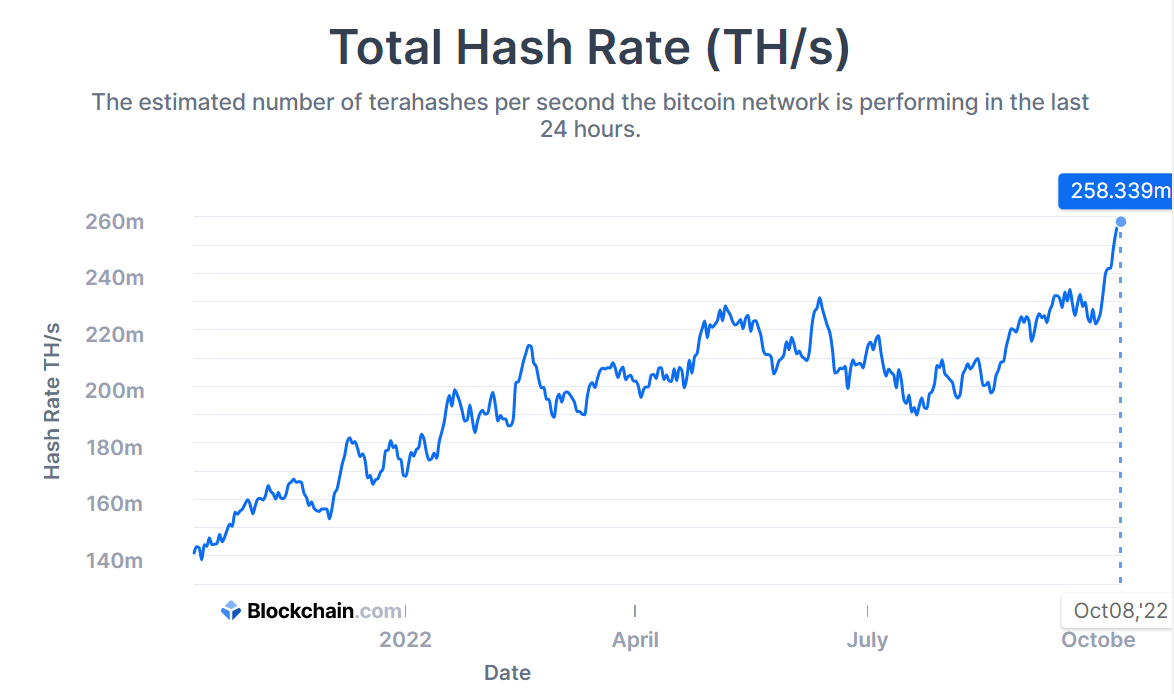

Throughout the month of October, Bitcoin’s (BTC) hash rate surged by 10.8% as it recorded new all-time highs on a daily basis. While the increase in hash rate ensures greater security for the Bitcoin network, multitudes of factors contribute to the metric.

Falling mining rig prices

Hash rate relates to the computing power required by Bitcoin miners to mine a block. As a result, a higher hash rate demands stronger mining rigs that could help miners mine a block and earn mining rewards.

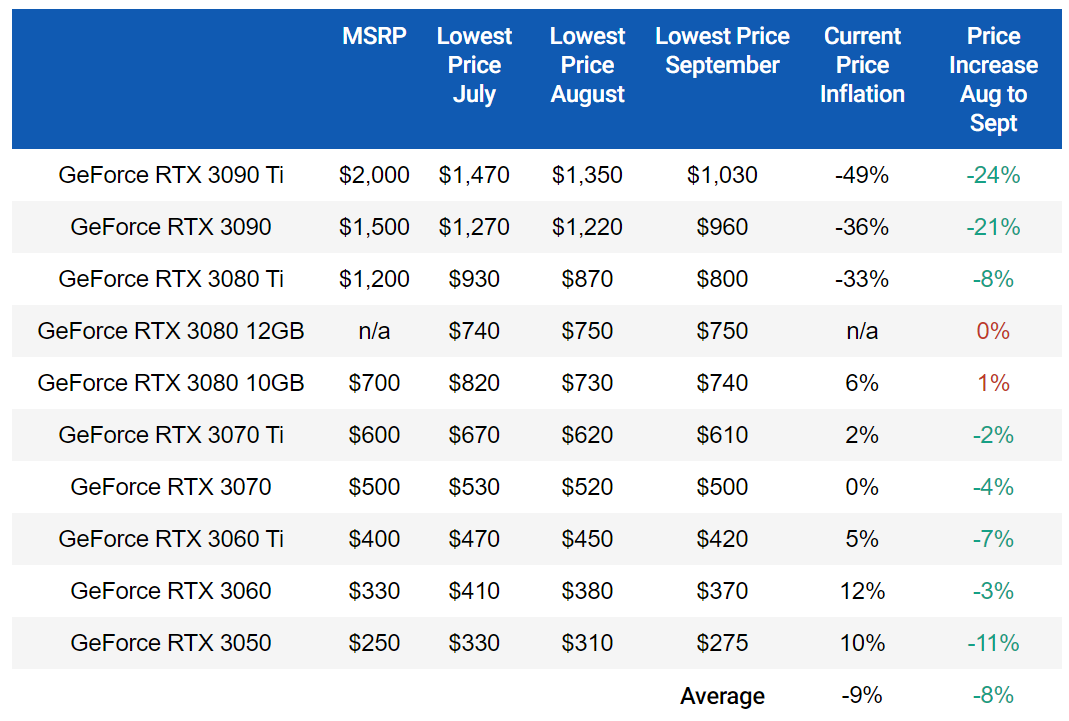

As global markets recovered from chip shortages in 2022, the prices of the graphics processing units (GPU) — a key component of mining rigs — came down to a reasonable value. Lower GPU prices initially helped miners offset their operational costs amid an ongoing bear market.

In addition, mining rig providers such as Bitmain brought down prices of Antminers in a bid to bring crypto miners back into profit. However, the return of investment, as previously reported by Cryptox, can be around 11 months for large-scale miners and 15 months for retail miners.

Bitcoin miners continue to take advantage of the falling mining rig prices to upgrade their equipment as they aim to remain competitive in the fierce competition. Moreover, major crypto firms such as Grayscale have also revealed plans to invest in Bitcoin mining hardware.

Increasing crypto-friendly jurisdictions

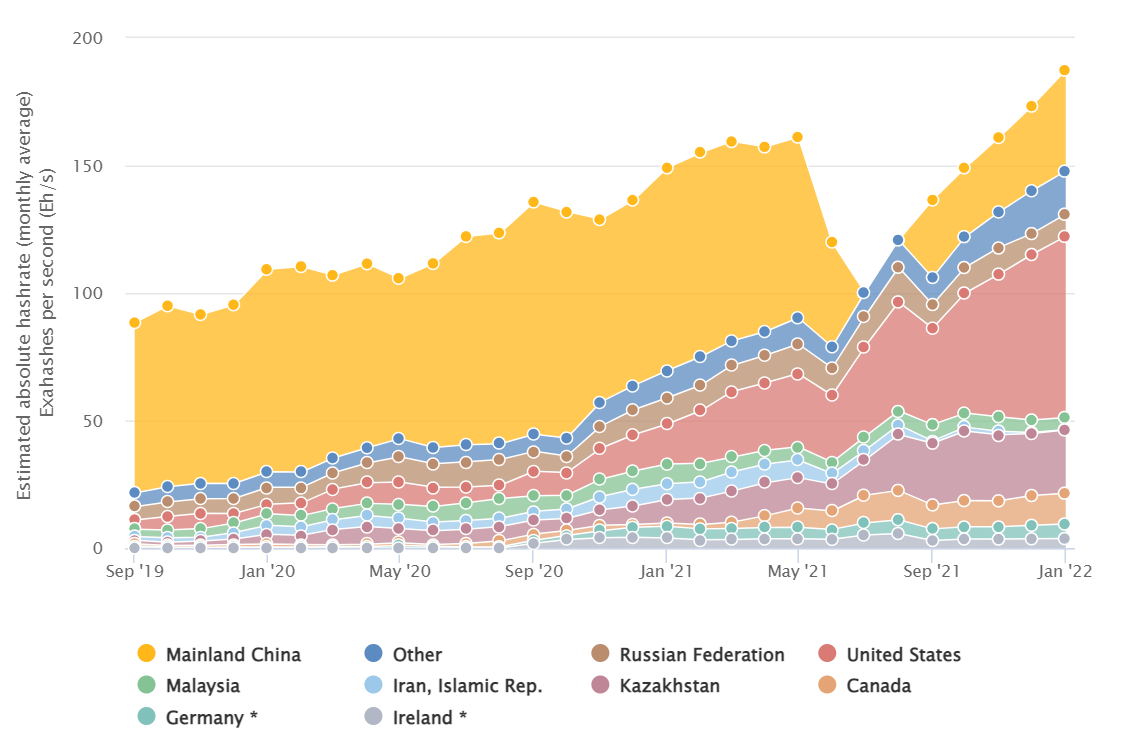

Ever since China imposed a blanket ban on crypto trading and mining, other countries decided to help out the misplaced Chinese miners by providing a safe haven in their own jurisdictions.

Countries including Kazakhstan, Canada and Germany, among others, were among the first choices for Bitcoin miners when it came to relocating their mining operations. As a result, Bitcoin mining became more decentralized as it grew less reliant on China.

However, data from Cambridge Centre for Alternative Finance showed that China resumed its mining operations just 3 months after the ban was imposed, further contributing to the rise in Bitcoin’s hash rate.

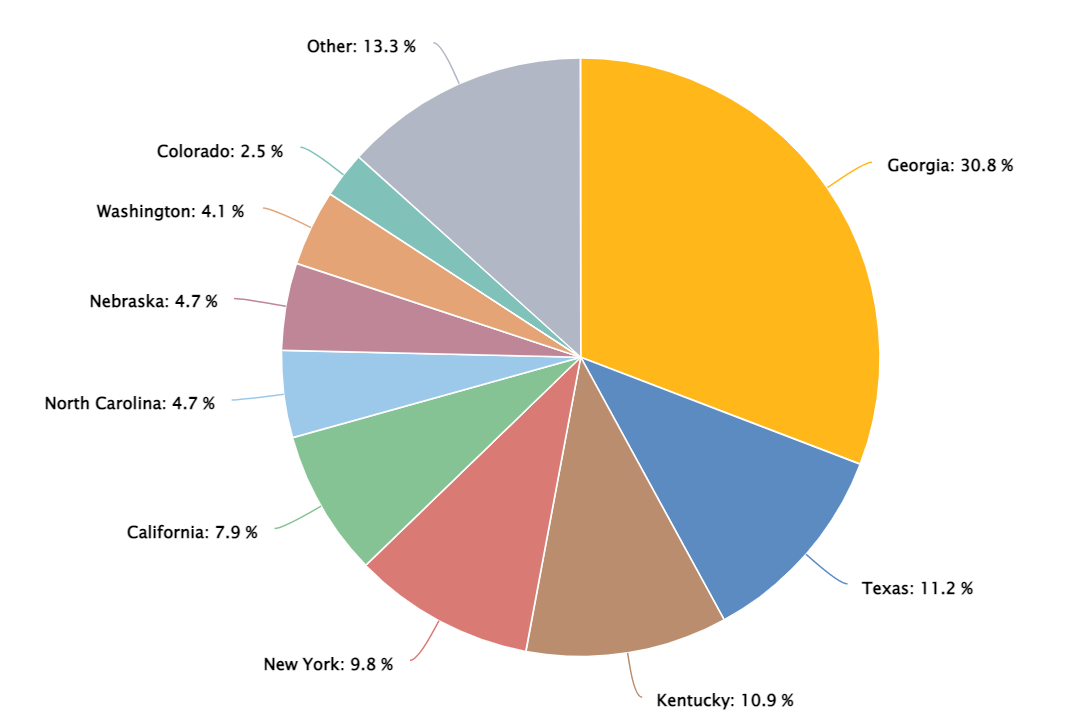

The United States currently tops as the biggest contributor to Bitcoin hash rate, with Georgia leading the drive at 30.8%, followed by Texas (11.2%), Kentucky (10.9%) and New York (9.8%).

The Merge: Ethereum’s transition to proof-of-stake (PoS)

Ethereum (ETH) recently transitioned from a proof-of-work (PoW) to a proof-of-stake (PoS) consensus mechanism following the Merge upgrade. As a result, Ethereum no longer supports the use of GPUs for mining operations.

The sudden shift in mining mechanism naturally forced Ethereum miners to sell off or repurpose their equipment towards mining Bitcoin.

Despite the increased network security, the rising hash rate can become a cause for concern as mining revenue in terms of the US dollar struggles to recover amid the ongoing bear market.