The cryptocurrency industry thrives on constant, ever-evolving innovation. But when it comes to stablecoin development, “that is not what you want,” according to Acting Comptroller of the Currency Michael Hsu.

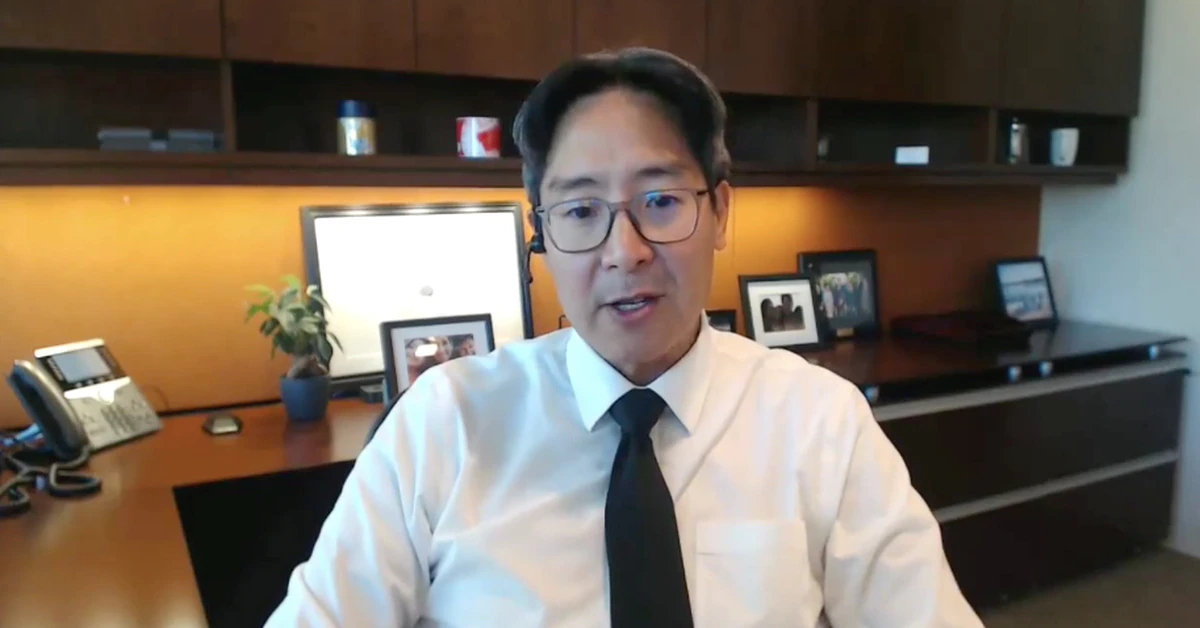

In an interview with CryptoX TV Monday, Hsu, who is the administrator of the U.S. federal banking system and CEO of the Office of the Comptroller of the Currency (OCC), argued that when dealing with people’s money, having too many innovators in the field poses risks.

“You want your money to be stable and reliable, you want it to be there in good times and bad times and not have to think about it,” Hsu said. “If you innovate too much in that space, you’re going to get a wide range of outcomes that some of which are not going to be good.”

Hsu spoke in the wake of a recent report released by the President’s Working Group on Financial Markets that recommended stablecoin issuers should be regulated like banks. Many in the crypto industry argue such a move would unfairly single them out.

But Hsu said vulnerable populations could be at risk without stronger safeguards.

“We want to be really careful about who is in this space and why, and what the risks for them are,” he said.

Hsu cited a July-August poll by Morning Consult in which 37% of respondents who were underbanked said they own cryptocurrency compared to only 10% of banked consumers.

“There is some risk that folks who are least able to bear it lose their money,” he said. “And I think we want to be really careful.”

Another reason for caution is the risk of too many investors trying to redeem their stablecoins for cash at once, leaving the issuer unable to honor its obligations, a risk that necessitates ever-more transparency from stablecoin issuers.

“I have personally been in situations with either banks, non-banks, money funds and others where there’s the question of what’s there, and the inability to answer that question confidently is what leads to the run,” Hsu said.