As Bitcoin goes, so go we all. It’s etched into the consciousness of crypto traders because the price of altcoins so often trends closely with the price of Bitcoin. If the original cryptocurrency rallies, so does the rest of the crypto market. Whenever BTC tumbles, it invariably drags its smaller siblings down with it.

Yet, as the crypto industry matures and many blockchain projects begin to generate their unique value, the link between the price of Bitcoin and that of many alternative digital assets grows more tenuous. The fact that the BTC dominance indicator currently sits at its three-year low, with Bitcoin responsible for just 40% of the cryptocurrency market capitalization, further speaks to the alts’ increasing autonomy.

During major market price movements, most cryptocurrencies are still largely correlated with Bitcoin action — as this week’s flash crash reminded us. However, today we are seeing more and more cases of altcoin prices remaining mostly unaffected by even the most dramatic BTC’s price swings. Here are three conspicuous examples from this week’s market bloodbath.

First, here is the price chart for Bitcoin, as seen through the interface of the Cryptox Markets Pro platform. In the seven days prior to this Thursday, BTC lost over 15% against the U.S. dollar, descending from around $56K to the mid-$30K’s before bouncing back to around $42K early Thursday.

So how did three popular altcoins fare against the Bitcoin price during this colossal market swing?

Polygon (MATIC) Analysis

Polygon, a platform for building and scaling decentralized applications, is firmly positioned at the heart of the explosively growing DeFi ecosystem. Last week alone, it added 75,000 new users and $1 billion in transaction volume.

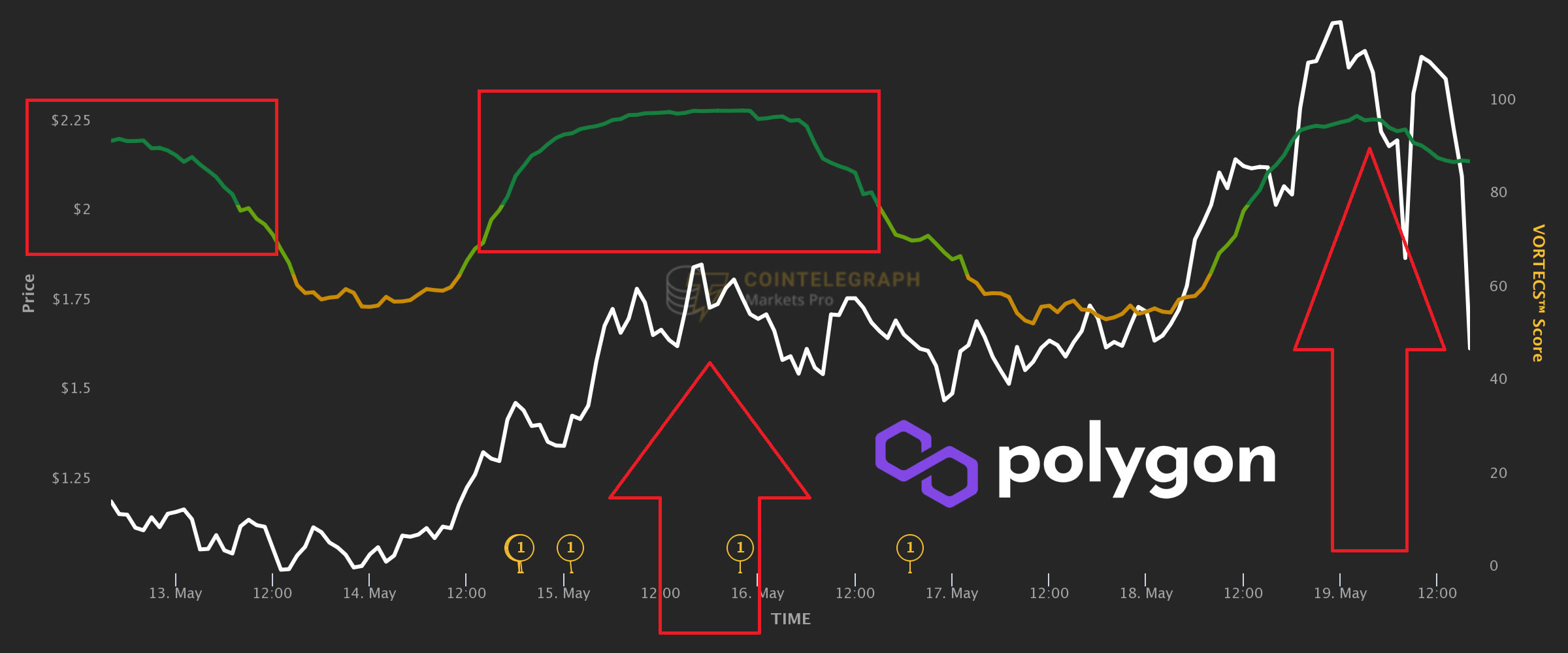

Against the backdrop of the general crypto market sliding down this week, Polygon’s token, MATIC, continued its staggering hike to new all-time highs, reaching $2.18 on May 18 – up from $0.36 just a month before. Over the week that has brought somber news for many other coins, MATIC gained 106% against the dollar and 142% against Bitcoin. (The chart below is denominated in dollars.)

During the token’s latest rally, the VORTECS™ score — an algorithmically generated metric that compares the observed patterns of market conditions around the coin to years’ worth of historical data — registered a mind-blowing sequence of 90+ values for MATIC, culminating in a score of 99 on May 15.

This is the highest score ever recorded for any token, and a score of this magnitude means that the model is extremely confident that in the past similar combinations of data points consistently preceded consequential price spikes.

MATIC’s rallies so far have followed quite similar scenarios in terms of market and social activity, as streaks of strong VORTECS™ scores (red boxes in the graph) frequently came two to three days before the next surge (red arrows).

It should be noted that VORTECS™ is trained on conditions that resulted in price appreciation around 48 hours beyond the score; so the repeated pattern of high score followed by price gains is a remarkable validation of the methodology behind the algorithm.

Solana (SOL) Analysis

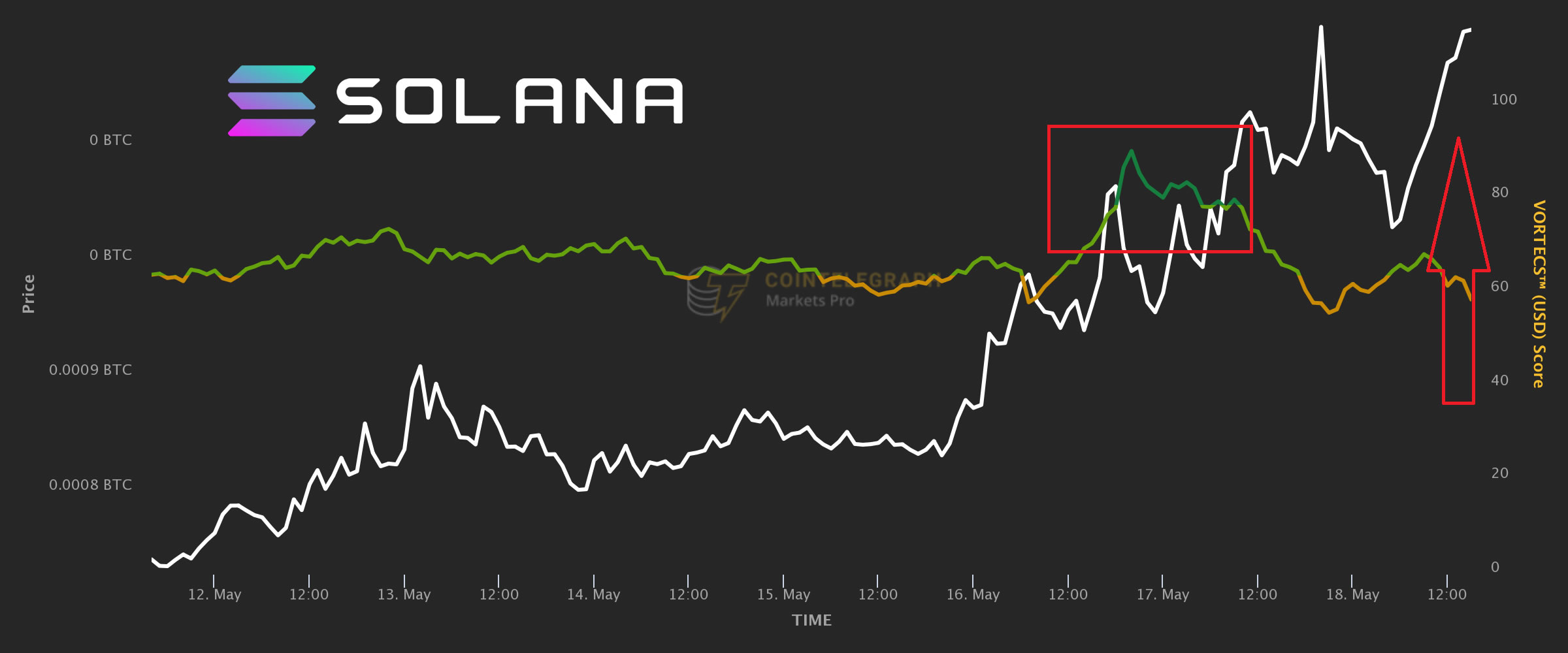

A layer-one network with solid fundraising and a slew of market-ready applications launched on top of it in the last couple of months, Solana’s token has been another one to defy the market’s bearish mood and tear the price charts. On May 18, SOL has sprung to its all-time high above $58.

The VORTECS™ score has been looking bullish for most of the week, before growing even more confident (dark green stretch marked by red box) some 30 hours before the most recent spike. Overall, Solana ended the week some 4% up against USD, beating Bitcoin by 23%.

In the chart here, the white line represents the value of Solana vs. Bitcoin rather than the dollar.

Harmony (ONE) Analysis

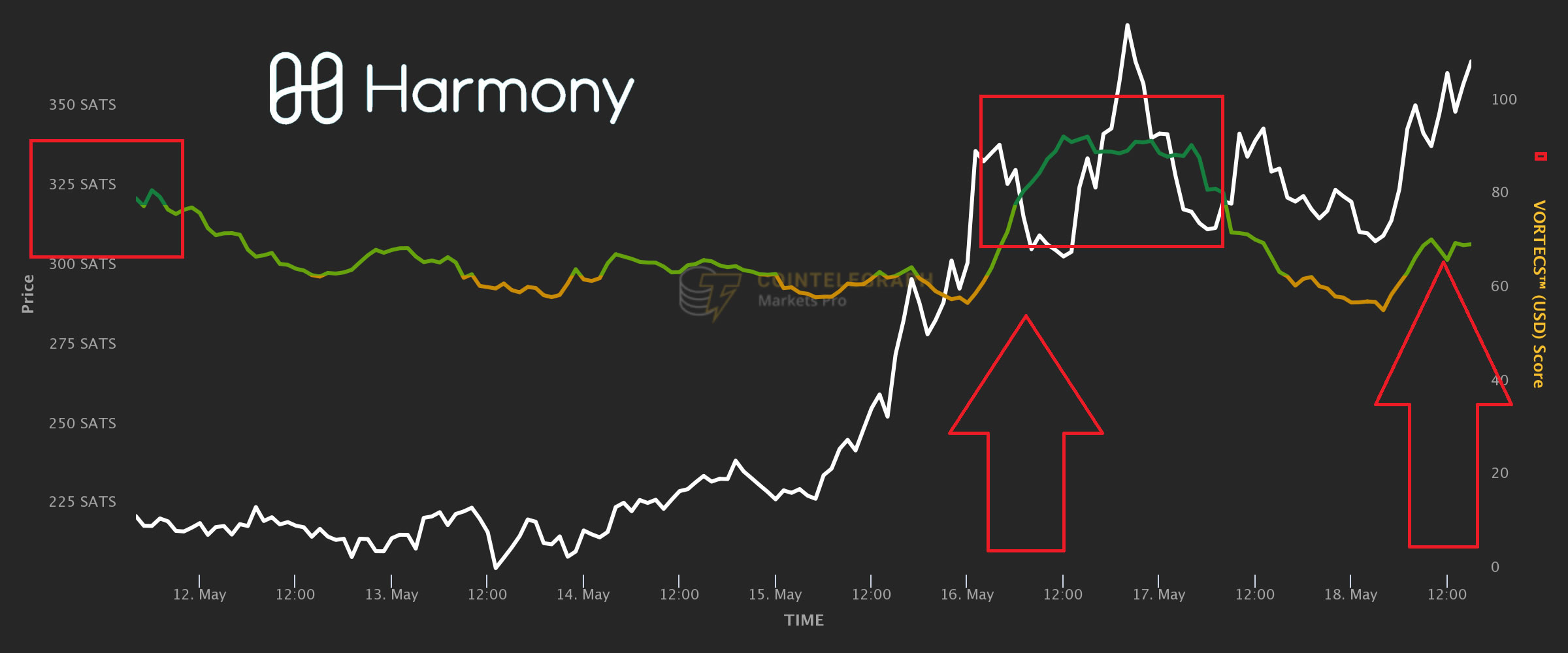

Harmony was another asset that did remarkably better than many of its counterparts this week. Reaching the price of $0.17 following a sequence of strong VORTECS™ scores, it came close to its ATH of $0.20 recorded back in March.

When the market tumbled on May 19, Harmony took a hit as well, yet it was among the quickest to recover the day after. Over the last 7 days, ONE gained about 24% against the dollar and almost 50% against Bitcoin, as illustrated in the chart.

When the market turns red, parking funds safely becomes every investor’s chief concern. Traders can fall back on stablecoins — or employ various forms of analysis to try and figure out which altcoins are most likely to go against the wider downward trend and be the first to make strong recovery.

The VORTECS™ score, exclusively available to Cryptox Markets Pro members, could be used in such calculations to evaluate how bullish or bearish the outlook for every coin is at any given moment. The platform’s interface allows to toggle between asset prices denominated in USD or BTC, which is useful at times when either of the benchmark currencies is in motion.

And as shown here, the fact that tokens with strong VORTECS™ Scores weathered this week’s market crash better than Bitcoin should be encouraging for crypto traders everywhere, many of whom have been advocating for further decorrelation in the markets for years.

Best-performing VORTECS™ Strategies

The Markets Pro team has been tracking 42 possible strategies since the launch of the VORTECS™ algorithm on January 3rd 2021. Current top returns as of May 20 2021, as detailed in this document on the methodology used, are as follows:

Holding Bitcoin: 22% return

Holding Top 100 altcoins: 298% return

Best-performing time-based VORTECS™ strategy: 2,74% return

Best-performing score-based VORTECS™ strategy: 2,691% return

Cryptox Markets Pro is available exclusively to members on a monthly basis at $99 per month, or annually with two free months included. It carries a 14-day money-back policy, to ensure that it fits the crypto trading and investing research needs of subscribers, and members can cancel anytime.

Important Disclaimer

Cryptox is a publisher of financial information, not an investment adviser. We do not provide personalized or individualized investment advice. Cryptocurrencies are volatile investments and carry significant risk including the risk of permanent and total loss. Past performance is not indicative of future results. Figures and charts are correct at the time of writing or as otherwise specified. Live-tested strategies are not recommendations. Consult your financial advisor before making financial decisions. Full terms and conditions.